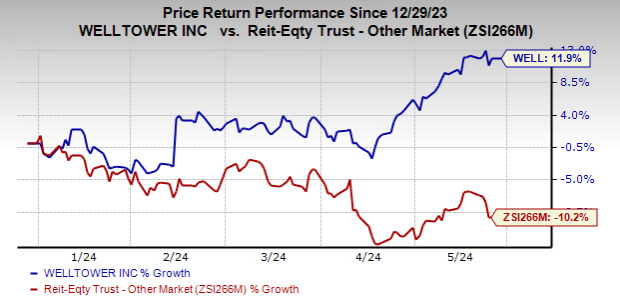

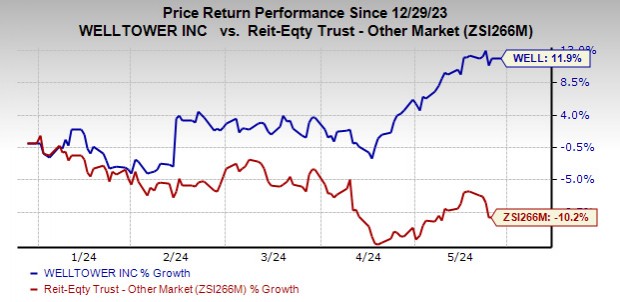

Shares of Welltower Inc. WELL have gained 11.9% in the year-to-date period against the industry’s fall of 10.2%.

The Toledo, OH-based healthcare real estate investment trust (REIT) owns a well-diversified portfolio of healthcare real estate assets in the key markets of the United States, Canada and the U.K. Its portfolio-restructuring initiatives and capital-recycling activities have aided Welltower in riding the growth curve so far.

Last month, this Zacks Rank #3 (Hold) company reported solid first-quarter 2024 results on higher revenues and robust senior housing operating (SHO) portfolio performance. Normalized funds from operations (FFO) per share of $1.01 surpassed the Zacks Consensus Estimate of 94 cents and climbed 18.8% year over year.

Image Source: Zacks Investment Research

Let us now decipher the factors behind the increase in the stock price and check whether the trend will last.

The senior housing industry is benefiting from an aging population and a rise in healthcare expenditure by this age cohort, which is generally higher than the average population. Given the robust demand for this need-based asset category coupled with muted new supply, Welltower’s SHO portfolio is witnessing healthy move-in activity, driving occupancy levels.

With a supply-demand imbalance, the portfolio is expected to experience sustained occupancy growth in 2024 and the coming years. Management anticipates the same-store SHO NOI to grow in 2024 at the midpoint of 19.5%, driven by positive revenue and expense trends.

With senior citizens’ healthcare expenditure expected to rise in the coming years and improving operating trends, Welltower’s SHO portfolio is well-prepared for compelling multiyear growth.

Welltower’s strategic portfolio restructuring initiatives over the recent years have enabled it to attract top-class operators and improve the quality of its cash flows.

Encouragingly, this healthcare REIT’s capital-recycling activities to finance near-term investment and development opportunities paves the way for its long-term growth. In the first quarter of 2024, Welltower completed $449.2 million of pro-rata gross investments, including $207.9 million in acquisitions and loan funding and $241.3 million in development funding. During this period, the company completed pro rata property dispositions and loan repayments of $107 million. It expects to fund an additional $660 million of development in 2024 relating to projects underway as of Mar 31, 2024.

Welltower maintains a healthy balance sheet position with ample financial flexibility. It had $6.5 billion of available liquidity as of Mar 31, 2024. It also enjoys investment-grade credit ratings of BBB+ and Baa1 from S&P Global Ratings and Moody’s, respectively, rendering it access to the debt market at favorable terms. With a strong financial footing, this healthcare REIT remains well-positioned to meet its near-term obligations and fund its development pipeline.

The REIT, expecting to continue benefiting from the recovery in the senior housing industry, raised its expectations for current-year normalized FFO per share to $4.02-$4.15 from $3.94-$4.10 estimated earlier. Analysts, too, seem bullish on the company. The Zacks Consensus Estimate for WELL’s 2024 FFO per share has moved 1.5% northward over the past month to $4.11.

However, Welltower faces competition from national and local healthcare operators. This may affect its pricing power in the market and hurt top-line growth. Also, tenant concentration in the company’s triple-net portfolio is concerning.

Given a high interest rate environment, the company may find it difficult to purchase or develop real estate with borrowed funds as the cost will likely be on the higher side.

Stocks to Consider

Some better-ranked stocks from the REIT sector are Lamar Advertising LAMR and Rexford Industrial Realty REXR, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for LAMR’s 2024 FFO per share has moved 3.7% upward in the past month to $8.03.

The Zacks Consensus Estimate for REXR’s ongoing year’s FFO per share has increased marginally over the past two months to $2.34.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Highest Returns for Any Asset Class

It’s not even close. Despite ups and downs, Bitcoin has been more profitable for investors than any other decentralized, borderless form of money.

No guarantees for the future, but in the past three presidential election years, Bitcoin’s returns were as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%. Zacks predicts another significant surge in months to come.

Hurry, Download Special Report – It’s FREE >>

Lamar Advertising Company (LAMR) : Free Stock Analysis Report

Rexford Industrial Realty, Inc. (REXR) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.