Nvidia vs. AMD in the AI Battle: Who Comes Out on Top?

The Unmatched Lead of Nvidia in Data Centers

Nvidia (NASDAQ: NVDA) dominates the data center computing market, a crucial sector given the immense financial resources devoted to artificial intelligence (AI) infrastructure. While AMD (NASDAQ: AMD) also reaps some benefits from this trend, Nvidia stands at the forefront, leveraging its competitive edge in this rapidly evolving field.

Nvidia’s current advantage may seem insurmountable. However, innovation is unpredictable—AMD could potentially catch up with a breakthrough of its own.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Given these developments, which stock looks more promising for investors by 2025?

Nvidia’s Dominance in the Data Center Market

Nvidia’s GPUs and accompanying software have established a strong industry standard in data centers. Although AMD’s GPUs appear competitive on paper, Nvidia’s CUDA software distinguishes it. This powerful platform allows GPUs to perform multiple calculations quickly, essential for the demands of AI processing.

The widespread adoption of CUDA over AMD’s ROCm software creates substantial switching costs for businesses already using Nvidia’s infrastructure. This makes it unlikely for AMD to close the gap anytime soon.

The financial comparisons between the two companies provide further clarity on Nvidia’s standing. In Q4 2024, AMD reported a data center revenue of $3.9 billion, reflecting a year-over-year growth of 69%. Nvidia, pending its Q4 results, shows an even more impressive picture when looking at Q3 data.

During Q3, AMD generated $3.5 billion from its data center division, an extraordinary year-over-year increase of 122%. Yet, these numbers pale compared to Nvidia’s Q3 FY 2025 data center revenue of $30.8 billion, which marked a 112% increase annually. This indicates Nvidia’s data center revenue is nearly tenfold that of AMD’s—an impressive lead. Investors will eagerly await Nvidia’s Q4 results, set to be reported on February 26, particularly amid rising discussions about AI investments from major tech firms.

Given Nvidia’s significant market stronghold and the accompanying switching costs for businesses, it’s tough for AMD to carve out a larger slice of Nvidia’s data center segment. Nonetheless, if AMD’s stock appears significantly cheaper, it may entice some investors, as its smaller data center operations continue to show robust growth.

Assessing AMD’s Value Compared to Nvidia

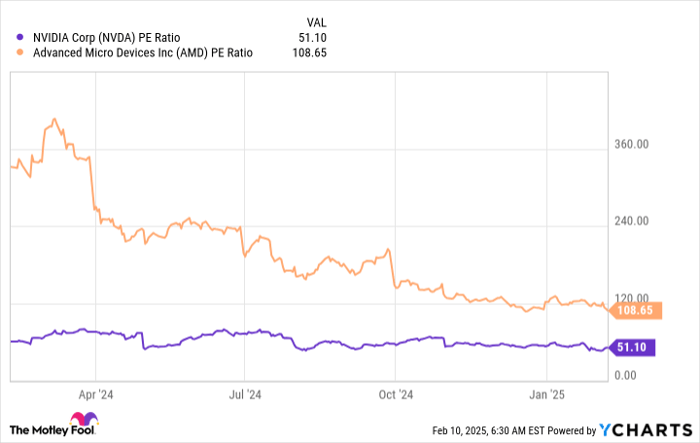

Both companies are profitable, so evaluating their valuations through metrics like the price-to-earnings (P/E) ratio is sensible.

NVDA PE Ratio data by YCharts

Using this metric, AMD’s stock appears pricier than Nvidia’s. Both firms are experiencing strong growth, and AMD’s profits are projected to rise in 2025, favoring the use of a forward P/E ratio for comparison.

NVDA PE Ratio (Forward) data by YCharts

From this viewpoint, AMD appears less expensive than Nvidia. However, this valuation gap is justifiable considering their respective growth rates. Nvidia’s revenue is anticipated to grow by 52% in FY 2026 (ending January 2026), while AMD is expected to see a 24% growth rate. This difference reflects market expectations and justifies Nvidia’s higher valuation.

With Nvidia showcasing faster growth and commanding the current high-stakes computing market, the prospect of investing in AMD seems less appealing. High-quality stocks like Nvidia often outperform their competitors, especially when starting from similar valuation levels.

Is Now the Right Time to Invest in Nvidia?

Before making an investment decision regarding Nvidia, keep this in mind:

The Motley Fool Stock Advisor analyst team has pinpointed what they see as the 10 best stocks to acquire right now—and Nvidia didn’t make the list. Those top ten stocks could potentially yield significant returns in the years to come.

If you had invested $1,000 in Nvidia on April 15, 2005, based on one of these recommendations, you would now have approximately $850,946!*

Stock Advisor offers investors a straightforward approach to achieving success, complete with portfolio-building guidance, regular analyst updates, and two new stock suggestions each month. Since its inception, the Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*.

Learn more »

*Stock Advisor returns as of February 7, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.