“`html

Apple and Microsoft Outshine, But Alphabet’s Value Potential Remains

Recently, Apple (NASDAQ: AAPL) lost its status as the world’s largest company to Microsoft (NASDAQ: MSFT). However, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) sits just behind them, with the potential to surpass both in value. Despite being one of the most profitable companies globally, it lacks the premium valuation attributed to its competitors.

If the market suddenly adjusted to align these companies’ valuations, Alphabet could easily take the lead as the world’s most valuable company. Yet, underlying market skepticism raises questions about this possibility.

Understanding Alphabet’s Low Valuation

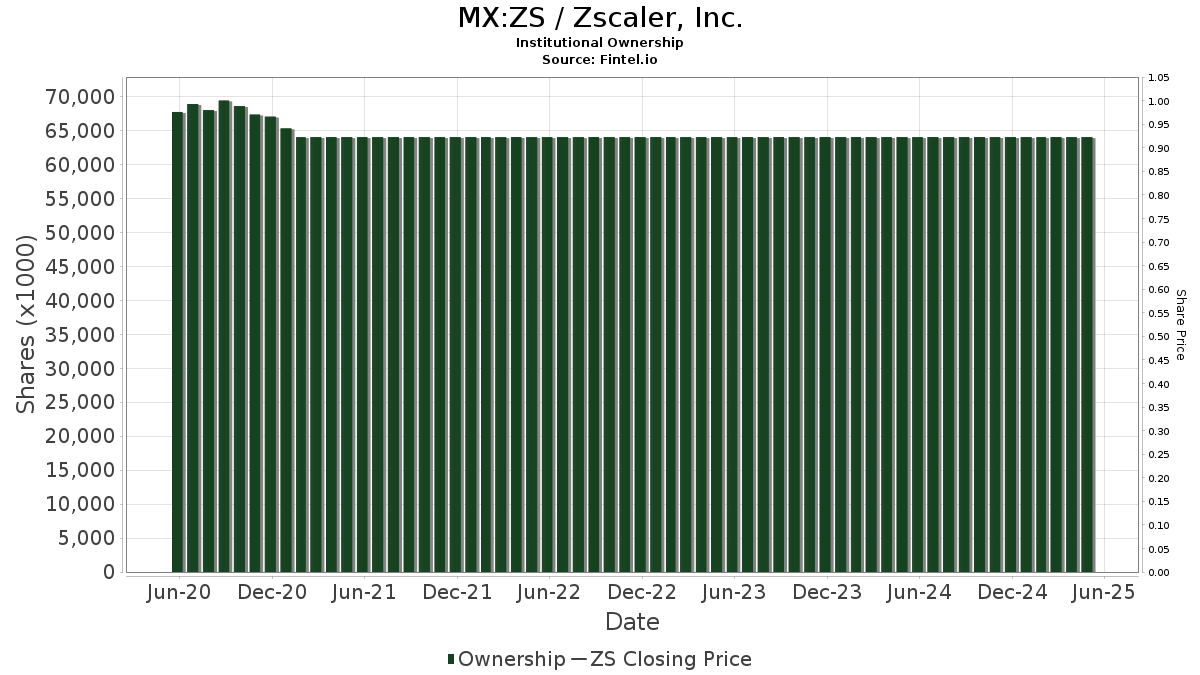

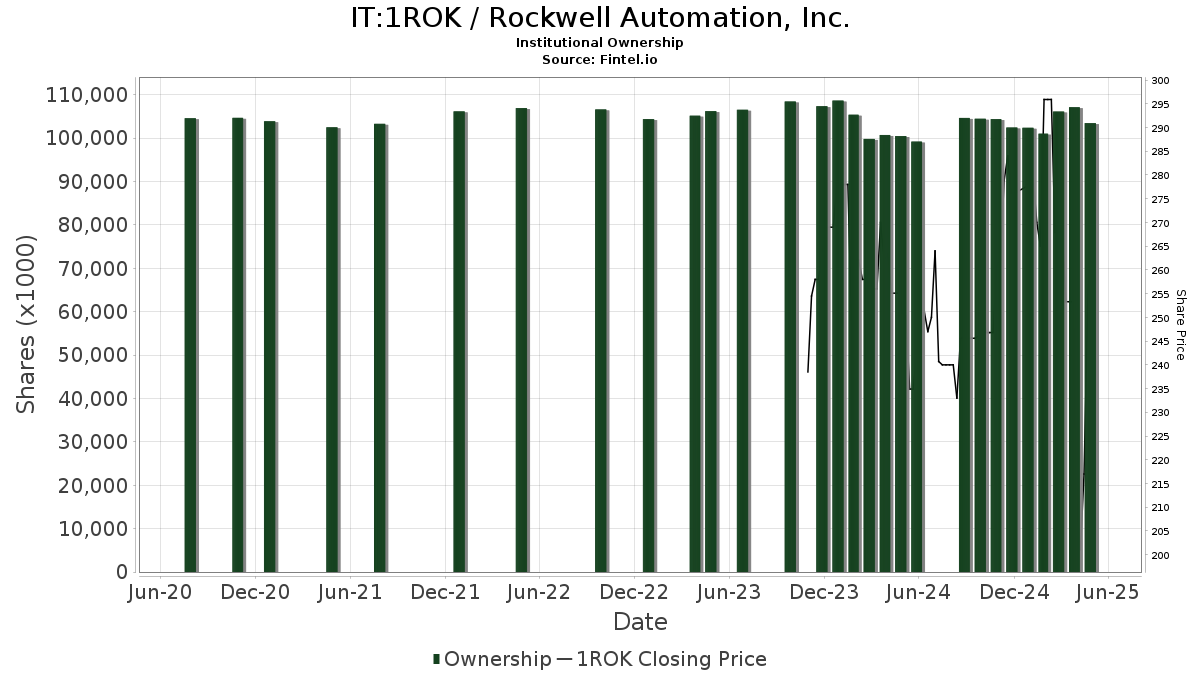

If we review current valuations, Alphabet stands out as noticeably undervalued compared to other major tech firms.

GOOGL PE Ratio data by YCharts; PE = price to earnings.

Despite generating significantly higher net income over the past year, Alphabet’s valuation lags behind.

GOOGL Net Income (TTM) data by YCharts; TTM = trailing 12 months.

Several factors contribute to Alphabet’s subdued valuation. First, its core business heavily relies on advertising, with $61.6 billion of its $80.5 billion in revenue sourced from this sector during the first quarter. The market perceives this dependency as a risk, especially as advertising budgets are among the first to be slashed in economic downturns.

As concerns grow that the U.S. economy may be nearing a downturn, investors are hesitant to buy Alphabet shares enthusiastically. Even when economic conditions improve, lingering fears of sustained downturns keep the stock from receiving a premium valuation.

Interestingly, Alphabet’s vulnerabilities mirror those of Apple, which also relies on consumer electronics sales. With high-priced devices, Apple could see consumers opt for more affordable choices during an economic slump. This raises questions about the rationale for Apple’s premium valuation relative to Alphabet.

Microsoft, in contrast, enjoys a stronger business model supported by its focus on cloud computing and business software. While its growth may slow, consistent demand mitigates risks of significant sales declines—suggesting its premium valuation against Alphabet is somewhat justified. However, Alphabet’s current valuation appears irrationally low in comparison.

