NASDAQ Thrives with Fed Rate Cuts

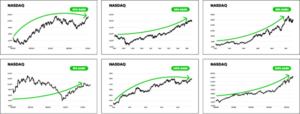

History whispers secrets to savvy investors, clues hidden in the stock market’s response to the Federal Reserve’s rate cuts. Over the past 35 years, the Fed’s scissors have snipped rates on seven occasions, and each time, the NASDAQ has pirouetted skyward.

The Phenomenon of NASDAQ Surge Post-Rate Cuts

Witness the dance of the NASDAQ after a rate cut – a performance marked by exuberant leaps. Every rally, without fail, trumpets a booming NASDAQ. No ordinary crescendos but towering achievements, with post-cut rallies averaging a staggering 98%, akin to scaling musical peaks.

Even the smallest NASDAQ progress following a rate cut, a 19.7% ascent, plays a significant tune. Yet, larger-than-life performances take center stage, with a few unforgettable symphonies surpassing the 100% mark, such as the soaring melodies of the early ’90s and the grand opus of 1998.

Investors will want to remain attentive to the NASDAQ’s ebullient performances, for they promise spectacular performances after each Federal Reserve rate cut, akin to an orchestra hitting its stride after the conductor’s baton taps the stand.

With historical echoes murmuring encouragement, investors brace themselves for the inexorable rise of the NASDAQ, anticipating another bullish symphony with the Federal Reserve’s next rate cut baton strike.

Forecasting the Fed’s Rate Cuts Amidst Market Rhymes

The Fed’s Monetary Maneuvers

After a symphony of 11 rate hikes echoing through the period since March 2022, the Federal Reserve is now poised to switch tunes with an orchestrated descent into rate cuts this year.

At the close of the December Federal Open Market Committee (FOMC) gathering, the Fed projected, via its “dot plot” survey, an expectation of three rate slashes in 2024, followed by another three to four in 2025. This ensemble of six to seven rate cuts over the coming duo of years would ultimately whisper the federal fund rate down to a melody between 3.5% and 3.75%.

However, as the first notes of inflation data for 2024 spilled over the financial stage, it was apparent that the inflation overture was still humming a bit too loudly. This intrigued Wall Street, leaving them pondering whether the Fed would retain its rate-cut sheet music at the March FOMC gathering.

A Harmonious Decision Amidst Inflation’s Overture

The updated dot plot revealed that the Fed indeed still aims to strike three poignant chords this year in the form of key interest rate reductions, while looking further ahead to a more tempered three cuts in 2025 instead of the initial four.

With the certainty that the Fed will be conducting this monetary symphony in due course, the crux now lies in deciphering the precise timing of the downbeat.

My forecast remains unwavering – the inaugural note of this rate-cut melody will resonate in June. This conviction stems, as detailed in a recent Market 360 segment, from words spoken by Christine Lagarde, president of the European Central Bank (ECB), during a recent address in Frankfurt, Germany.

Lagarde’s words painted a picture of global central bank harmony, with signals pointing to synchronized rate cuts by major players like the Federal Reserve, ECB, and the Bank of England come June. This coordination in the tempo of rate cuts is expected to keep global currencies in tune.

Although a fellow analyst friend of mine has a differing date in mind, we’re set to orchestrate a duet at my upcoming event, the Election Shock Summit, so he can reveal his surprise date for the Fed’s rate cut. We’ll unpack how the May FOMC meeting might create a crescendo affecting not just the stock market but potentially the upcoming presidential election. Additionally, we’ll delve into strategies for harmonizing your portfolio for optimal returns.

The Election Shock Summit is slated for next Wednesday, April 10, at 8 p.m. Eastern time. Secure your front-row seat by clicking the link to reserve your spot.

Warm Regards,

Louis Navellier