Super Micro Computer (NASDAQ: SMCI) catapulted an astonishing 2,990% in the past three years, outperforming the tech-heavy Nasdaq-100 Technology Sector index by a significant 22%. With such stellar performance, one might wonder if now is the opportune moment to capitalize on the ascending trajectory of Super Micro Computer’s shares, commonly known as Supermicro. Well, let’s delve deeper into the catalysts that could propel Supermicro to even greater heights in the next three years.

The Accelerating Growth Trajectory of Supermicro Computer

In producing modular high-performance servers and storage solutions, Supermicro has registered remarkable demand over the past three years. Closing fiscal 2023 (June 30, 2023) with $7.1 billion in revenue, Supermicro witnessed a substantial leap from its fiscal 2020 revenue of $3.34 billion, equating to a robust three-year compound annual growth rate (CAGR) of 28%. Projections for fiscal 2024 estimate revenue to reach $14.5 billion, signifying a potential for the company’s top line to more than double in just a year.

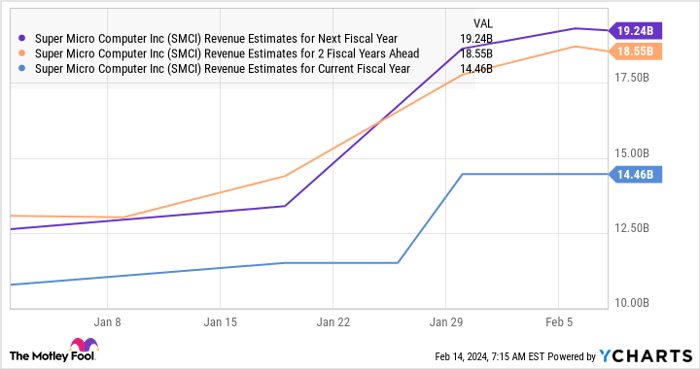

Moreover, analysts have revised their forecasts for the upcoming fiscal years, indicating substantial long-term growth potential.

SMCI Revenue Estimates for Next Fiscal Year data by YCharts

In light of this chart, Supermicro’s revenue is anticipated to soar to over $19 billion in fiscal 2026. If realized, this forecast would accelerate Supermicro’s revenue CAGR to more than 39% from fiscal 2024 to fiscal 2026. Furthermore, the company’s plans to elevate its server production capacity are expected to elevate its annual revenue potential beyond $25 billion. Quite impressive, right? It’s as though Supermicro has struck gold and struck it big — it’s like hitting the jackpot in a raging AI-themed casino. The gamble isn’t just paying off; it’s flourishing astronomically, with the company experiencing a surge in orders for its server racks used in deploying high-end AI chips from the likes of Nvidia. This blooming AI domain itself is a goldmine, with the global AI server market poised to explosively snowball 5x between 2023 and 2027, generating an annual revenue of $150 billion. With all these exciting prospects, it’s not far-fetched to envisage Supermicro’s top-line growth extending beyond fiscal 2026.

Prospective Upside for Investors in the Next Three Years

Should Supermicro’s top line surge to $25 billion in fiscal 2027 and maintain its current sales multiple of 5, its market cap could soar to $125 billion, a substantial leap from its current market cap of approximately $45 billion. This translates to a potentially lucrative uptick of almost 180% over the next three years. Faced with such prospective upside, investors might want to consider seizing this opportunity to invest in Supermicro and ride the wave of its potential growth. The stock is currently attractively priced, despite its remarkable surge.

Before diving in, let’s consider this:

The Motley Fool Stock Advisor analyst team has just revealed what they believe are the 10 best stocks for investors to buy right now…and Super Micro Computer didn’t make the cut. These 10 stocks are expected to yield massive returns in the coming years. If you’re keen on stock investing, the Stock Advisor service furnishes a user-friendly blueprint for success. It provides guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. Since 2002, the Stock Advisor service has impressively eclipsed the return of the S&P 500, more than tripling it*. We shouldn’t take such insights for granted, right? They bear valuable testament to the potential that lies ahead for investors in the stock market.

Interested in discovering the 10 stocks?

*Stock Advisor returns as of February 12, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.