FedEx (NYSE: FDX) is gearing up to reveal its fiscal Q3 2024 results on Thursday, March 21. Market analysts anticipate revenue to meet expectations while earnings may outperform predictions. FedEx is anticipated to experience a slight uptick in its average daily volumes across its business segments, reaping the rewards of cost reduction strategies. Dive into our interactive dashboard analysis on FedEx’s Earnings Preview for a deeper insight.

The Roller Coaster Ride of FDX Stock Against the S&P 500

Tracking FDX stock performance shows a modest shift from around $260 in early January 2021 to the current level of about $255. Meanwhile, the S&P 500 surged by approximately 35% over a similar three-year period. Despite some fluctuations, FDX stock has struggled to match the performance of the index, boasting 0% returns in 2021, -33% in 2022, and 46% in 2023. On the flip side, the S&P 500 marked 27% gains in 2021, -19% in 2022, and 24% in 2023, painting a picture of FDX consistently lagging behind in previous years.

Beating the S&P 500 has been a tough nut to crack for many heavyweight players across various sectors, including industrials giants and tech mammoths. However, the Trefis High Quality (HQ) Portfolio, comprising 30 stocks, has outshone the S&P 500 consistently over the same period. The secret to its success? The HQ Portfolio stocks deliver higher returns with lower risk compared to the benchmark index, offering investors a smoother ride.

Potential for Upswing in the Current Economic Climate

As uncertainties loom in the macroeconomic landscape, characterized by surging oil prices and elevated interest rates, investors ponder whether FedEx will repeat its underperformance seen in 2021 and 2022 against the S&P 500 over the next year. The good news is that there may be room for growth in FDX stock from a valuation standpoint.

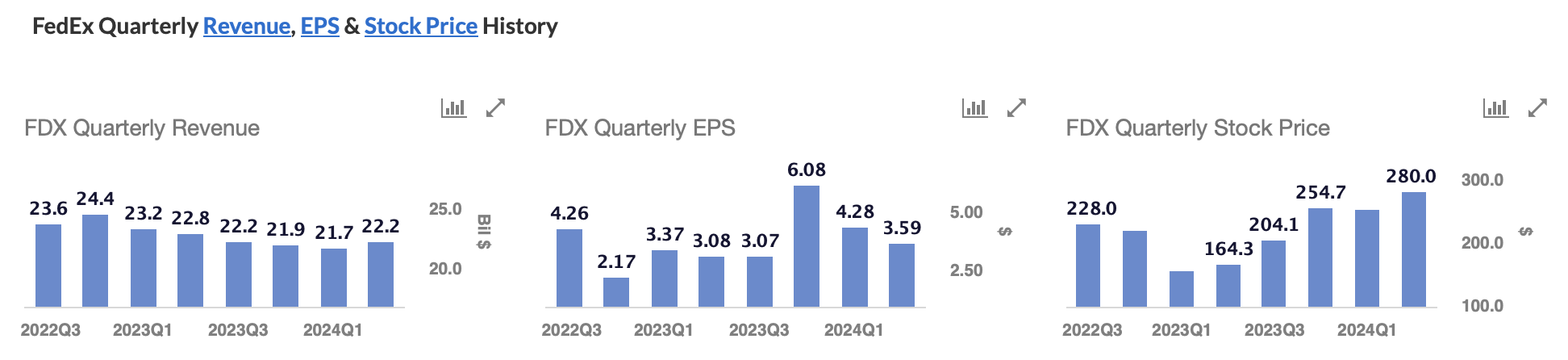

FedEx has the potential for growth, with its expected Q3 revenues aligning with consensus estimates. Despite challenges in delivery volumes due to weakened consumer demand amidst high inflation, the company aims to enhance its market share both domestically and internationally. Improved volumes are on the horizon for Q3, signaling positive momentum for FedEx. On the earnings front, adjustments suggest that FDX may outshine estimates and witness an expansion in operating margins.

The Future of FDX Stock and Market Dynamics

- Estimations place FedEx’s valuation at $284 per share, offering an 11% upside from the current market price of $257. Based on forward expected adjusted earnings and historical trends, the stock seems poised for growth.

- Market share gains and margin enhancement strategies bode well for FedEx’s future prospects, with potential rate cuts expected to fuel broader market growth, including FDX stock.

- If FedEx delivers strong Q3 results and raises guidance for the fiscal year, we could witness further upward momentum in FDX stock levels.

As investors eagerly await FedEx’s impending financial report, it’s crucial to evaluate how FedEx’s peers are faring in crucial performance metrics. Discover insightful peer comparisons across industries at Peer Comparisons.

| Returns | Mar 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| FDX Return | 3% | 1% | 38% |

| S&P 500 Return | 2% | 9% | 131% |

| Trefis Reinforced Value Portfolio | -1% | 3% | 635% |

[1] Returns as of 3/20/2024

[2] Cumulative total returns since the end of 2016

For further insights and market-beating portfolios, consider investment strategies with Trefis. Explore all Trefis Price Estimates for a comprehensive understanding.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.