AMD Stock Update: Earnings and Revenue Growth Insights

Advanced Micro Devices (AMD) has been a focal point for Zacks.com visitors recently. A review of the factors influencing AMD’s near-term performance may provide valuable insights into the stock’s trajectory.

In the past month, AMD shares increased by +3%, contrasting with the Zacks S&P 500 composite which declined by -0.5%. Furthermore, the Zacks Computer – Integrated Systems industry, where AMD is categorized, saw a decrease of 5.3%. The key consideration now is the potential direction of the stock.

While media reports regarding significant changes in business prospects often impact stock prices immediately, fundamental factors ultimately influence long-term investment decisions.

Understanding Earnings Estimates Revisions

At Zacks, we prioritize changes in the projections for a company’s earnings above all else. This is because the present value of future earnings streams informs the fair value of its stock.

Our analysis hinges on how sell-side analysts modify their earnings estimates based on the latest trends. An increase in earnings estimates generally leads to a higher fair value for the stock. Consequently, when the fair value exceeds the current market price, it often triggers buying activity, driving the price upward. Studies have shown a robust correlation between earnings estimate revisions and short-term price movements.

For the current quarter, Advanced Micro is projected to report earnings of $0.93 per share, reflecting a year-over-year growth of +50%. However, the Zacks Consensus Estimate has decreased by -2.7% over the last month.

Looking toward the current fiscal year, the consensus estimate of $4.40 denotes a +32.9% increase from the previous year, with a -4.1% adjustment in the last 30 days.

For the next fiscal year, the estimated earnings of $5.85 indicate a +33.1% rise from the previous year. This estimate has also seen a decrease of -2.1% in the past month.

The Zacks Rank, a tool that assesses stocks based on earnings revisions, has categorized Advanced Micro as #3 (Hold), indicating a more nuanced perspective on its near-term performance.

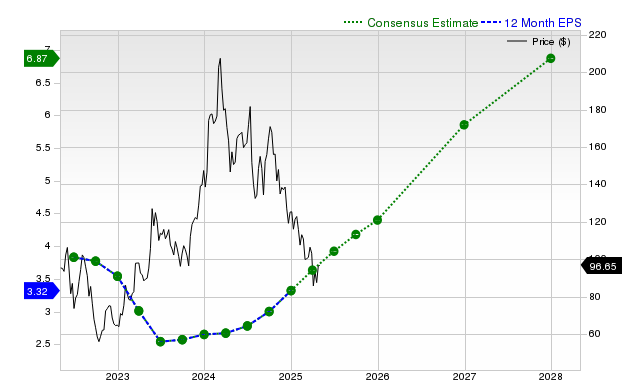

The chart below demonstrates the progression of the company’s forward 12-month consensus EPS estimate:

12-Month EPS Chart

Projected Revenue Growth

While earnings growth is a critical indicator of a company’s financial health, revenue growth is equally vital. Sustained earnings increases are challenging without revenue growth, making revenue projections essential.

For Advanced Micro, the current quarter’s consensus sales estimate is $7.12 billion, representing a year-over-year increase of +30.1%. For the current and next fiscal years, projections of $31.31 billion and $37.17 billion indicate growth rates of +21.4% and +18.7%, respectively.

Last Reported Results and Surprise History

In its most recent quarter, Advanced Micro reported revenues of $7.66 billion, up +24.2% year-over-year. The EPS of $1.09 for the same period compares favorably with $0.77 a year prior.

The reported revenues surpassed the Zacks Consensus Estimate of $7.52 billion, yielding a positive surprise of +1.9%. Similarly, the EPS also beat expectations by +1.87%.

Over the past four quarters, the company has consistently exceeded consensus EPS estimates, also topping revenue estimates each quarter.

Valuation Analysis

Valuation is critical in making informed investment decisions. Determining whether a stock‘s current price reflects its intrinsic value and growth prospects is essential for predicting future price performance.

Analysts compare a company’s valuation multiples—like price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF)—against historical values. This aids in assessing whether a stock is fairly or undervalued. Additionally, comparing these metrics with industry peers can provide further perspective on valuation.

In the Zacks Style Scores system, the Zacks Value Style Score ranks stocks from A to F based on valuation metrics. Advanced Micro has received a D grade, indicating it is trading at a premium compared to its peers.

Conclusion

The details discussed here and additional findings on Zacks.com may help evaluate the relevance of market trends concerning Advanced Micro. The Zacks Rank #3 suggests the stock may perform in line with the broader market shortly.