Smooth Sailing Ahead? A Look at Stock Market Potential Amid Fed Missteps and Upcoming Election Spending

Despite today’s market dip, we might be on the brink of a significant stock market surge.

This assertion comes from the perspective of someone who worries about the current market’s high valuations. In truth, I don’t think a market surge is supported by the underlying economic fundamentals.

However, this situation is worth noting as a real possibility for two key reasons.

First, the Federal Reserve seems poised to repeat past mistakes. Second, an influx of government spending anticipated from the next president could stimulate economic growth, no matter who takes the office.

Let’s examine these points in detail.

Is the Fed Facing Another Potential Miscalculation?

In recent discussions, I’ve emphasized the need for caution in today’s market, citing indicators showing extremely high valuations, excessive investor optimism, and various warning signals. It’s easy to build a bearish outlook when viewing the market through this lens.

Yet, there are bullish factors that could propel stock prices upward in the near future. The actions of the Fed are particularly noteworthy.

It now appears the Fed may have overstepped with its significant 50-basis-point rate cut in September. If the Fed continues to lower rates as traders expect, we may soon see inflation resurgence alongside an asset bubble.

To put this in perspective, the Fed’s objective (as outlined in the September Summary of Economic Projections, or SEP) is to bring long-term inflation back to 2.9% within the next few years. This figure represents the “neutral” interest rate, where the Fed neither aids nor hinders economic growth.

However, the neutral rate is variable and cannot be precisely determined. This uncertainty creates room for mistakes, often leading to over-stimulation or excessive tightening of the economy, which can culminate in bubbles or crashes.

Given the Fed’s track record of errors since the Covid pandemic began, what if they are wrong again about the neutral rate of 2.9%?

Noted economist Ed Yardeni, favored by Louis Navellier, suggests that they might be.

Yardeni Estimates the Current Neutral Rate is at Least 4%

Yardeni supports his argument with several economic factors but emphasizes government spending as a key influence.

He states:

Productivity growth may be one of the most important factors in determining the neutral interest rate. There are many other moving parts undoubtedly, including the federal budget deficit.

Over the last three years, the deficit has reached record highs during a period characterized by solid economic growth. Importantly, inflation has begun to ease.

Large fiscal deficits have helped to boost economic growth and alleviated the recessionary effects expected from tighter monetary policies.

Therefore, Yardeni concludes that current fiscal policies have raised the determined neutral interest rate. Fed officials may overlook this because they tend to avoid political discussions.

This argument sheds light on why many economists failed to foresee the recession many anticipated in 2023. After all, when the government infuses the economy with trillions of newly created dollars, it becomes challenging to induce a recession.

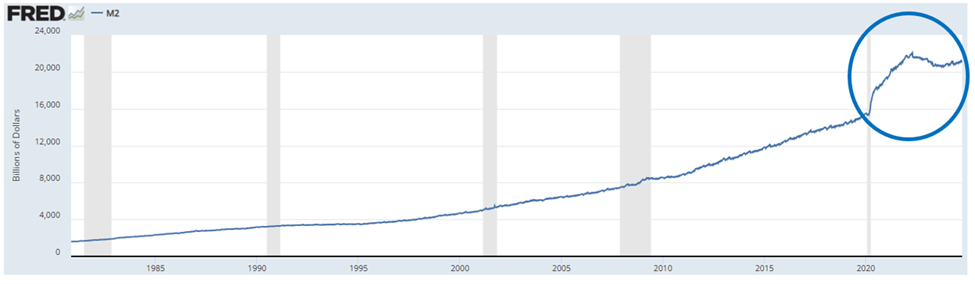

If you need a reminder, consider the surge in our M2 Money Stock post-2020.

Source: Federal Reserve data

Much of this money eventually ended up on the Fed’s balance sheet.

Source: Federal Reserve data

The impact on the housing market has also been significant.

Source: Federal Reserve data

If the Fed is incorrect about the neutral rate, its September rate cut and any subsequent reductions could overshoot and lead to inflation and a rapid increase in asset prices.

In context, if Yardeni is correct in estimating the neutral rate at a minimum of 4%—let’s say 4.25%—then the Fed’s current target rate of 4.75% to 5.00% is only slightly above that.

