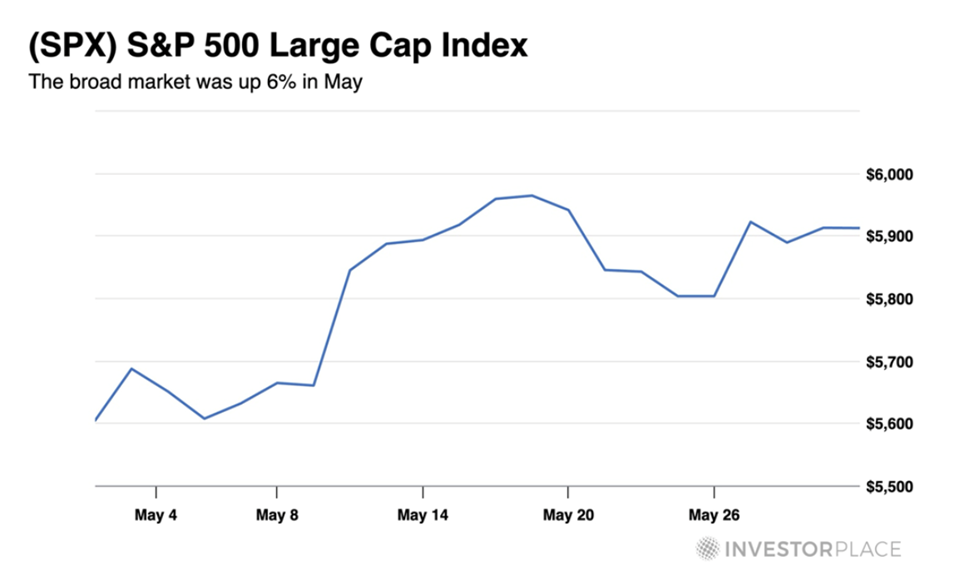

May 2025 saw a significant recovery for investors, with the S&P 500 rising by 6.2%, marking its best performance for the month since 1990. This recovery followed a nearly 19% drop in April and represents more than half of the average annual return of 11% over the past 30 years.

Traders also capitalized on this volatility, achieving a cumulative return of 129% from four short-term trades recommended in May, significantly outperforming the S&P 500. The strategy employed focuses on “mean reversion,” aiming to profit from stocks returning to their average levels after extreme price movements.

The volatility in 2025, which saw $6.6 trillion wiped from the market in a two-day period, is viewed by traders as an opportunity rather than a threat, providing numerous chances to exploit price fluctuations for profit.