The journey of ChargePoint (NYSE: CHPT) has been a rollercoaster ride for investors, with shares peaking in late 2020 and now potentially on the cusp of a value resurgence pending improved operating results. The current $750 million market capitalization and 2023 revenue of $506.6 million have pushed the price-to-sales ratio down to a mere 1.5 times, the lowest level since the company went public.

However, the overarching challenge over the next decade lies in the company’s ability to turn a profit. With a history of losses, the year 2024 becomes particularly pivotal for ChargePoint.

Image source: Getty Images.

An Outmoded Business Model

The foundation of ChargePoint’s strategy has centered around expanding its base of charging stations to capitalize on high-margin subscription revenue as electric vehicle (EV) adoption burgeons. However, this approach has proven to be flawed.

The sale of EV chargers, or Networked Charging Systems, forms the core revenue stream for ChargePoint, but this segment has been operating at a deficit thus far. In 2023, the company raked in $360.8 million from charger sales but spent a staggering $386.1 million to construct them. Coupled with a 1% decline in revenue, this sector has failed to deliver substantial returns.

While subscription revenue showed a promising 41.2% uptick to $120.4 million, boasting a commendable gross margin of 39%, these gains fell short of offsetting the company’s hefty $480.1 million in operational costs, resulting in a whopping $457.6 million loss for the year.

Without transformative shifts, ChargePoint’s long-term prospects remain precarious.

A Glimmer of Hope from Management

Despite the challenging financial landscape, the management team struck an optimistic note in the Q4 2023 earnings report, expressing confidence in achieving non-GAAP adjusted EBITDA breakeven by the close of 2024. This aspiration contrasts starkly with the $45.3 million Q4 loss and the $272.7 million annual loss in 2023.

However, looming trends may impede this turnaround. Firstly, U.S. automakers are transitioning to the NACS charging standard, leading to a further commodification of chargers. Secondly, the deceleration in EV sales growth casts a shadow over 2024, posing a potential downturn in consumer and manufacturer demand. This unfavorable operating environment bodes ill for charger utilization.

The Landscape in a Decade

To secure its survival, ChargePoint must pivot towards profitability in charger sales. While the subscription arm is promising, the crux lies in establishing a profitable foundation in charger transactions for sustainable operation.

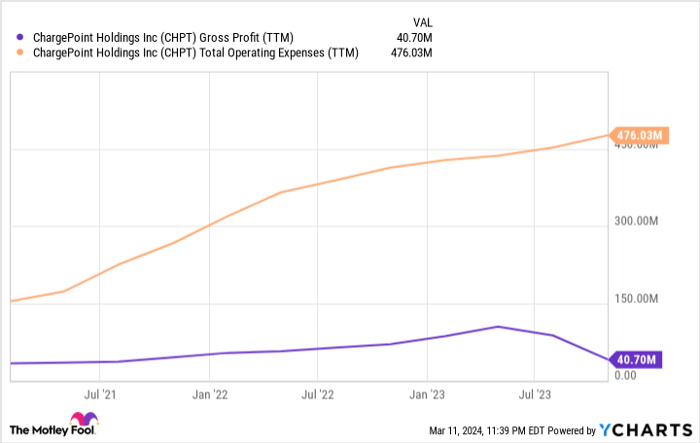

Additionally, a substantial reduction in operating expenses is imperative to attain profitability. Presently, operational costs nearly match sales figures, a disparity that should ideally range between 15% to 20% of sales for a hardware-centric entity.

CHPT Gross Profit (TTM) data by YCharts

Fundamentally, the intensity of competition within the EV charger domain proves a significant challenge. Chargers, irrespective of the manufacturer, are almost indistinguishable, rendering it arduous for ChargePoint to carve out substantial margins.

Furthermore, with the industry converging around a universal standard like NACS, the landscape becomes increasingly homogenized. In such a scenario, how can ChargePoint differentiate itself?

As the stock prices dwindle and with a cash reserve of $327.4 million, akin to the $328.9 million operating cash drained in 2023, avenues for additional fundraising, like the $287.2 million accrued in 2023, are poised to become more arduous to execute.

In the absence of an acquisition by another charger entity, automaker, or utility firm, ChargePoint faces a bleak future as a solitary entity. These are the sobering realities of the contemporary charger market.

Considering an investment in ChargePoint?

Before venturing into the world of ChargePoint stocks, deliberate on this:

The Motley Fool Stock Advisor analyst panel has singled out what they deem the top 10 stocks for investment opportunities today, with ChargePoint not making the cut. These selected stocks hold the potential for substantial returns in the forthcoming years.

Stock Advisor equips investors with actionable insights for success, offering counsel on portfolio construction, regular updates from analysts, and two fresh stock picks each month. Since 2002, the Stock Advisor service has outperformed the S&P 500 threefold*.

Explore the 10 stocks

*Stock Advisor returns as of March 11, 2024

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool observes a strict disclosure policy.

The perspectives presented are those of the author and may not align with those of Nasdaq, Inc.