Investors Eye Quantum Computing Stocks Amid Nvidia’s Decline

Many investors aspire to discover the next Nvidia (NASDAQ: NVDA), a stock capable of delivering life-changing returns. However, chasing gains in the thousands of percentage points is challenging and often requires a high-risk approach to get in early.

Over the past year, one of the hot sectors has been quantum computing. With increased investments in artificial intelligence and the demand for advanced computing power, stocks related to quantum computing have surged. This article examines some of the leading stocks in this space and their potential to rival Nvidia.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy now. Learn More »

Stocks Achieving Over 500% Gains in Six Months

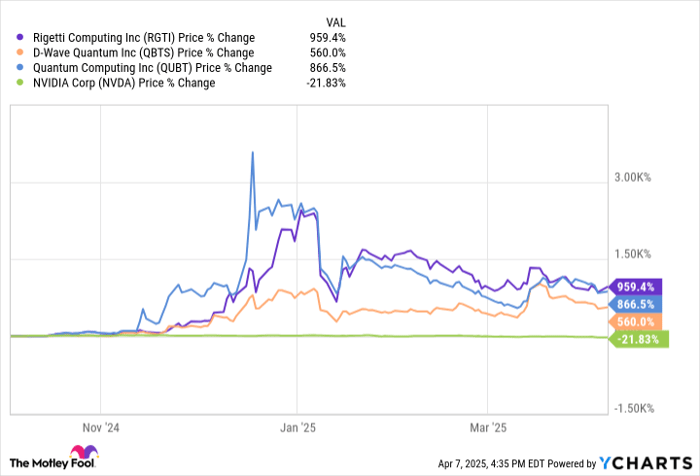

Notably, shares of Rigetti Computing, D-Wave Quantum, and Quantum Computing have all experienced remarkable rises in the past six months. While Nvidia’s shares have dipped, these quantum computing stocks have soared.

RGTI data by YCharts.

Despite its name not explicitly highlighting “quantum,” Rigetti Computing works on building quantum systems. The significance of quantum computing lies in its ability to drastically accelerate processing times, providing faster solutions that can enhance various industries. However, the quantum computing market remains nascent.

Analysts from Grand View Research estimate that the quantum computing market will grow at a compound annual growth rate of over 20% through 2030. By then, it is projected to be valued at just over $4.2 billion.

Investors may be attracted to these stocks due to their seemingly modest valuations amidst vast growth potential. Rigetti holds the highest market value among these stocks at about $2.7 billion, while Nvidia commands a market cap of approximately $2.8 trillion.

Caution Advised for Investors in Quantum Computing Stocks

While these stocks have garnered attention as scorching buys in recent months, none are currently profitable. These companies are in early-stage growth and may take years to reach breakeven, if at all.

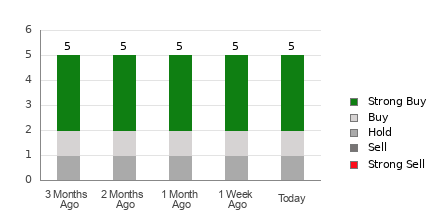

RGTI Revenue (Quarterly) data by YCharts.

Some analysts are optimistic that quantum computers capable of real-world problem-solving could emerge in five years, while others caution that a longer timeline is plausible. A primary concern for investors is whether these companies will survive until such innovations are feasible. Regardless of the optimism surrounding quantum technologies, caution is warranted for investors navigating these high-risk assets.

It’s Premature to Declare Any of These Stocks the Next Nvidia

While quantum computing holds promise for the future, not every company in this arena is guaranteed to yield returns comparable to Nvidia’s. Despite Nvidia’s impressive rise over the past decade, it was a recognized tech leader back then. Current quantum computing stocks carry a much higher risk profile.

Investors seeking exposure to quantum computing might consider more established tech companies. Nvidia is actively investing in quantum computing, which could position it well as the technology evolves.

Committing significant funds to stocks that may falter in five or ten years poses a considerable risk, potentially leading to substantial losses.

Investing in the next big tech Stock could yield significant rewards; however, it is also likely to result in substantial losses. A more prudent option could be to invest in a well-established technology firm, like Nvidia or another company poised to benefit from the rise of quantum computing.

Should You Invest $1,000 in Nvidia Right Now?

Before purchasing stock in Nvidia, take this into account:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks available now… and Nvidia was not included. The selected stocks have the potential for huge returns in the near future.

If you had invested $1,000 in Nvidia when it appeared on our list on April 15, 2005, your investment would have grown to $590,231!

Stock Advisor equips investors with straightforward strategies for success, including portfolio-building guidance, analyst updates, and two new Stock recommendations each month. The Stock Advisor service has more than quadrupled the S&P 500 returns since 2002.* Don’t miss out on the latest top 10 list, accessible upon joining Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 5, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.