$WFRD Set to Report Earnings with Analysts Expecting Strong Revenue

$WFRD ($WFRD) is set to announce its quarterly earnings on Tuesday, April 22nd, after the market closes, according to Finnhub. Analysts predict revenue of $1,212,854,633 and earnings of $0.87 per share.

For ongoing updates on $WFRD, including insider trading, hedge fund movement, and more, visit Quiver Quantitative’s dedicated $WFRD Stock page.

Insider Trading Activity at $WFRD

In the past six months, $WFRD insiders have completed 10 trades on the open market, with no purchases and 10 sales recorded.

Below is a summary of insider trading activity at $WFRD during this period:

- SCOTT C WEATHERHOLT (EVP, GC & CCO) has made 0 purchases and 2 sales, unloading 44,505 shares for approximately $2,945,051.

- DESMOND J MILLS (SVP & Chief Accounting Officer) sold 25,956 shares over 3 transactions, totaling around $1,833,034.

- DEPINDER SANDHU (EVP, Global Product Lines) executed 2 sales with 14,000 shares, totaling about $929,740.

- ARUNAVA MITRA (EVP and CFO) completed 2 sales of 10,000 shares for an estimated $675,711.

- DAVID JOHN REED (EVP, Chief Commercial Officer) sold 4,762 shares, reaching around $346,006.

For detailed insider transactions, examine Quiver Quantitative’s insider trading dashboard.

Institutional Activity Involving $WFRD

Recently, 172 institutional investors have increased their holdings in $WFRD, while 210 have reduced their positions in the latest quarter.

Here are some notable institutional actions:

- CAPITAL RESEARCH GLOBAL INVESTORS added 4,443,823 shares (+295.9%) in Q4 2024, estimated at $318,311,041.

- PRICE T ROWE ASSOCIATES INC /MD/ decreased holdings by 1,750,599 shares (-23.6%) in Q4 2024, valuing around $125,395,406.

- INVESCO LTD. increased its portfolio by 1,455,906 shares (+inf%) in Q4 2024, estimated at $104,286,546.

- JENNISON ASSOCIATES LLC liquidated 1,324,101 shares (-100.0%) in Q4 2024, for an estimated $94,845,354.

- FULLER & THALER ASSET MANAGEMENT, INC. acquired 840,456 shares (+181.7%) in Q4 2024, totaling about $60,201,863.

- BALYASNY ASSET MANAGEMENT L.P. removed 672,650 shares (-100.0%) in Q4 2024, estimated at $48,181,919.

- CONGRESS ASSET MANAGEMENT CO decreased its position by 646,855 shares (-99.1%) in Q1 2025, valued at about $34,639,085.

For insights into hedge fund portfolios, explore Quiver Quantitative’s institutional holdings dashboard.

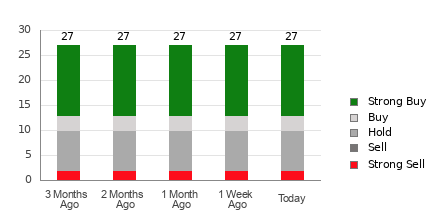

Recent Analyst Ratings for $WFRD

Several Wall Street analysts have recently reported on $WFRD. Currently, one firm has rated the stock as a buy, while none have issued a sell rating.

Noteworthy recent analyst comments include:

- Evercore ISI gave a rating of “Outperform” on 10/24/2024.

For the latest analyst ratings and price targets for $WFRD, refer to Quiver Quantitative’s $WFRD forecast page.

Price Targets for $WFRD

In the past six months, two analysts have provided price targets for $WFRD, with a median target set at $114.5.

Recent price targets include:

- Derek Podhaizer from Piper Sandler established a target of $87.0 on 12/18/2024.

- James West from Evercore ISI set a target price of $142.0 on 10/24/2024.

This article is not financial advice. For more information, please see Quiver Quantitative’s disclaimers. There may be inaccuracies related to ticker-mapping and other data anomalies.

This article was originally published on Quiver News; read the full story.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.