Funtap/iStock via Getty Images

Realty Income (NYSE:O) is gearing up to reveal its Q4 earnings results on Tuesday, February 20th, after the market’s closing bell.

Positive Momentum and Strong Performance

The net-lease REIT had edged up the lower end of its 2023 earnings guidance subsequent to Q3 earnings, enabling it to outperform the Wall Street consensus estimates for both earnings and revenue. The company also revised its guidance for same-store rent growth upwards, indicating robust performance.

In Q4 of the previous year, Realty Income exceeded expectations, buoyed by higher occupancy levels, and presented a 2023 FFO guidance that surpassed the predictions of Wall Street analysts. These positive outcomes reflect the formidable strength of the real estate investment trust.

Prospects and Predictions for Q4’23

For the upcoming Q4’23, the consensus FFO estimate stands at $1.04, indicating a marginal decline of 1.14% year-over-year. Additionally, the revenue estimate for the same period is projected to amount to $983.7M, marking an impressive 12.64% year-over-year increase. These figures highlight the steady growth pattern anticipated by investors and analysts alike.

Market Position and Market Response

Following its agreement to acquire Spirit Realty in a $9.3B all-stock deal, the stock price experienced a dip to as low as $46.22. However, at present, it has rebounded to $52.50, albeit still 7% lower than its 200-day simple moving average. This fluctuation indicates the market’s response to the company’s strategic decisions, propelling it into a position of financial strength and market advantage.

Strategic Acquisitions and Growth Trajectory

Moving forward, the planned takeover of Spirit Realty Capital is poised to substantially enhance O’s long-term financial standing and market influence. Furthermore, the investments in properties and other ventures reflect the company’s proactive approach to growth and expansion, harnessing an initial average cash yield of around 7.1% for the full year. The anticipation of accretive investments and the delivery of above-peer average operating results underscore Realty Income’s strategic foresight and operational acumen.

Analyst Perspectives and Recommendations

While some analysts have highlighted the limitations posed by its size and market capitalization, many have expressed optimism about Realty Income’s performance. Over the last 2 years, the company has habitually outperformed FFO and revenue estimates, indicating its resilience and consistency in delivering exemplary results. The prevailing consensus among sell-side analysts rates the stock as a Buy, with an average price target of $63.02, supported by the expectations of strong future performance.

Conclusion and Future Outlook

As investors eagerly await Realty Income’s Q4 earnings report, the prevailing sentiment suggests a positive outlook. The potential for growth, coupled with strategic acquisitions and resilient performance, positions Realty Income for a promising trajectory in the real estate investment sector.

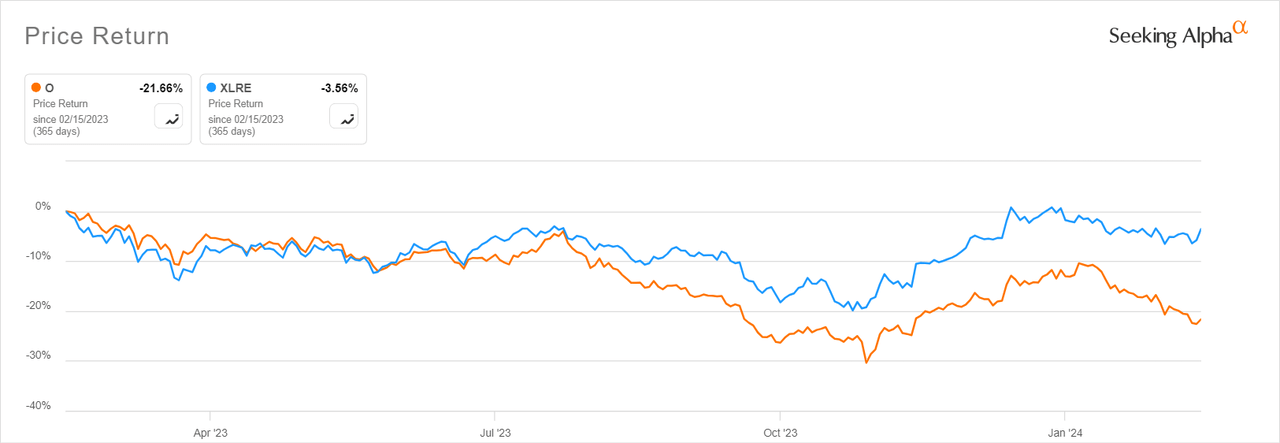

Here is a look at O’s 1-year stock performance, compared to the broader S&P 500 real estate index: