The year 2024 poses a captivating conundrum for dividend growth investors amidst the persistent specter of soaring inflation coupled with the precarious dance of fluctuating interest rates. The U.S. and Canada experienced a mild reprieve in late 2023, only to find themselves grappling with a resurgence in December. As the financial terrain remains rife with uncertainty, the task of cherry-picking stocks becomes increasingly daunting.

A looming labor scarcity looms due to our graying population. With more retirees bidding adieu to the workforce and a dearth of young blood to replenish the ranks, the pursuit of skilled labor will likely stoke the embers of inflation as unemployment levels manage to remain tepid, despite recent marginal upticks.

In a bid to offset escalating expenses, companies are compelled to elevate their productivity levels. Faced with burgeoning overheads, enterprises are impelled to recalibrate their operations to bolster efficiency. The upcoming years are poised to favor those who champion productivity, potentially heralding the inception of the next bull run.

Navigating the Dangers

Foremost on our minds is the formidable specter of a market crash with long-drawn recuperation prospects. The tribulations of 2022 were somewhat mollified by the hopeful prospects of the Federal Reserve halting their escalations of interest rates. Although 2023 witnessed a cessation of interest rate hikes, our jubilation is premature at best.

While the specter of interest rate ascents has receded, a palpable impact looms large — both consumers and companies reliant on borrowing or debt refinancing will grapple with the lingering effects of elevated rates for the foreseeable future. The recent disruptions in shipping routes through the Red Sea and Suez Canal further augur the potential amplification of inflationary pressures.

Consequently, the sequel to this financial saga may mirror the enduring trials of 2008, where a refulgent recovery spanned a staggering four years. While accumulators reveled in the bargain bonanza, retirees bore the brunt of the storm.

Drawing from this past travail, I advocate that retirees maintain a cash reservoir amounting to 18 months to 2 years’ worth of their retirement budget. By channeling dividends into this reserve, retirees can alleviate apprehensions during stock market fluctuations. Contingent upon the pace of withdrawals and the yield generated by their portfolio, this stratagem could potentially elongate the cash reserve’s longevity to 3-4 years, or perhaps even longer. This reserve not only confers tranquility but also furnishes an added layer of flexibility.

The Axioms for 2024 Investments

Refrain from undertaking a wholesale overhaul of your investment strategy. Instead, recalibrate your portfolio to ensure its adept alignment with impending dynamics. The potential advent of an protracted bear market casts its shadow over both invested and cash-endowed investors. Here’s the game plan.

For Invested Investors (like me!):

- Assess: your portfolio’s diversification across a multitude of sectors

- Evaluate: lackluster stocks and re-evaluate their pertinence in your portfolio

- Trim: overweight positions

- Optimize: your holdings with robust stocks exhibiting strong metrics and growth potential

- Cultivate: a cash buffer if you are retired and reliant on your portfolio for generating income

For Cash-Endowed Investors (the waiting game…)

The enigma of waiting endlessly for opportune moments is akin to chasing shadows. Instead:

- Curate: your buy list straightway

- Invest: 33% of your capital presently

- Pause: for a quarter, scrutinize earnings, and invest another 33%

- Emulate: this pattern for an additional quarter to completely deploy your capital over the forthcoming 6 to 9 months

The underlying principle of this stratagem is to fortify your portfolio regardless of whether you invest right before a market downturn or amidst the commencement of another 5-year bull market.

- If you invest 33% precariously close to the cusp of a crash, it’s worth noting that major market crashes are intense but fleetingly ephemeral. Consequently, three to six months down the line, you can capitalize on buying during the downturn, averaging down your position with reduced prices.

- Alternatively, if you invest 33% as a nascent 5-year bull run unfolds, you can gradually amass a profit cushion with an average price below the market.

Commence with the Dividend Triangle

My initial foray involves sifting stocks through the prism of a deceptively simplistic yet remarkably effective tool — the “dividend triangle.” This entails identifying market pioneers exhibiting robust growth vectors: companies poised to elevate their sales figures while concurrently witnessing profit upswings. Crucially, I gravitate towards companies exhibiting a penchant for year-on-year dividend escalations. Ergo, the pivotal trio of metrics in my screen encompasses:

- Revenue growth (5-year trend)

- Earnings per share (EPS) growth (5-year trend)

- Dividend growth (5-year trend)

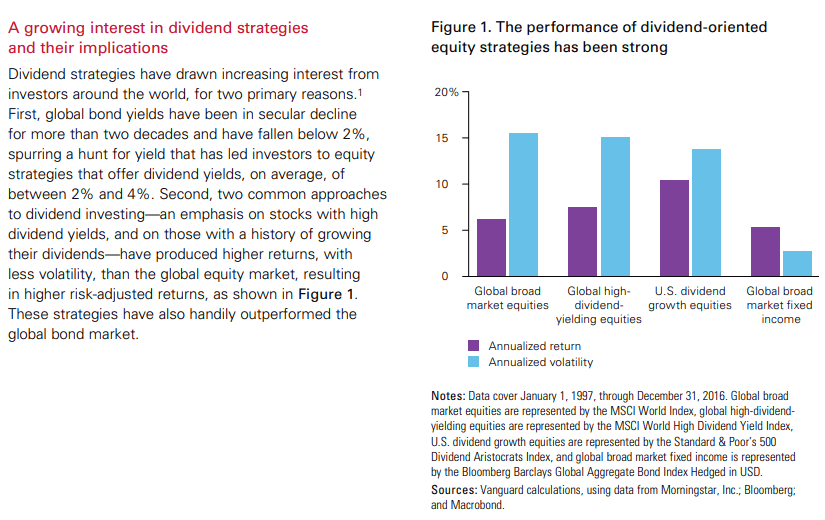

In times of market tumult, entrusting your faith in companies embodying a robust dividend triangle proves to be a sage bet. Not only do these stalwarts weather recessive tempests with aplomb, but they also exhibit prompt convalescence post any market correction. Vanguard’s endorsement further underlines the allure of dividend growers, positing them as outperformers in the market with a conspicuous dearth of volatility.

3 Metrics Won’t Suffice for 2024

While the dividend triangle serves as a commendable starting point, its scope is patently insufficient. The 5-year metrics merely furnish a retrospective vantage point, evincing a historical blueprint without guaranteeing future trajectory. Ascertaining where to deploy capital in 2024 necessitates a 5-year vista into an array of supplementary metrics in conjunction with the dividend triangle.

I scrutinize the 5-year trend pertaining to the following metrics:

- Dividend triangle trend (reflecting year-on-year accretion in revenue, EPS, and dividend)

- Payout and cash payout ratios. Learn more here.

- Long-term debt and debt-to-equity ratio. Learn more here.

- Cash flow from operations. Learn more here.

- Price to earnings ratio (PE).

Sporadic fluctuations or abrupt surges in these metrics mandate diligent explication. Delving into quarterly earnings reports invariably furnishes resolution to my quandaries, thereby facilitating the composition of my investment thesis.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.