Arista Networks Earnings Anticipated: Historical Patterns and Predictions

Arista Networks (NYSE:ANET) will announce its earnings on Tuesday, May 6, 2025. In the past, ANET stock has often seen positive returns following earnings reports. Over the last five years, the stock achieved positive one-day returns 60% of the time, with a median gain of 6.1% and a peak single-day gain of 20.4%.

Strategies for Event-Driven Traders

For traders looking to capitalize on these historical trends, understanding the patterns may provide an edge. However, actual market reactions will depend significantly on how the reported earnings align with expectations. Two main strategies are:

- Pre-Earnings Positioning: Analyze past performance trends to determine the likelihood of a positive post-earnings return and go accordingly.

- Post-Earnings Correlation Analysis: Investigate the historical link between immediate and medium-term stock performance after earnings to frame your trading position.

Current Earnings Forecast

Consensus estimates suggest that Arista will report earnings of $0.59 per share on revenue of $1.97 billion. This reflects year-over-year growth from last quarter, when earnings were $0.50 per share with revenues of $1.57 billion. This expected increase is likely driven by the rising adoption of artificial intelligence and the growth of data center infrastructure, both of which support Arista’s business expansion.

Company Fundamentals

Arista Networks holds a market capitalization of $111 billion. Over the past year, it generated $7.0 billion in revenue and reported an operating profit of $2.9 billion, resulting in a net income of $2.9 billion.

Historical Performance Insight

Analyzing the last five years reveals that out of 20 earnings reports, Arista had 12 positive one-day returns versus 8 negative ones, indicating a 60% success rate for positive returns. Notably, this success rate dips to 55% when only the last three years are considered.

- Median of the 12 positive returns: 6.1%

- Median of the 8 negative returns: -6.0%

Understanding Return Correlations

Traders should also consider the relationship between short-term and medium-term returns post-earnings. Finding pairs with high correlation offers a potentially safer investment strategy. For example, if 1D and 5D returns correlate closely, a trader could enter a long position for the following five days if the one-day return is positive.

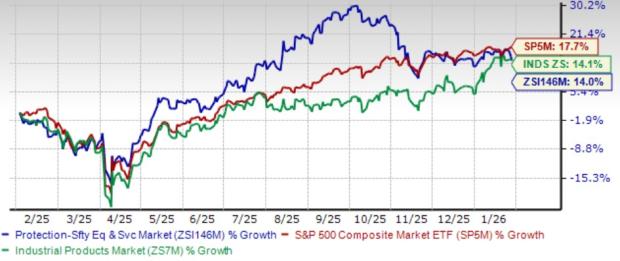

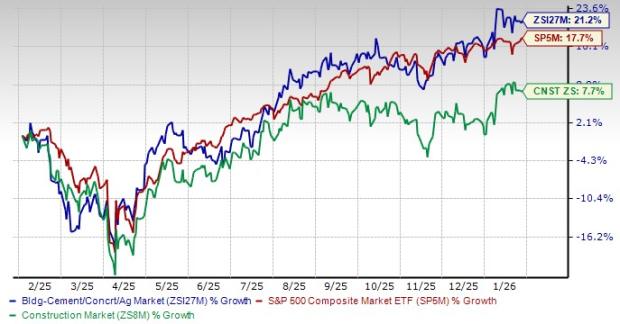

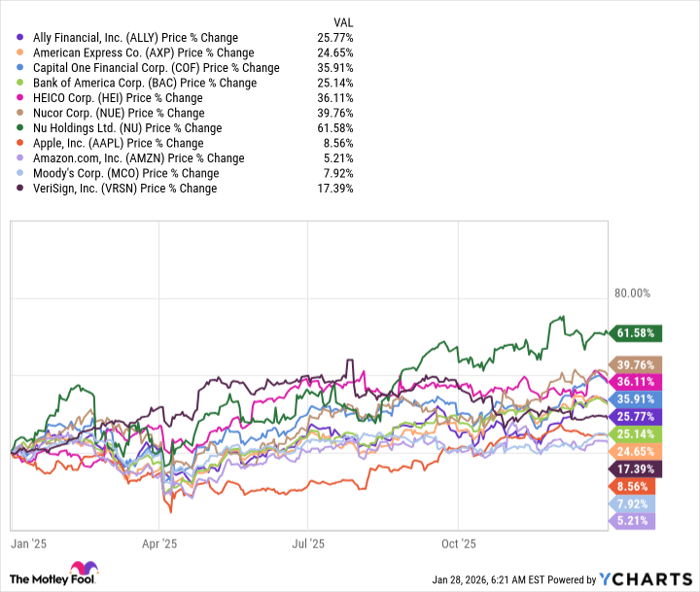

Peer Earnings Impact

Performance among peers can influence how Arista’s stock reacts post-earnings. Historical data shows that the stock’s behavior often aligns with peers reporting just before Arista. Analyzing this correlation can provide valuable insights for predicting Arista’s stock movement.

ANET Correlation With Peer Earnings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.