Shares of Block (NYSE: SQ) fell 13.7% last month, according to data from S&P Global Market Intelligence. A combination of a downgraded analyst rating and challenging market conditions pushed the fintech stock lower, but it reversed some of those losses in early May.

A Wall Street analyst set things in motion

Block’s rating was downgraded by a prominent bank on Wall Street in early April. Those analysts cited skepticism about the growth prospects for its consumer finance business, CashApp. CashApp accounted for 60% of the company’s gross profit last quarter, so weakness in that segment would have meaningful ramifications for its overall growth rate and cash-flow generation.

Image source: Getty Images.

Bitcoin played a role, too

Following the downgrade news, the stock slid lower thanks to Bitcoin‘s (CRYPTO: BTC) drop. Block holds more than 8,000 Bitcoins, which are worth hundreds of millions in aggregate. Bitcoin transactions make up 43% of the company’s revenue, though these transactions make up a relatively small percentage of its gross profit. Investors associate Block with cryptocurrencies, and the stock is highly correlated with Bitcoin. That relationship is especially clear when there’s no major company-specific news.

SQ data by YCharts

The impact of Bitcoin’s price on Block’s financial health and cash flows is likely overrated by the market. The company’s balance sheet and operating income are much more closely related to its core business operations. Still, its fundamentals do rise and fall with activity in the crypto markets, so the correlation is likely to persist. That weighed on the stock in April.

Block’s operating performance has been a bright spot

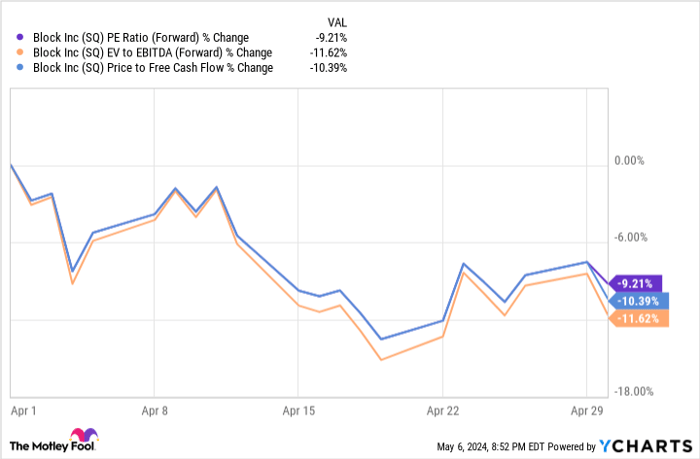

Block’s important valuation ratios all moved lower during April. The stock became cheaper relative to expected earnings, adjusted earnings before interest, taxation, depreciation, and amortization (EBITDA), and free cash flow. This is comprehensive evidence that Block’s struggles in the market were attributable to momentum and investor sentiment rather than fundamental issues.

SQ PE Ratio (Forward) data by YCharts

The importance of actual financial results was on display as the calendar flipped over to May. Block delivered strong earnings results on May 2, which helped to claw back some of the losses sustained in April. It topped Wall Street’s quarterly earnings-per-share (EPS) estimate by 18%. This was fueled by 22% growth in gross margin over the prior year. Importantly, the fintech leader delivered growth across its three major products:

- CashApp, a consumer finance product suite

- Square, a payment transfer and customer analytics platform

- Afterpay, a buy-now-pay-later service.

Broad-based growth is generally a highly bullish signal. The company increased its full-year forecasts and announced plans to reinvest its larger-than-expected gains from Bitcoin transactions back into the cryptocurrency.

This all excited investors, who bought up shares when its forward P/E ratio fell to nearly 66. Volatility will remain a core piece of the investment narrative for Block. Long-term investors should focus on the cash-flow opportunities created by its suite of leading fintech businesses.

Should you invest $1,000 in Block right now?

Before you buy stock in Block, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Block wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $554,830!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 6, 2024

Ryan Downie has positions in Block. The Motley Fool has positions in and recommends Bitcoin and Block. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.