ADP Positioned for Strong Fiscal Q3 2025 Earnings Release

With a market cap of $119.6 billion, Automatic Data Processing, Inc. (ADP) is a leader in cloud-based Human Capital Management (HCM) solutions. The company provides a range of services that includes payroll, HR, talent management, and benefits administration. ADP operates through its Employer Services and Professional Employer Organization (PEO) segments, delivering comprehensive HCM platforms and outsourcing solutions to businesses across various sizes.

Upcoming Earnings Announcement

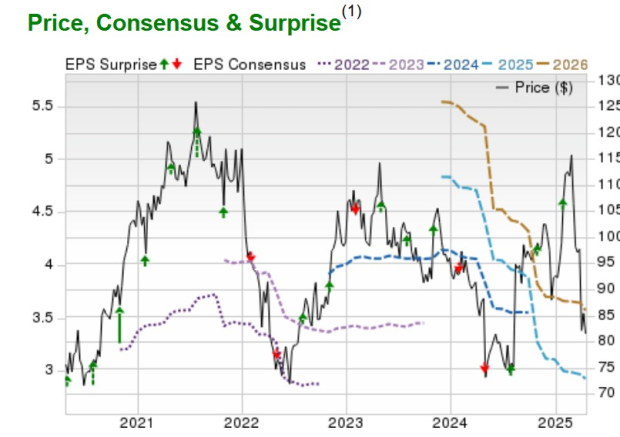

The Roseland, New Jersey-based company is set to announce its fiscal Q3 2025 earnings results before the market opens on Wednesday, Apr. 30. Analysts are projecting that ADP will report a profit of $2.96 per share, which represents a 2.8% increase from last year’s $2.88 per share. The firm has consistently exceeded Wall Street expectations in the past four quarters.

Fiscal 2025 and Projections

For fiscal 2025, analysts anticipate that ADP will report EPS of $9.94, marking an 8.3% growth from $9.18 in fiscal 2024. Additionally, EPS is expected to rise by 9.2% year-over-year to $10.85 in fiscal 2026.

Stock Performance Overview

Shares of Automatic Data Processing have gained 19.1% over the past 52 weeks. This performance surpasses the increase of 7.5% in the broader S&P 500 Index ($SPX) and the 4.8% rise in the Industrial Select Sector SPDR Fund (XLI) during the same period.

ADP shares experienced a slight recovery on Jan. 29 after the company reported better-than-expected fiscal Q2 2025 earnings results, achieving EPS of $2.35 and revenue of $5.1 billion. Key factors such as strong new business bookings and a 21% rise in interest revenue to $273 million contributed to this positive outlook. Furthermore, traction from the AI-powered ADP Lyric platform enhanced investor confidence. The company also reaffirmed its forecast for 6% – 7% revenue growth and 7% – 9% adjusted EPS growth for the fiscal year.

Analysts’ Consensus and Share Price Target

Analysts remain cautious, giving Automatic Data Processing a general “Hold” rating. Among 18 analysts, four recommend a “Strong Buy,” 13 maintain a “Hold” rating, and one suggests a “Strong Sell.” Currently, ADP shares are trading below the average analyst price target of $311.33.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.