Amazon Delivers Strong Q1 2025 Results Amid Tariff Concerns

Amazon (NASDAQ: AMZN) has announced its first-quarter results for 2025, reporting after the market closed on Thursday. The e-commerce and cloud services leader exceeded Wall Street’s earnings estimates, generating an impressive $155.7 billion in revenue.

Despite ongoing concerns regarding tariffs, analysts remain cautiously optimistic. There are positive indicators for Amazon’s resilience in tackling these challenges.

Amazon’s Approach to Tariffs

During the Q1 earnings call, CEO Andy Jassy acknowledged the uncertainties surrounding tariffs. He stated, “It’s hard to tell what’s going to happen with tariffs right now.” Despite this, he added that demand remains strong. Currently, average selling prices have not seen significant increases. Some categories have shown heightened purchasing activity, suggesting customers may be preparing for potential tariff impacts.

To mitigate the effects of tariffs, Jassy noted the company has engaged in “some forward buying.” Some third-party sellers have also imported goods in anticipation of tariffs. Even before tariffs were a concern, Amazon worked to diversify its production sources. Jassy explained, “[W]e have been diversifying where we produce things over a long period of time.”

Amazon’s wide range of offerings may provide additional insulation from tariff effects. Jassy emphasized that the company “often weather[s] challenging conditions better than others.” He referenced Amazon’s performance during the COVID-19 pandemic, asserting that the firm emerged stronger, with increased market share. “I’m optimistic this could happen again,” Jassy concluded.

Looking Forward

Jassy’s optimistic perspective on the future aligns with several growth initiatives within Amazon.

The company continues to refine its cost structure, including expanding same-day delivery locations and enhancing its rural delivery network. Automation and robotics in facilities are on the rise, while inventory placement is being optimized—all of which could improve profits moving forward.

Additionally, advertising has shown promise. In Q1, Amazon’s ad revenue grew by 19% year over year, reaching $13.9 billion. The company anticipates significant growth opportunities in advertising as it expands its offerings.

Recently, Amazon launched its first Project Kuiper satellites, with plans to incrementally place more into orbit throughout 2025 to offer global internet service later this year. Moreover, the company is testing its Zoox autonomous ride-hailing service in Los Angeles, its sixth testing location.

Nevertheless, Amazon Web Services (AWS) remains the primary growth driver. Jassy reiterated that over 85% of global IT spending currently occurs on-premises. He anticipates this trend will shift toward the cloud over the next 10 to 20 years, especially with advancements in artificial intelligence potentially elevating AWS’s business prospects.

While some competitors in the cloud space demonstrate rapid growth, Jassy defended AWS’s position, stating it possesses a “meaningfully larger base on the technology infrastructure side than others.” He cited a consistent 17% year-over-year growth on a $117 billion revenue run rate, which represents significant growth potential.

Investment Outlook

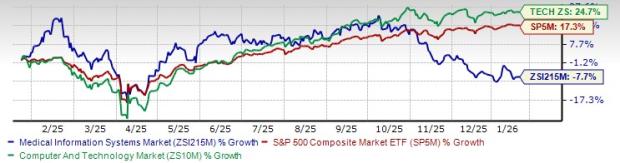

Amazon’s shares remain over 20% lower than their previous highs, despite recent gains. Historical trends indicate that such sell-offs can create lucrative buying opportunities for long-term investors.

Importantly, Amazon’s valuation appears attractive relative to its historical range, with the stock currently trading at a price-to-earnings ratio of 31, the lowest level seen in 16 years.

A leader in three critical growth markets—e-commerce, cloud computing, and AI—Amazon is also branching into potentially high-growth sectors such as healthcare and robotaxis.

While tariffs may pose challenges in the near term, the stock still represents a solid investment for long-term investors.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.