Wells Fargo Boosts Molson Coors Beverage Outlook to Overweight

On November 8, 2024, Wells Fargo revised its assessment of Molson Coors Beverage (LSE:0K2K) from Underweight to Overweight.

Analysts Project 3.62% Stock Price Gain

The average one-year price target for Molson Coors Beverage, as of October 22, 2024, stands at 61.62 GBX/share. Forecasts vary, with a low estimate of 47.76 GBX and a high of 79.23 GBX. This average indicates a potential increase of 3.62% from its most recent closing price of 59.47 GBX/share.

Explore our leaderboard showcasing companies with the most significant price target potential.

Annual Revenue and Earnings Projections

Molson Coors Beverage is projected to achieve annual revenue of 11,210MM, reflecting a 4.04% decline. Additionally, the expected non-GAAP EPS is 4.35.

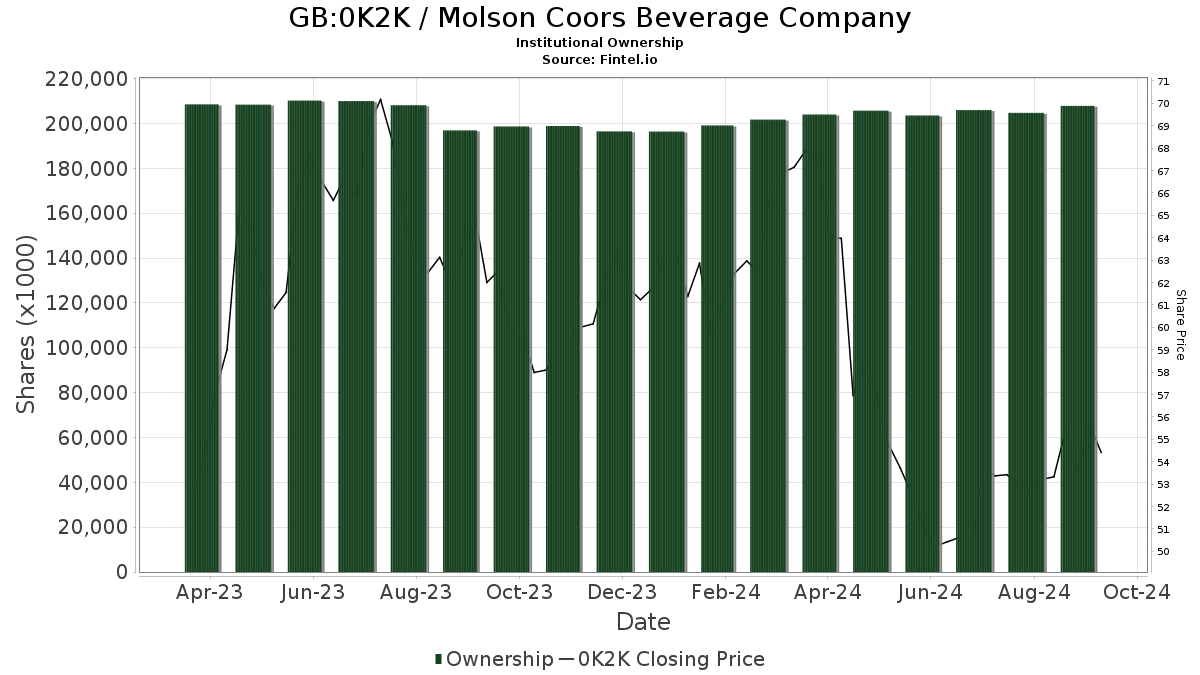

Current Fund Sentiment

At present, 1,335 funds or institutions claim positions in Molson Coors Beverage, a slight decrease of 6 owners, or 0.45%, from the previous quarter. The average portfolio weight of all funds for 0K2K is 0.20%, which has risen by 7.96%. Over the last three months, total shares held by institutions rose by 1.14%, reaching 208,946K shares.

Institutional Shareholder Activity

Among significant stakeholders, Dodge & Cox commands 14,575K shares, giving it a 7.57% ownership stake. This marks an increase from its previous holding of 14,515K shares, though the firm’s overall allocation in 0K2K decreased by 21.48% in the last quarter.

The DODGX – Dodge & Cox Stock Fund shares 10,727K shares, representing 5.57% ownership, with no change in the last quarter.

Meanwhile, LSV Asset Management holds 6,306K shares for a 3.27% ownership, down from 6,331K shares previously, reflecting a 0.40% decrease in its allocation over the past quarter.

Vanguard Total Stock Market Index Fund Investor Shares own 5,635K shares, or 2.93% of the company, which is an increase from its earlier holding of 5,584K shares, although its allocation slashed by 25.82% last quarter.

The Pacer US Cash Cows 100 ETF (COWZ) increased its position significantly, holding 5,475K shares, thereby capturing 2.84% ownership. This reflects a remarkable increase of 37.35% from its last reported 3,430K shares.

Fintel provides vital investment research resources for individual investors, traders, financial advisors, and small hedge funds.

Our extensive data covers global markets, including fundamentals, analyst reports, ownership statistics, fund sentiments, insider trading analysis, and much more. Our exclusive stock recommendations utilize advanced, backtested quantitative models to drive better investment returns.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the perspectives of Nasdaq, Inc.