Wheat Market Shows Weakness as Futures Close Lower

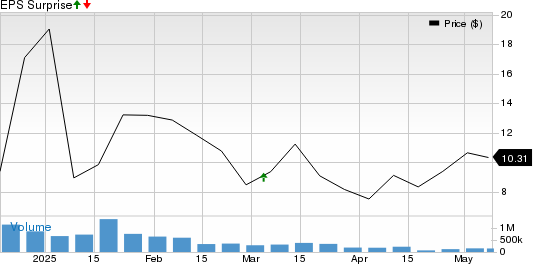

The wheat complex experienced a decline as trading closed on Thursday. Chicago SRW futures fell by 5 cents in the front months, while Kansas City HRW futures decreased by 4 to 5 cents. Additionally, Minneapolis spring wheat futures dropped 2 to 3 cents by the end of the trading session.

The weekly Export Sales report, released this morning, indicated that 69,659 MT of wheat were sold in the week ending May 1. Notably, Mexico purchased 37,300 MT. New crop sales surpassed expectations, reaching 492,978 MT—setting a marketing year high for the 2025/26 marketing year and more than doubling figures from the previous week. A total of 183,500 MT was sold to unknown destinations, with South Korea acquiring 100,800 MT.

Looking ahead, the USDA will publish its first WASDE report on Monday, providing the 2025/26 balance sheets. Analysts anticipate that the old crop will be reported at 850 million bushels, reflecting a 4-million-bushel increase, while the new crop is projected at 863 million bushels.

In other developments, Taiwanese mill importers made a significant purchase of 99,200 MT of wheat from the United States overnight. Data from Statistics Canada, released this morning, indicated that wheat stocks at the end of March totaled 15.421 million metric tons, representing a 1.2% decline from the previous year.

Jul 25 CBOT Wheat closed at $5.29 1/4, down 5 cents.

Sep 25 CBOT Wheat closed at $5.44, down 5 cents.

Jul 25 KCBT Wheat closed at $5.24 3/4, down 4 3/4 cents.

Sep 25 KCBT Wheat closed at $5.38 3/4, down 5 cents.

Jul 25 MGEX Wheat closed at $6.00 3/4, down 2 1/4 cents.

Sep 25 MGEX Wheat closed at $6.12 1/2, down 2 1/2 cents.

On the date of publication, Austin Schroeder did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are intended solely for informational purposes. For additional information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.