Nvidia (NASDAQ: NVDA) has been a rocket ship of success, soaring in both the short and long run. Boasting a remarkable 241% return in just one year and a staggering 21,320% over a decade, Nvidia’s performance has eclipsed major benchmarks like the S&P 500. As investors ponder whether it’s too late to jump on the Nvidia bandwagon, one key tool in forecasting the trajectory of a company is to visualize its upcoming business landscape, detaching from the vagaries of stock price fluctuations.

In March 2020, I sketched a picture of Nvidia’s potential in five years, peering into March 2025. This article serves as a Year 4 checkpoint to assess the validity of those early predictions.

Captain of the Ship: CEO Jensen Huang Steers the Course

Status at Year 4: Right on track.

Back in March 2020, the conjecture was that Jensen Huang would be steering Nvidia’s ship, conditions permitting, and the odds today still favor him at the helm. Despite crossing the 61-year mark, Huang’s boundless zeal for his craft remains unmistakable, as evidenced by his enduring intellectual vigor.

Riding High: Nvidia Dominates Gaming Graphics

Status at Year 4: Still leading — with a bigger slice of the pie.

In the realm of discrete GPUs for desktop gaming, Nvidia’s reign remains unchallenged, bolstered by an increased market share. The company’s stronghold extended to an imposing 80% in the desktop GPU market by the fourth quarter of 2023, outpacing rivals like Advanced Micro Devices and Intel.

Level Up: Gaming Sector Sees Continued Growth

Status at Year 4: Growth trajectory uninterrupted.

The global gaming market continues its upward trajectory, clocking a robust compound annual growth rate of approximately 13% until 2023, reaching a substantial valuation of around $250 billion.

AI Ascendancy: Nvidia’s GPUs Remain the Cream of the Crop

Status at Year 4: Still the standard — with an expanded domain.

As predicted in 2020, Nvidia maintains a dominant stance in the realm of AI chip technology, fortified by an expanding slice of the market share. The surging demand for chips fostering generative AI capabilities has fueled this growth, with Nvidia spearheading innovation in this domain.

Autonomous Drive: A Speed Bump on the Road to Legalization

Status at Year 4: Timeline likely optimistic.

The vision of fully autonomous vehicles cruising the streets by 2025 appears optimistic in hindsight. Despite the delayed timeline, Nvidia’s strategic positioning and collaborations within the auto industry set the stage for significant growth when the tide shifts.

The Wild Card: Nvidia’s Innovation Quotient

Status at Year 4: Exceeded expectations.

Nvidia’s penchant for innovation has rung true, with the company unveiling an array of groundbreaking technologies that astound and captivate. The launch of the Omniverse platform stands as a testament to Nvidia’s ability to surprise and redefine technological landscapes.

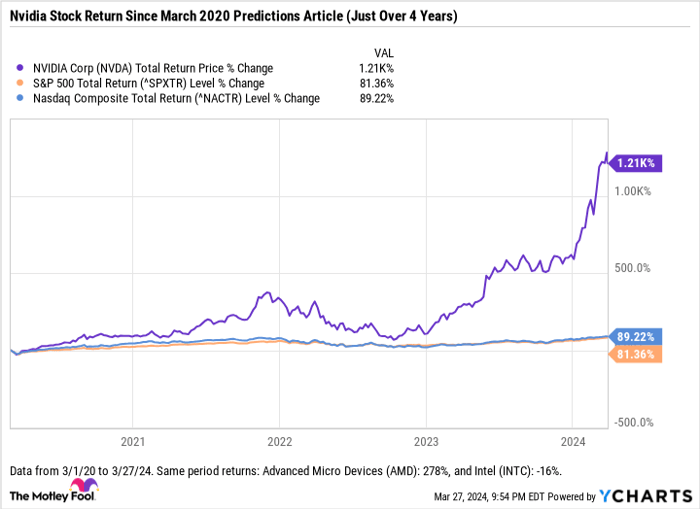

Data by YCharts.

A Gaze into the Crystal Ball: Nvidia’s Stock Price Balancing Act

Status at Year 4: Trending towards market outperformance.

While forecasting exact stock prices is an exercise fraught with uncertainties, Nvidia’s trajectory still points toward a trajectory that tilts in favor of market outperformance. With a remarkable 1,210% return over the past four years, Nvidia’s ascent outpaces major indices, setting the stage for continued financial success.

Following this Year 4 check-in on the 2020 forecasts, the outlook for Nvidia remains optimistic, with a strong momentum suggesting continued outperformance in the years ahead.

Feeling the FOMO? Dive into the Nvidia Opportunity?

Before diving into Nvidia stock, ponder this:

The Motley Fool Stock Advisor team has spotlighted the 10 best stocks poised for significant growth, with Nvidia notably absent from the list. These handpicked stocks promise lucrative returns, providing investors with a roadmap to navigate the volatile market terrain.

Stock Advisor offers a road map to investment success, empowering investors with expert guidance, portfolio-building strategies, and bimonthly stock selections that consistently outstrip S&P 500 returns since 2002*.

Discover the top 10 stocks here

*Stock Advisor returns as of March 25, 2024

Beth McKenna holds positions in Nvidia. The Motley Fool holds positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool endorses Intel and suggests options like long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short May 2024 $47 calls on Intel. The Motley Fool adheres to a disclosure policy.

The opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.