Political Winds Influence CGC Stock Surge

Canopy Growth (CGC) has seen a meteoric rise in recent weeks, sending its stock soaring to new heights. However, this upsurge is not a result of stellar financial performance but rather the winds of politics. Vice President Kamala Harris’ push for the decriminalization of marijuana has breathed new life into cannabis operators like Canopy, sparking a frenzy of interest in its derivatives market.

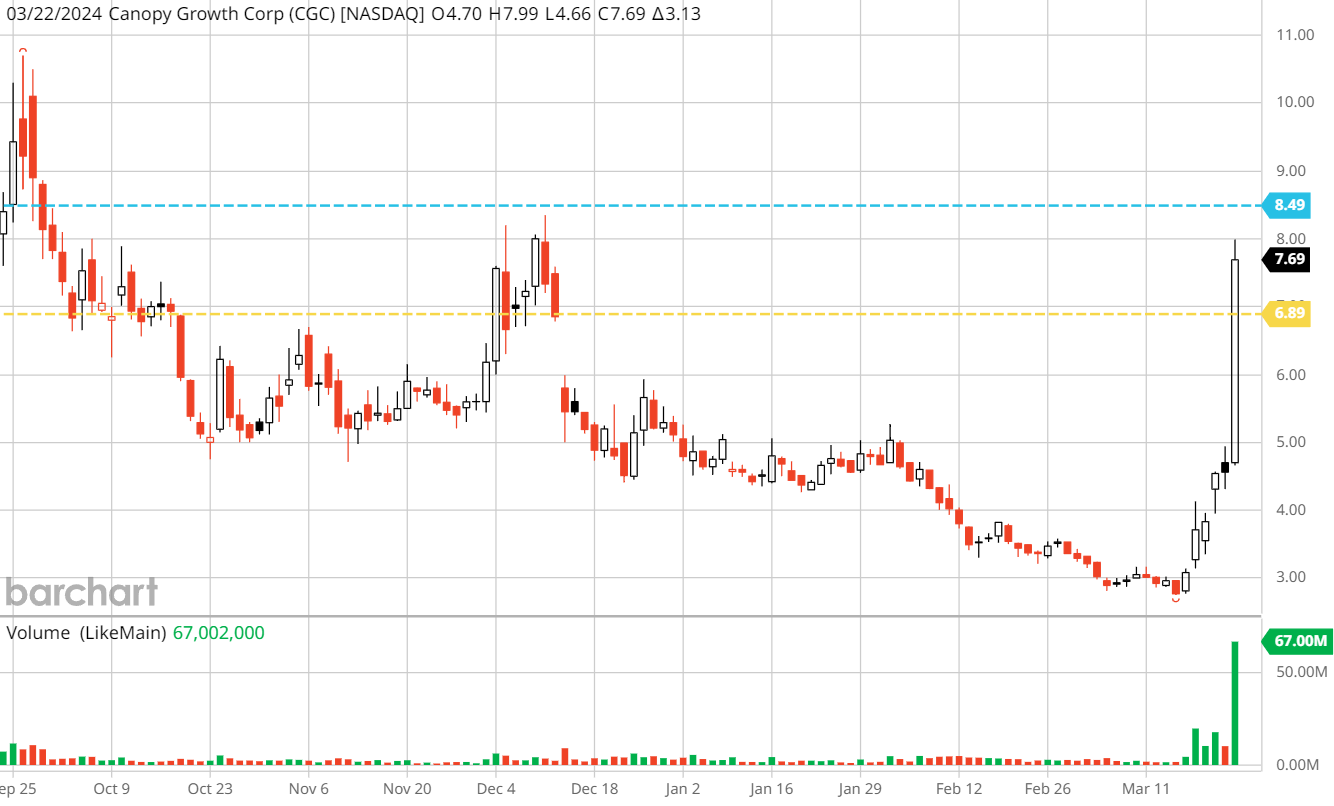

In the grand scheme of things, Canopy’s recent success is a mere blip on the radar. Over the past 52 weeks, CGC stock has plummeted nearly 60%, while its long-term decline over five years exceeds 98%. Such historical data paints a stark contrast to its recent bullish run.

Analysts remain skeptical of Canopy’s prospects, with a consensus moderate sell rating and a mean price target of $4.19 – representing a substantial downside risk from its current trading price. These factors, coupled with a decline in sales since fiscal 2021, point to a less-than-rosy financial outlook for the company.

Unusual Options Activity Raises Eyebrows

Despite these red flags, Canopy’s options market has been buzzing with activity. CGC stock recently captured attention for its unusual options volume, ranking second in the category. The surge in total volume, call volume, and put/call volume ratio raises questions about the true nature of this bullish trend.

A closer look at the options flow screener reveals that many of the calls being traded are likely being sold by major traders, suggesting a bearish sentiment regarding CGC stock’s future performance. With major resistance levels looming ahead, caution is advised for investors eyeing a quick profit.

Furthermore, the recent dip in CGC stock during afterhours trading underscores the volatility of the market. In the face of uncertainty, a prudent approach is recommended to navigate the choppy waters of Canopy’s stock.

Looking ahead, Canopy Growth stock may present a speculative opportunity in the lead-up to the 2024 election, driven more by political dynamics than financial fundamentals.

Political Winds Favoring Canopy Growth

President Joe Biden’s administration faces challenges on multiple fronts, with criticisms mounting over economic issues post-COVID-19 recovery. However, a potential game-changer lies in the rescheduling of cannabis and the pardoning of low-level possession offenders.

The positive public perception of such moves, particularly among young voters, could bolster support for Biden and the Democrats. On the flip side, the conservative stance on law and order by former President Donald Trump could hinder efforts to push for cannabis legalization within the Republican camp.

Overall, the political landscape seems to be favoring CGC stock, offering a glimmer of hope amid the turbulent waters of the stock market.

Despite the excitement surrounding Canopy Growth, investors would be wise to approach with caution, keeping a close eye on market developments and political shifts that could impact CGC stock’s trajectory.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.