Tyson Foods Prepares for Key Earnings Report Amid Mixed Market Performance

Company Overview and Upcoming Earnings Announcement

Springdale, Arkansas-based Tyson Foods, Inc. (TSN) produces, distributes, and markets chicken, beef, pork, prepared foods, and related products. Valued at $21.1 billion by market capitalization, TSN ranks among the largest food companies globally. Its products reach national and regional grocery retailers, wholesalers, meat distributors, warehouse clubs, military commissaries, and industrial food processors. The global protein leader is set to announce its fiscal fourth-quarter earnings for 2024 before the market opens on Tuesday, Nov. 12.

Expectations for Earnings Report

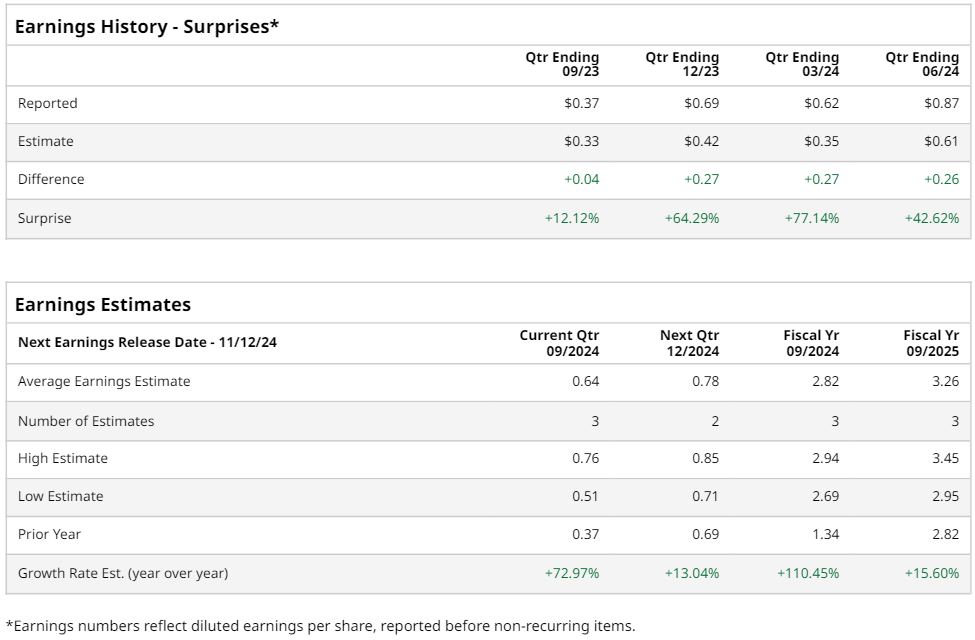

Ahead of this key earnings report, analysts anticipate TSN will post a profit of $0.64 per share on a diluted basis, reflecting a significant increase of 73% from $0.37 per share reported in the same quarter last year. Notably, the company has consistently exceeded Wall Street’s earnings per share (EPS) estimates over its last four quarterly reports.

Annual Earnings Forecast and Future Projections

For the full fiscal year, predictions suggest TSN will report an annual EPS of $2.82, marking a rise of 110.5% from the previous year’s $1.34. Furthermore, EPS is expected to climb 15.6% year over year to $3.26 in fiscal 2025.

Stock Performance and Market Comparisons

In terms of stock performance, TSN has trailed behind the S&P 500’s ($SPX) 38.5% gains over the past 52 weeks, with its shares rising by 27.2% during this period. Nonetheless, TSN managed to outpace the Consumer Staples Select Sector SPDR Fund’s (XLP) 21.9% gains in the same timeframe.

Recent Downgrade and Financial Highlights

On September 25, shares of TSN fell more than 4% after Piper Sandler downgraded the stock from “Neutral” to “Underweight,” setting a price target of $50. In contrast, on August 5, TSN shares rose by over 2% following the company’s Q3 results. The adjusted EPS came in at $0.87, surpassing Wall Street’s estimate of $0.61, while revenue reached $13.4 billion, a 1.6% increase from the previous year. Additionally, the adjusted operating income soared by 174.3% year over year to $491 million.

Future Guidance and Analyst Ratings

Looking ahead, TSN projects adjusted operating income between $1.6 billion and $1.8 billion for fiscal 2024. Sales are expected to remain relatively flat compared to fiscal 2023, with planned capital expenditures ranging from $1.2 billion to $1.3 billion.

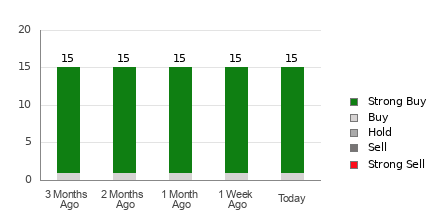

Analysts express cautious optimism regarding TSN stock, with a general “Hold” rating prevailing. Out of eight analysts assessing the stock, two recommend a “Strong Buy,” five suggest a “Hold,” and one advocates for a “Strong Sell.” The average analyst price target for TSN currently stands at $60.33, indicating a potential upside of 2.4% from current levels.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.