Duolingo’s Impressive Growth: A Language Learning Success Story

IPO Success and Value Surge

Language-learning company Duolingo (NASDAQ: DUOL) launched its initial public offering (IPO) in 2021 at a price of $102 per share. Since then, its value has tripled, showcasing significant market success.

Different languages come with varying complexities, often requiring 1,000 to 2,000 hours to acquire proficiency. Duolingo has recognized the importance of maintaining learner motivation, especially since mastering a new language is a lengthy endeavor. The company’s success lies not just in understanding this need, but in their effective strategies to keep learners engaged.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Engaging Learning Experience

Learning a new language can be daunting. While a learner might understand a word, recalling it in conversation can be difficult. Furthermore, mastering grammar rules that differ from one’s native language is often tough. However, Duolingo addresses these challenges by incorporating gaming elements into its learning app. This method reduces stress while increasing motivation.

To engage users effectively, Duolingo implements A/B testing on all features. This approach allows for constant refinement and enhances the aspects that genuinely resonate with learners.

User Growth During the Past Three Years

The company’s growth is evident through user metrics:

| Metric | Q3 2021 | Q3 2024 | Percentage gain |

|---|---|---|---|

| Monthly active users | 41.7 million | 113.1 million | 171% |

| Daily active users | 9.8 million | 37.2 million | 280% |

| Paid subscribers | 2.2 million | 8.6 million | 291% |

Data source: Duolingo’s financial filings.

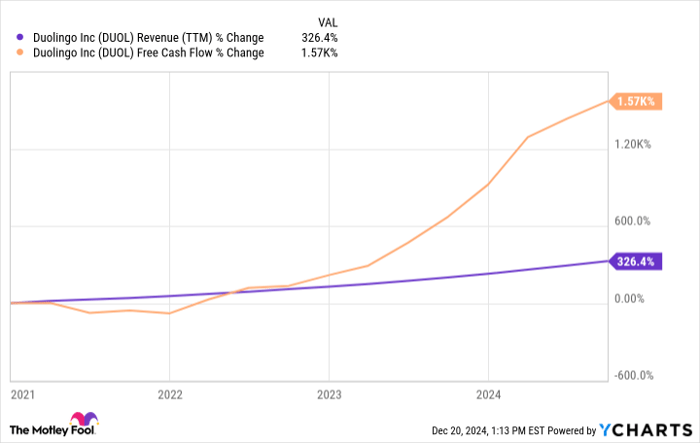

Revenue Sources and Cash Flow Growth

A key area of growth for Duolingo lies in its paid subscriptions. In the third quarter of 2024, 82% of the company’s revenue was generated from subscription sales. As the user base expanded, so did the revenue, leading to significant increases in free cash flow:

DUOL Revenue (TTM) data by YCharts.

Upcoming Opportunities with AI

As 2025 approaches, Duolingo is set to integrate new artificial-intelligence (AI) features into its offerings. Recently, the company introduced a premium subscription tier called Max, which includes generative AI elements.

Some analysts perceive AI as a potential threat to educational platforms, suggesting that learners could rely on AI chatbots instead of subscribing to services like Duolingo. However, given the current nascent stage of AI development, its true impact remains to be seen. Presently, it seems AI could serve as a boon for Duolingo, enhancing user experiences like conversational practice with its character, Lily.

Adoption of Duolingo Max is promising, though broader availability is still in progress. As of Q3, only half of Duolingo’s 37 million daily active users had access to this feature. If the rollout continues successfully, subscriptions could further increase.

This anticipated growth, driven by subscription-based revenue and the Max tier, sets up a strong outlook for Duolingo in 2025. A rise in higher-tier subscriptions could significantly impact revenue, providing a notable boost to their financial performance.

Investment Insight: Now Might Be the Time

For those concerned about missing out on investing in successful stocks, examine this opportunity.

On rare occasions, our team recommends a “Double Down” stock, aimed at companies poised for significant growth. Here are some past examples:

- Nvidia: An investment of $1,000 in 2009 would now be worth $349,279!*

- Apple: An investment of $1,000 made in 2008 would be valued at $48,196!*

- Netflix: A 2004 investment of $1,000 would now have grown to $490,243!*

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool recommends Duolingo. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.