Here’s Yardeni’s conclusion:

If the Fed continues to lower the federal funds rate, monetary policy will most likely stimulate an economy that doesn’t need to be stimulated.

This strategy could result in heightened inflation in prices and assets. The latter trend is already observable in the stock market.

Looking Ahead: Economic Stimulus and Market Reactions

Inflation Data and Political Spending: What’s Next for Markets?

Latest Inflation Figures from the Fed

This morning, we received the latest update on inflation, specifically the Personal Consumption Expenditures (PCE) Price Index, which the Federal Reserve closely monitors.

Year-over-year inflation has reached 2.1%, matching expectations. However, the core PCE—which excludes the often volatile food and energy prices—rose to 2.7% annually and 0.3% monthly. This annual increase was 0.1% above forecasts.

It’s important to remember that the Fed aims for a 2% inflation rate, and currently, we are at 2.7%. This figure indicates inflation is 35% above the target. Despite this, the Federal Reserve has started easing monetary policy with a 50-basis-point cut, and further easing may be coming.

There’s speculation that the neutral rate could be around 2.9%. If it’s indeed above 4%, Ed Yardeni warns that we could see both price and asset inflation rise. We are already witnessing significant movements in the stock market.

Political Spending and Potential Market Impact

Both Vice President Kamala Harris and former President Donald Trump have plans that could lead to substantial government spending if they win the presidency in the upcoming election.

The Committee for a Responsible Federal Budget warns:

Our large and growing national debt threatens to slow economic growth, increase interest rates, weaken national security, and escalate the risk of a fiscal crisis.

None of the leading candidates in the 2024 election have proposed effective plans to address this increasing debt. Analysis indicates that under Harris, national debt could rise by nearly $4 trillion by 2035, while under Trump, it could increase by approximately $8 trillion.

Yardeni again points out, Large fiscal deficits have boosted economic growth and offset the recessionary impact of the tightening of monetary policy.

Elon Musk and Potential Spending Cuts

One possible variable on the political scene is Elon Musk, who has proposed that if Trump wins, he could take charge of cutting federal spending.

During a recent “telephone town hall,” Musk suggested:

We need to reduce spending to live within our means. This may bring temporary hardship, but it is essential for long-term prosperity…

Musk believes that after the election, there will be an immediate push to identify areas for cuts. He likened government spending to “a room full of targets” that are easy to hit.

When a commentator speculated that this approach might lead to market declines initially, Musk agreed, stating, Sounds about right.

His proposition mirrors the approach of Argentinian President Javier Milei, who emphasized drastic reductions in government expenditure. Changes in this area could significantly affect capital flows in the stock market.

Billionaire investor John Paulson has expressed willingness to assist Musk in cutting federal spending. He has indicated that subsidies for green energy projects might face cuts, stating:

Eliminating these tax subsidies for solar, wind, and other inefficient energy sources could bring down spending.

While cutting wasteful spending is an attractive idea, skepticism remains. The existing government structure will likely resist changes that threaten its stability.

Revisiting the Possibility of a Market Melt-Up

Given the staggering 20% rise in the market so far in 2024, continuing this upward trend might seem unlikely. Yet the Fed could unintentionally stimulate the economy if it misreads the neutral rate. Moreover, a new president may continue to drive spending, further boosting the economy.

While caution is warranted, history shows that market valuations can exceed rational expectations during periods of significant macroeconomic forces.

Investors should be prepared for both a potential market melt-up and a reassessment of valuation norms.

Final Thoughts

If you missed the recent discussion featuring renowned investor Louis Navellier and geopolitical expert Charles Sizemore regarding potential election chaos, I encourage you to check out the replay. They shared intriguing predictions that may surprise you.

It’s worth noting that these experts have a track record for making bold, accurate predictions; last December, they forecasted Joe Biden’s potential replacement on the Democratic ticket.

For those concerned about potential market volatility following the election, I suggest listening to their insights on managing your portfolio during this period.

We will continue to provide updates on these developments in the Digest.

Have a great evening, and a Happy Halloween!

Best,

Jeff Remsburg