JD.com Reports Strong First Quarter, Faces Significant Challenges Ahead

JD.com, a leading e-commerce giant in China, announced its first-quarter 2025 results, which exceeded expectations. The company’s revenues for the quarter grew 15.8% year over year to RMB 301.1 billion ($41.5 billion), surpassing the Zacks Consensus Estimate by 3.2%. JD.com also reported a non-GAAP diluted net income of RMB 8.41 ($1.16) per share, reflecting an impressive 48.8% year-over-year increase and beating the consensus estimate by 10.48%.

This strong performance can be linked to a boost in consumer sentiment and ongoing improvements in JD’s supply chain capabilities and user experience. The company’s investments in artificial intelligence and robotics position it favorably for future growth. Nonetheless, investors should remain cautious due to several near-term challenges facing the company.

To better understand these issues, we will explore the key factors affecting JD.com’s performance and why investors might consider re-evaluating their positions until a clearer recovery signal is evident.

Challenges in JD’s New Business Segment

JD’s new business segment recorded a non-GAAP operating loss of RMB 1.3 billion in the first quarter of 2025, despite an 18% year-over-year revenue increase. This loss primarily stems from the aggressive expansion of its food delivery division, which is still nascent and has yet to significantly impact financial results.

Although the food delivery initiative is gaining user traction, it has yet to contribute positively to profitability. With the operations only beginning to scale toward the end of the first quarter, JD incurred considerable costs without realizing a corresponding revenue boost. The company remains in the initial stages of establishing its food delivery network, necessitating further enhancements in user experience and operational efficiency.

Downward Trend in JD’s Earnings Estimates

The Zacks Consensus Estimate for JD.com’s 2025 earnings stands at $4.59 per share, which has been revised down by 3.16% in the past 30 days, indicating a potential growth of 7.75% year over year. The consensus for 2025 revenues is projected at $172.07 billion, suggesting a year-over-year growth of 7.04%.

Notably, JD.com has consistently beaten the Zacks Consensus Estimate in the past four quarters, with an average surprise of 25.23%.

JD.com, Inc. Price and Consensus

JD.com, Inc. price-consensus-chart | JD.com, Inc. Quote

Competitive Pressures in the E-commerce Market

The online retail sector in China is highly competitive. Major competitors include Alibaba (BABA) and PDD Holdings Inc. Sponsored ADR (PDD), while globally, JD.com faces competition from Amazon (AMZN).

Alibaba controls approximately 80% of the Chinese e-commerce market, and PDD Holdings attracts customers with aggressive pricing and group-buying deals. Amazon maintains a competitive edge globally through exceptional pricing, extensive product selection, and convenience.

This tough competition can adversely affect JD. It risks declining profit margins and market share if it can’t keep up with rivals in pricing and customer perks. Established competitors enjoy longer histories, stronger brand recognition, and superior supplier relationships, posing significant challenges to JD’s market position.

JD’s Stock Performance and Valuation Insights

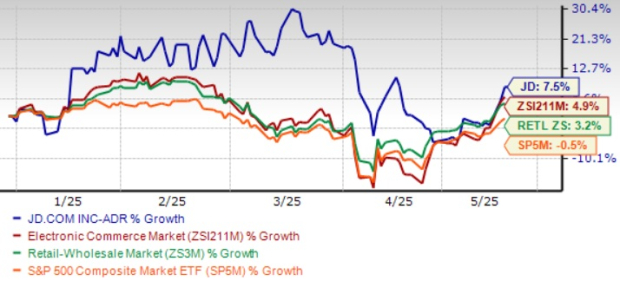

Year-to-date, JD’s shares have risen 7.5%, outperforming the Zacks Retail-Wholesale sector, which increased by 3.2%, and the Zacks Internet – Commerce industry’s growth of 4.9%. Comparatively, JD outperformed the S&P 500 index, which decreased by 0.5% during the same period.

However, JD has lagged behind its industry peers. Shares of Alibaba and PDD have increased by 55.3% and 23.2%, respectively, while Amazon’s stock has decreased by 3.6% in the same timeframe.

JD.com’s Year-to-Date Price Return Performance

Image Source: Zacks Investment Research

From a valuation standpoint, JD trades at a forward 12-month P/E ratio of 7.94X, significantly lower than the Zacks Internet – Commerce industry’s ratio of 22.94X. This suggests that investors may be securing a favorable price relative to the company’s anticipated earnings growth.

JD’s P/E F12M Ratio Indicates Discounted Valuation

Image Source: Zacks Investment Research

Conclusion

JD.com’s first-quarter results were robust, yet near-term outlook is less clear. Losses in the new business segment, particularly in food delivery, as well as costly investments in AI, automation, and logistics, are affecting immediate profitability. Additionally, launching an international all-cargo air route between Wuhu, China, and Hanoi, Vietnam, signifies increased capital expenditure without short-term gains. With easing earnings estimates and heightened market competition, investors should consider pulling back until clearer recovery indicators are observed.

Currently, JD carries a Zacks Rank #4 (Sell).