Market’s Melodic Response to Rate Cuts

Source: travellight / Shutterstock.com

There’s a famous quote that says, “History doesn’t repeat itself, but it often rhymes.”

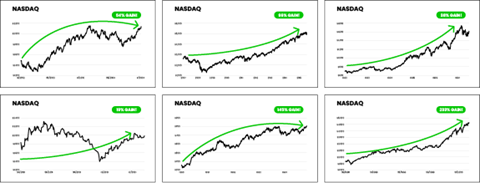

Just like a well-worn melody that echoes through time, the stock market dances to a familiar tune when the Federal Reserve plays the chords of rate cuts. In the grand opera of finance, the Fed has orchestrated seven such performances in the last 35 years. And every time the baton falls, the NASDAQ takes flight like a bird released from a cage.

To witness this symphonic spectacle for yourself…

And as you marvel at these crescendos, remember, these are no mere whispers in the wind. Each post-rate cut rally is a thunderclap, with the NASDAQ leaping, bounds in the air. The smallest leap saw a respectable 19.7% ascent. On average, these cuts have paved the way for mega-rallies of 98% in the NASDAQ.

Among these buoyant leaps are a couple of standout performances – one reminiscent of the early ’90s…

And another grand overture unfolded in 1998.

The Federal Reserve Roadmap: Insight for Investors

Anticipating the Fed’s Move

For investors tracking the stock market’s cadence, it’s hard to overlook the orchestra of signals from the Federal Reserve. After a prolonged stint of rate hikes since March 2022, the Fed now appears poised to execute a U-turn, steering towards a 180-degree policy shift: rate cuts in 2024 and 2025.

Retail Reactions to Rate Cuts

Surprises emerge at the December Federal Open Market Committee (FOMC) meeting as the Fed unveils its roadmap for rate reductions. Initial projections estimated three rate cuts in 2024, followed by an additional three to four in 2025. This flurry of cuts could potentially plunge the federal fund rate to a range between 3.5% and 3.75%.

However, the inflation narrative disrupts the anticipated rhythm. Despite predictions of dampened inflation, attested by preliminary data for 2024, the actual figures reveal inflation maintaining a fervent pace. This unexpected revelation cast doubts on the Fed’s resolve to adhere to its rate-cut agenda, especially as the March FOMC meeting loomed.

Predicting the Timing

In the face of looming uncertainty, one cogent fact remains: a forthcoming reduction in key interest rates is inevitable. The only variable at play is the element of time – a question of “when” rather than “if”.

Pundits in financial circles are placing their bets, with speculation rife. A particular camp foresees the initial rate cut scheduled for June. This prediction is reinforced by a vivid analogy echoing Christine Lagarde’s declarative sentiments from the European Central Bank.

Conversely, an alternative perspective emerges from a seasoned analyst’s quarters. This voice in the crowd diverges on pinpointing the exact date, raising intrigue and inviting speculation to feast on a tantalizing possibility during the upcoming Election Shock Summit.

Seizing Investor Opportunities

Mark your calendars for the event of the season – the Election Shock Summit scheduled for April 10. Esteemed financial pundits are geared up to unravel the mysteries of market dynamics, offering insights on the impending rate slashes and their ripple effects on the stock market and political landscape. A prime opportunity to position portfolios strategically enters the horizon.

Investors seeking to ride the waves of economic shifts are encouraged to secure a front-row seat. The intricacies of financial maneuvering, combined with the thrill of anticipating market dynamics in sync with global juggernauts, promises a riveting experience.

Regards,

Louis Navellier

Louis Navellier

Editor, Market 360