Regulatory Challenges Facing Alphabet

Another significant factor impacting Alphabet’s valuation involves regulatory scrutiny. A U.S. district judge found the company guilty of monopolistic practices in its search engine and advertising sectors. Consequently, the Department of Justice has proposed that Alphabet sell its Google Chrome browser. While this action is still far from realization and likely to undergo prolonged legal challenges, it induces uncertainty for shareholders.

This uncertainty over Alphabet’s enduring business model raises concerns about its stability moving forward. Stakeholders are left pondering whether the company they invest in today will retain its structure five years down the line.

Conversely, a potential breakup might unlock new shareholder value, possibly improving returns. However, the possibility of such an outcome remains uncertain. If a breakup does not proceed, Alphabet will continue operating in its dominant capacity but could face additional regulatory constraints.

Ultimately, Alphabet’s valuation presents an opportunity for investors. Although market fears contribute to its lower valuation, it appears unwarranted. With few opportunities to purchase stocks at such low prices, investors may find it prudent to consider Alphabet shares now.

Evaluating Investment in Alphabet

Before investing in Alphabet shares, it is essential to weigh the following:

The Motley Fool Stock Advisor analyst team has identified the 10 best stocks for current investment opportunities, and Alphabet is not included. The selected stocks are likely to yield substantial returns in the coming years.

For instance, when Netflix made the list on December 17, 2004, a $1,000 investment would now be worth $623,103! *

Similarly, if $1,000 were invested in Nvidia when it was listed on April 15, 2005, it would now be valued at $717,471! *

Overall, Stock Advisor boasts an average return of 909%, surpassing 162% for the S&P 500.

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. Keithen Drury holds positions in Alphabet. The Motley Fool has vested interests in and recommends Alphabet, Apple, and Microsoft. Disclosure policies are in effect.

The views and opinions expressed herein belong solely to the author and do not necessarily reflect those of Nasdaq, Inc.

“`