Copa Holdings CPA is scheduled to report first-quarter 2024 results on May 15 after market close.

The Zacks Consensus Estimate for earnings has been revised 2.5% downward over the past 60 days to $3.06 per share. It has an impressive earnings surprise history, having surpassed the consensus estimate in each of the preceding four quarters, the average beat being 18.02%.

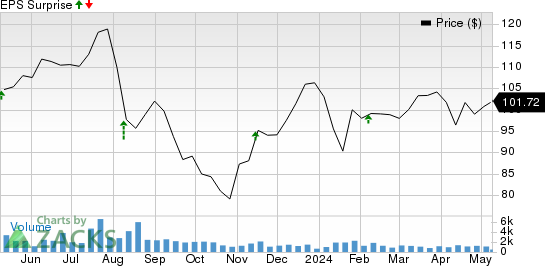

Copa Holdings, S.A. Price and EPS Surprise

Copa Holdings, S.A. price-eps-surprise | Copa Holdings, S.A. Quote

Given this backdrop, let’s unearth the factors likely to have influenced CPA’s performance in the quarter under review.

We expect the top-line performance to have been hurt by the temporary grounding of Boeing 737 MAX 9 planes in its fleet in January. Passenger revenues, which account for the bulk of the top line, are likely to have been low, in turn, hurting total revenues. Our estimate for passenger revenues is pegged at $798.4 million, indicating a 4.3% decline from the year-ago levels.

Performance of the Cargo segment is also likely to have been disappointing due to lower cargo volumes and yields. We expect revenues from Cargo and Mail services to fall 13% from the prior-year actuals. The Zacks Consensus Estimate for quarterly total revenues is currently pegged at $837.31 million, suggesting a dip of 3.45% from year-earlier actuals.

High operating costs, mainly due to an increase in wages, salaries, benefits and other employee expenses, are likely to have hurt the bottom line. We expect wages, salaries, benefits and other employee expenses to increase 30.2% from year-ago figures.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Copa Holdings this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

CPA currently has an Earnings ESP of 0.00% (the Most Accurate Estimate is in line with the Zacks Consensus Estimate of $3.06) and a Zacks Rank #2.

Highlights of Q4

Copa Holdings’ fourth-quarter 2023 earnings per share of $4.47 (excluding 8 cents from non-recurring items) surpassed the Zacks Consensus Estimate of $3.90 but declined 0.45% year over year. Revenues of $916.9 million beat the Zacks Consensus Estimate of $893.6 million and rose 2.96% year over year on the back of upbeat passenger revenues.

Q1 Performances of Some Other Transportation Companies

Delta Air Lines DAL reported first-quarter 2024 earnings (excluding 39 cents from non-recurring items) of 45 cents per share, which comfortably beat the Zacks Consensus Estimate of 36 cents. Earnings increased 80% on a year-over-year basis.

Revenues of $13.75 billion surpassed the Zacks Consensus Estimate of $12.84 billion and increased 7.75% on a year-over-year basis, driven by strong air travel demand. Adjusted operating revenues (excluding third-party refinery sales) came in at $12.56 billion, up 6% year over year. Delta expects adjusted earnings of $2.20-$2.50 per share for second-quarter 2024.

CSX Corporation‘s CSX first-quarter 2024 earnings per share of 46 cents beat the Zacks Consensus Estimate by a penny. However, the bottom line declined 4% year over year.

Total revenues of $3.68 billion surpassed the Zacks Consensus Estimate of $3.65 billion. The top line decreased 1% year over year due to a lower fuel surcharge, a decline in other revenues, low trucking revenues and reduced export coal prices.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s an American AI company that’s riding low right now, but it has rounded up clients like BMW, GE, Dell Computer, and Bosch. It has prospects for not just doubling but quadrupling in the year to come. Of course, all our picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

CSX Corporation (CSX) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.