West Pharmaceutical Services, Inc. (WST), the global leader in innovative solutions for injectable drug administration, recently released its fourth-quarter 2023 financial results. The company reported adjusted earnings per share (EPS) of $1.83, a 3.4% increase from the previous year, surpassing the Zacks Consensus Estimate by 2.8%. The growth in earnings can be partially attributed to high-value product (HVP) sales, outstanding performance in the Contract Manufacturing segment, and strategic cost management.

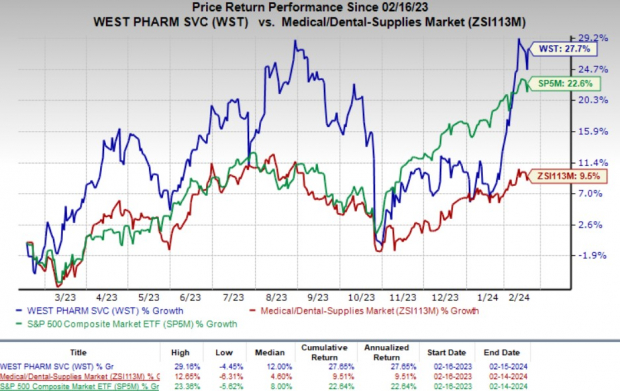

In the past year, West Pharmaceutical’s shares have ascended a staggering 27.7%, easily outstripping the medical-dental supplies industry’s 9.5% growth and the broader S&P 500 Index’s 22.6% increase.

Image Source: Zacks Investment Research

Surpassing Expectations

West Pharmaceutical’s net sales in the fourth quarter reached $732 million, a 3.3% year-over-year increase.

The company attributes the growth to the substantial demand for its high-value product (HVP) and robust sales in the Contract Manufacturing segment. However, the company experienced lower pandemic-related sales, which marginally impacted overall revenues.

Segmental Performance

West Pharmaceutical operates under two primary segments: Proprietary Products and Contract-Manufactured Products.

The Proprietary Products segment posted net sales of $593.7 million, indicating a 1.5% year-over-year growth. The HVP product line contributed approximately 75% of the segment’s net sales.

However, the Contract-Manufactured Products segment witnessed a more significant surge, with net sales climbing 11.6% year over year to $138.3 million.

Rising Gross Profits

West Pharmaceutical’s gross profit surged by 6.1% to $278.2 million in the fourth quarter, leading to a near-100 basis points expansion in gross margin, reaching 38%.

In terms of operational performance, the company saw adjusted operating profit climb to $159.9 million, a 0.8% increase from the previous year.

2024 Outlook and Future Growth

Despite the robust performance, West Pharmaceutical issued a slightly conservative outlook for 2024. The company anticipates adjusted EPS in the range of $7.50-$7.75, lower than the Zacks Consensus Estimate. West Pharmaceutical also foresees net sales reaching $3 billion to $3.025 billion, with an organic sales growth estimate of 2-3%.

Analyst Insights and Market Position

In response to the quarterly results, some analysts have expressed concerns about West Pharmaceutical’s slightly conservative revenue outlook.

The recovery in organic growth is encouraging. However, lower COVID-19-related sales continue to impact the top line while declining operating margin dampens overall performance. Nevertheless, the impressive demand for the HVP products remains a bright spot, particularly the strong organic net sales growth in the Pharma, Biologics, and Generic market units, excluding COVID-related sales.

West Pharmaceutical Services, Inc. price-consensus-eps-surprise-chart | West Pharmaceutical Services, Inc. Quote

Implications for Investors

Despite the mixed results, West Pharmaceutical’s focus on innovative solutions and strong demand for HVP products bode well for the company’s future growth. The company’s strategic positioning in the market, combined with its robust financial position and continual investments in research and development, points to prospects for long-term value creation for investors.

In a broader context, it appears that West Pharmaceutical’s success mirrors the resilience and adaptability of the healthcare industry in navigating disruptive market conditions and emerging stronger.

Analyst Recommendations

Consequently, analysts advise a watchful yet optimistic approach toward West Pharmaceutical’s stock. The company currently carries a Zacks Rank #3 (Hold), encouraging investors to maintain a cautious yet hopeful outlook. Further, other top-ranked stocks in the broader medical space, such as Universal Health Services (UHS), Integer Holdings Corporation (ITGR), and Cardinal Health (CAH), present compelling investment opportunities with strong growth prospects and favorable industry trends.

In conclusion, West Pharmaceutical’s position in the market continues to warrant detailed observation, providing intriguing prospects for strategic investment and sustainable market performance.

Riding the Wave: Cardinal Health Shines in Booming Industry Landscape

The Untold Story of Cardinal Health

In a crowded marketplace rife with potential investment pitfalls, Cardinal Health Inc. has been a solid wallflower, quietly blossoming into a robust financial force. The company has been riding the upward wave in a booming industry, making all the right moves to become the golden child of the market.

Underrated Stock with Overwhelming Potential

The healthcare juggernaut has not only defied analysts’ estimates in each of the trailing four quarters but has also delivered an average surprise of 15.64% – a staggering feat that speaks volumes about its growth trajectory and management’s prudence.

Soaring Shares in a Stagnant Market

Amidst a pandemic-stricken economy, Cardinal Health’s shares have defied all odds and risen by an astounding 32.2% in the past year, dwarfing the industry’s growth of 9.4%. This meteoric rise is a testament to the company’s resilience and adaptability even in the face of adversity.

A Diamond in the Rough

While many stocks languish in obscurity, Cardinal Health has been cruising through bear market lows, on the verge of a “watershed medical breakthrough.” With a bustling pipeline of projects targeting diseases involving the liver, lungs, and blood, the company is not just another investment option but a timely opportunity to tap into potential growth.

Projected Growth and Achievement

The potential for Cardinal Health seems promising, potentially rivaling recent phenomenal performers like Boston Beer Company and NVIDIA. If history is any indication, Cardinal Health may well be the next big thing in the stock market, opening doors for growth and accomplishment.

The Future of Cardinal Health

The story of Cardinal Health is just beginning to unfold, and investors would be wise to keep an eye on this market gem. With its trailblazing performance and potential for exponential growth, Cardinal Health stands poised to carve out a unique space for itself in the ever-evolving financial landscape.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.