The Evolving Landscape of Fixed Income Markets

It has undeniably been a tumultuous year for fixed income investors. With the Federal Reserve abruptly raising rates and then hinting at potential cuts, the fixed income terrain has been reshaped.

Amidst the anticipation of rate adjustments, many investors have turned to investment-grade securities, patiently waiting for the anticipated cuts to take effect. However, a closer look may reveal hidden gems beyond the conventional options.

Unveiling the Potential of Asia High Yield Bonds

Intriguingly, the realm of high yield Asia bonds beckons with promises of reduced interest rate risks and brighter credit prospects. Contrary to popular belief, investing in high yield Asia bonds could offer a more favorable landscape compared to other high yield markets.

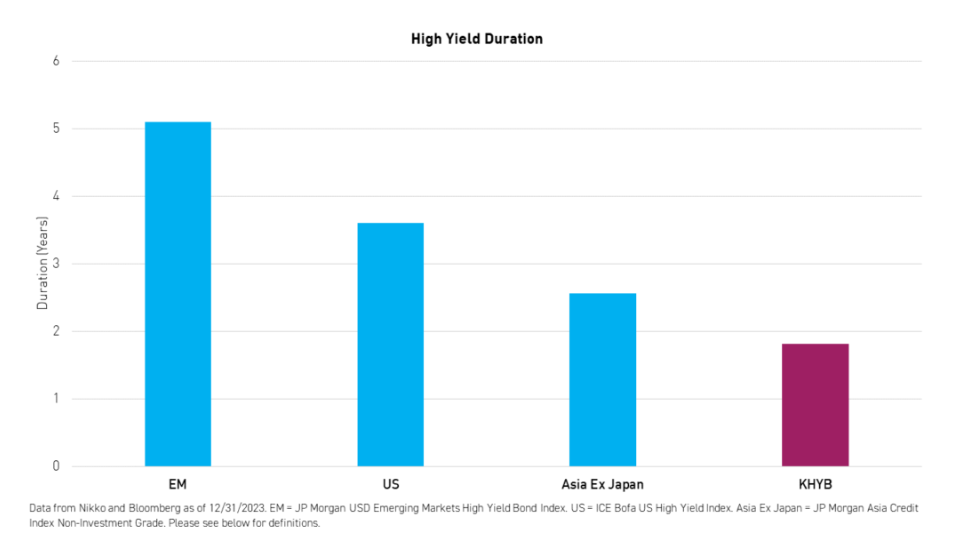

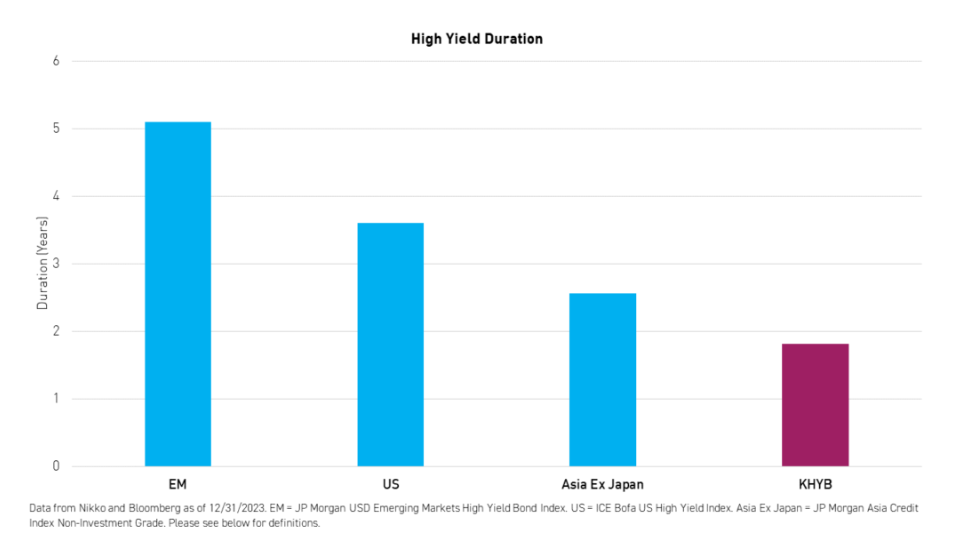

For instance, the KraneShares Asia-Pacific High-Income Bond ETF (KHYB) showcases the allure of Asia high yield bonds with its lower duration, translating to diminished interest rate sensitivity. This contrasting dynamic to the U.S. fixed income market is captured vividly in visuals provided by KraneShares.

Embracing Lower Interest Rate Sensitivity and Reduced Credit Risk

This shift towards Asia high yield bonds not only shields a fixed income allocation from interest rate fluctuations but also addresses diminishing credit risks in the region. With China resolving its real estate challenges, corporate default rates in Asia are poised to decline significantly this year.

So, what sets KHYB apart? The strategy, managed by Nikko Asset Management Americas, implements a proactive investment approach with a fee of 69 basis points. Leveraging top-down macro research and bottom-up credit analysis, Nikko diligently crafts a portfolio based on a blend of qualitative and quantitative factors, evaluating issuer credit profiles and values.

In essence, KHYB offers a compelling avenue for investors seeking to diversify beyond the U.S. fixed income market, presenting an attractive medium-term option. With a commendable 5.8% return over the past year, KHYB stands as a viable consideration should U.S. rate cuts remain elusive.

For updated news, insightful information, and comprehensive analysis, feel free to explore the China Insights Channel.

The expressions and viewpoints articulated here represent the perspective of the author and do not necessarily align with those of Nasdaq, Inc.