Southern Company: Investment Outlook Amid Growth and Challenges

Southern Company (SO), a key player in the U.S. utilities sector, is responsible for the generation, transmission, and distribution of electricity. Its subsidiaries serve millions of customers across Georgia, Alabama, and Tennessee, with a diverse energy portfolio that includes nuclear, coal, hydro, solar, wind, and advanced battery storage.

The company is embracing the future of energy by investing significantly in natural gas, renewable resources, and innovative solutions like microgrids. This strategy positions Southern to lead the transition toward sustainable energy alternatives.

Approximately 90% of Southern Company’s earnings come from regulated electric and gas utilities, providing a stable, low-risk income stream for investors. This reliability combined with an extensive infrastructure solidifies Southern’s position in the energy landscape of the United States.

Investors often ponder whether now is the right time to purchase Southern shares or hold existing ones. The company’s strong reputation and impressive asset range make it an attractive option, but potential challenges may influence its valuation. Let’s examine the factors currently driving investor interest in SO and the risks that may pose concerns.

Investor Optimism Surrounding Southern Company

Focus on Affordability and Customer-Centric Model: Southern balances reliability and affordability, a strategy that helps attract large-load customers such as data centers. The recently approved Georgia tariff framework offers clarity for these customers, ensuring long-term revenue stability without excessive costs for residential users.

Robust Economic Development and Load Growth: The company reports a significant pipeline of over 50 GW in potential incremental loads by the mid-2030s, with 10 GW already committed. Demand for data centers has grown by 11% year-over-year. Additionally, industrial growth, exemplified by Hyundai’s new plant in Georgia, supports the long-term outlook and population growth in the Southeast.

Digital Transformation and Grid Modernization: Southern is advancing a digital transformation by investing in smart grid technologies and enhanced digital infrastructure. These initiatives are designed to improve operational efficiency and service reliability. Through its subsidiary Southern Telecom, the company meets the increasing demands of data-intensive businesses, aligning with the rising push for digital connectivity. Southern’s use of AI analytics and automated grid operations further establishes its role as a technology-driven leader in the evolving energy sector.

Regulatory Support and Constructive Frameworks: Operating in favorable regulatory environments aids Southern’s growth. Georgia Power’s Integrated Resource Plan (IRP) and ongoing proposals for 13 GW of new energy resources are progressing, with essential filings expected in July 2025. This allows the company to recover investments through rate cases, adding to earnings stability.

Dividend Growth and Shareholder Returns: The board has approved an 8-cent annual dividend increase, marking the 24th consecutive year of growth and 78 years of uninterrupted payouts. This steady dividend growth, alongside a manageable payout ratio of 60%, demonstrates management’s confidence in sustainable cash flow, making SO an appealing option for income-focused investors.

Potential Market Challenges for Southern Company

Regulatory and Political Uncertainty: Upcoming rate cases and IRP approvals present regulatory risks, particularly due to the timing in an election year. Delays or unfavorable rulings on cost recovery could negatively impact earnings. Additionally, potential federal policy shifts, including changes to tax credits under the Inflation Reduction Act, may introduce further uncertainty.

Exposure to Natural Gas Price Volatility: Natural gas is a crucial revenue component for Southern, but its price fluctuations can threaten profit margins and earnings stability. While many contracts allow the company to pass on fuel costs to customers, significant price hikes could attract closer regulatory scrutiny. The shift toward electrification and possible policy constraints on natural gas infrastructure pose long-term challenges for the company’s distribution and pipeline investments.

Tariff and Supply-Chain Pressures: Import tariffs on materials such as solar panels and steel could elevate capital costs by 1-3%. While certain mitigations like USMCA compliance exist, prolonged trade disputes or supply chain disruptions have the potential to delay projects or reduce profit margins.

Execution Risks in Large Load Pipeline: Despite the impressive 50+ GW pipeline, only a fraction may see fruition. Speculative projects, permitting complications, or hesitations from clients, particularly in the data center sector, could lower growth expectations. Management remains cautiously aware of these risks.

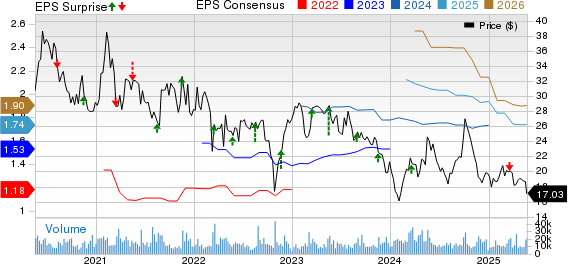

Stock Performance as a Concern: SO’s share price has appreciated by 8.9% year-to-date, yet this falls short compared to the Electric Power sector’s 9.3% rise and the broader industry’s 9.8% increase. Moreover, SO has underperformed its peers; companies like Enel Chile S.A. (ENIC), CenterPoint Energy (CNP), and DTE Energy (DTE) have seen year-to-date gains of 27.8%, 17.3%, and 12.7%, respectively. This relative underperformance may indicate investor concerns and could impact SO’s valuation in the future.

DTE Energy’s diversified clean energy approach and CenterPoint Energy’s significant investments in grid modernization contribute to their strong Stock performance. Likewise, Enel Chile S.A. benefits from a growing renewable portfolio, enhancing its attractiveness to sustainability-focused investors.

Year-to-Date Share Price Performance: SO vs. Sector and Peers

Image Source: Zacks Investment Research

Final Thoughts on Southern Company Stock

Southern Company maintains a strong growth outlook driven by its commitment to affordability, customer-centered strategies, and investments in digital transformation. Benefitting from a favorable regulatory environment and a significant economic development pipeline, particularly within the Southeast, it can be anticipated that Southern will continue to pursue growth opportunities while navigating potential challenges ahead.

# Utility Sector Analysis: Navigating Growth and Risks

Growing demand for data centers and industrial expansion highlights positive trends for utility companies. Furthermore, consistent dividend growth indicates strong financial stability, making these companies attractive to income-focused investors.

Challenges Facing the Sector

Despite these strengths, there are challenges to consider. Regulatory uncertainties surrounding upcoming rate cases pose risks. Additionally, fluctuations in natural gas prices could impact profitability, and potential supply-chain issues from tariffs remain a concern. Execution risks associated with large pipeline projects also linger. Recent stock performance has underperformed compared to industry peers, likely reflecting investor apprehension.

Investment Recommendations

Given the mixed outlook, investors might consider waiting for a more favorable entry point before adding this Zacks Rank #3 (Hold) stock to their portfolios. It’s also advisable to monitor competitors such as Enel Chile S.A., CenterPoint Energy, and DTE Energy, each offering unique growth opportunities within the evolving utility landscape.

Current Market Opportunities

For a broader view, evaluate today’s Zacks #1 Rank (Strong Buy) stocks to identify potential investments.

In summary, while the utility sector shows growth, investors should weigh both the opportunities and the possible pitfalls before making decisions.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.