WTI Crude Oil Struggles as Tariff Concerns Weigh on Prices

West Texas Intermediate (WTI) crude oil is facing downward pressure, recently dropping below critical support levels. Analysts are closely observing these market dynamics.

Tariff Tensions Impacting Demand

According to Adam Turnquist, chief technical strategist for LPL Financial, tariffs have significantly affected oil demand. He noted, “Oil has struggled recently as tariff-related demand concerns weigh on risk appetite.”

The U.S. government’s new 10% tariff on oil imports, along with China’s retaliatory 125% tariff on U.S. goods, has generated uncertainty in the markets. This situation has raised fears regarding declining global oil demand.

Reflection of these tariff tensions can be seen in the International Energy Agency’s (IEA) recent adjustment to its 2025 demand growth forecast, now lowered by 300,000 barrels per day to 730,000.

Supply Challenges Contribute to Price Decline

In addition to demand concerns, supply factors also pressure prices. OPEC+ announced an unexpected supply increase of 411,000 barrels per day beginning in May, which contributes to the bearish outlook. This increase partly aims to reprimand members like Kazakhstan for not adhering to output restrictions. Further supply hikes are anticipated at OPEC+’s upcoming meeting on May 5, which could exacerbate market pressures.

Technical Analysis of WTI Prices

As of now, WTI has dropped to multi-year lows, breaking through key support around $64. Turnquist describes this movement as forming a “bearish flag,” suggesting a high risk for further declines. Should oil prices close below $60, he warns of a potential drop toward the $55-$56 support range.

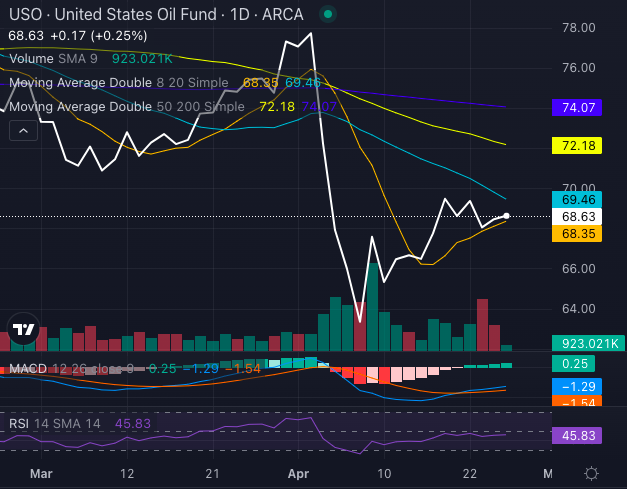

Impact on the United States Oil Fund

The United States Oil Fund LP USO, a widely used oil proxy, has mirrored these declines, currently down 11.30% year-to-date and 8.79% over the past month.

Chart created using Benzinga Pro

With USO’s price falling below key moving averages and displaying a bearish MACD (moving average convergence/divergence) reading of negative 1.29, the outlook remains bleak.

A persistent bearish trend in oil prices could signify further challenges for USO moving forward.

Read Next:

Photo: Shutterstock