Western Digital Partners with NVIDIA for Enterprise-Class SSDs to Fuel AI Growth

Western Digital Corporation (WDC) recently announced its PCIe Gen5 DC SN861 E.1S enterprise-class NVMe SSDs are now certified for NVIDIA (NVDA) GB200 NVL72 rack-scale system.

As technology continues to advance, the demand for artificial intelligence (AI), machine learning, and large language models (LLMs) is rising rapidly. Organizations face challenges in managing increasing amounts of data and extracting valuable insights swiftly. This shift highlights the need for storage solutions that can handle performance, scalability, and efficiency.

WDC’s SSDs, now certified for NVIDIA’s GB200 NVL72 system, excel in environments where accelerated AI computing is crucial. They provide high-speed data processing while minimizing latency and maximizing efficiency. The GB200 NVL72 system allows data centers to create over 100 custom system designs tailored to their needs while ensuring consistent performance.

Advanced Capabilities of WDC’s DC SN861 SSD

The DC SN861 E.1S SSD from Western Digital features cutting-edge specifications designed to enhance the AI data cycle. It supports essential processes like AI model training and inference, offering capacities of up to 16TB. The new SSD boasts up to three times better random read performance than previous generations, ensuring low latency ideal for LLM training and AI applications.

AI models are resource-heavy and require substantial power. The design of Western Digital’s SSD emphasizes a low power profile, yielding higher IOPS per watt, which helps reduce total ownership costs. The new PCIe Gen5 bandwidth addresses the rising need for high-speed, low-latency computing as AI technologies become more prevalent. This SSD is engineered for critical workloads, supporting NVMe 2.0 and OCP 2.0, and comes with a robust five-year limited warranty, making it suitable for demanding AI tasks.

WDC is Poised for Growth in the SSD Market

Western Digital is making significant strides in the SSD market, reporting a 60% sequential increase in enterprise SSD demand last quarter, largely fueled by AI-related activities. The company anticipates that SSD enterprise solutions will make up a double-digit percentage of its overall portfolio by fiscal 2025. Presently, they are sampling 64TB SSDs and expect to begin volume shipments by the end of 2024. For the current fiscal first quarter, Flash revenues are projected to grow in the mid-to-high teens sequentially, reflecting ongoing advancements in SSD technology and growing mobile momentum.

However, WDC faces challenges from intense competition in the storage industry and the risks linked to customer concentration. Additionally, a significant debt load and prevailing macroeconomic uncertainties add further pressure.

Stock Performance and Rankings for WDC

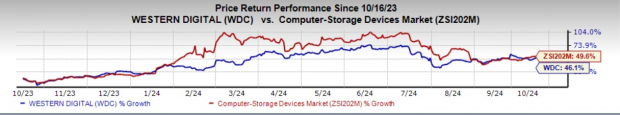

Currently, WDC holds a Zacks Rank of #4 (Sell). Over the past year, its shares have increased by 46.1%, slightly lagging behind the sub-industry’s growth of 49.6%.

Image Source: Zacks Investment Research

Other Noteworthy Stocks in Technology

Investors may also consider some better-performing stocks in the technology sector, such as Workday Inc. (WDAY) and SS&C Technologies Holdings, Inc. (SSNC). WDAY currently carries a Zacks Rank of #1 (Strong Buy), while SSNC holds a Zacks Rank of #2 (Buy). For a complete list of Zacks #1 Rank stocks, click here.

Workday offers enterprise-level software solutions for finance and human resources. Its cloud platform integrates finance and HR, enabling organizations to gain key analytical insights. It recently reported an earnings surprise of 7.36%.

SS&C Technologies has averaged an earnings surprise of 3.1% over the last four quarters, with a 4.9% surprise in the most recent quarter. Analysts forecast earnings of $5.18 for SSNC.

Infrastructure Investment Opportunities Ahead

A significant initiative is on the horizon to rebuild America’s aging infrastructure. This bipartisan move is set to spend trillions, creating enormous opportunities for investors.

The key question for investors remains: “Will you capitalize on the right stocks early, maximizing their growth potential?”

Zacks has released a Special Report to assist investors in this pursuit, featuring five companies positioned to benefit from major spending on infrastructure, including repairs to roads, bridges, and energy transformation. This report is available for free. Download: How To Profit From Trillions On Spending For Infrastructure.

For the latest recommendations from Zacks Investment Research, download 5 Stocks Set to Double for free.

Western Digital Corporation (WDC): Free Stock Analysis Report.

NVIDIA Corporation (NVDA): Free Stock Analysis Report.

SS&C Technologies Holdings, Inc. (SSNC): Free Stock Analysis Report.

Workday, Inc. (WDAY): Free Stock Analysis Report.

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.