Boeing Co.: A Potential Comeback After a Turbulent 2024

The Boeing Co. (NYSE: BA) navigated a challenging 2024 marked by regulatory challenges, negative publicity, and a major workers’ strike that cost the company billions. Starting the year at $250.15, Boeing’s shares plummeted to a low of $137.03 on November 14, 2024, amid a series of adverse developments.

Boeing’s new CEO, Kelly Ortberg, an experienced leader from Rockwell Collins, faced the tough task of managing expectations after reporting disappointing financial results. Fortunately, the stock has since rebounded to $180.72, reducing its annual loss to just over 30%. This article explores four key reasons why Boeing might emerge stronger in 2025.

1) Difficulties are Behind, with Low Expectations for 2025

The resolution of a strike involving 33,000 machinist workers on November 4, 2024, marked a significant turning point. The strike halted production of Boeing’s 737, 777, and 767 airplanes, costing the company approximately $5.5 billion and resulting in losses exceeding $6 billion in its third-quarter earnings report. To stabilize, Boeing raised over $20 billion and reduced its workforce by 10%, laying off 17,000 employees.

On December 17, 2024, Stephanie Pope, CEO of Boeing Commercial Airplanes, announced the return of all production lines, emphasizing the company’s commitment to staff training and optimal inventory levels for efficient production. In the coming year, Boeing plans to gradually ramp up production of its 737 MAX aircraft, aiming for 37 planes per month by May 2025. However, there are concerns that mistakes from the past may resurface if production increases too quickly. Reputation and public trust will play crucial roles as the company moves forward.

2) Strong Order Backlog Exceeds Half a Trillion Dollars

Boeing maintains a substantial backlog of over 6,200 airplanes, amounting to more than half a trillion dollars, despite the delays caused by the strike. As the sole major U.S. manufacturer in the market, most clients had no choice but to endure the wait. Notable orders include 432 planes from Southwest Airlines Co. (NYSE: LUV), 100 from Delta Air Lines Inc. (NYSE: DAL), 240 from Emirates, and 497 from United Airlines Holdings Inc. (NASDAQ: UAL).

New orders also continue to emerge. On December 19, 2024, China Airlines announced an estimated $12 billion order, which includes 10 Boeing 777-9 planes and four 777-8 freighters, alongside 10 Airbus A350-1000s. Additionally, Pegasus Airlines revealed a potential $18 billion order for up to 200 Boeing 737 MAX 10 aircraft, with 100 firm orders and options for 100 more—marking the largest plane purchase agreement for the Turkish airline.

3) Lower Oil Prices Could Enhance Airline Profit Margins and Fuel Demand

Labor and fuel costs are the most significant expenses for airlines. Fuel prices, which fluctuate dramatically, can significantly influence airline profitability. When fuel prices decrease, airlines experience improved margins, allowing them to better plan for fleet expansions. Recent government policies aimed at increasing oil production could contribute to lower fuel prices, benefiting Boeing by potentially driving up aircraft orders.

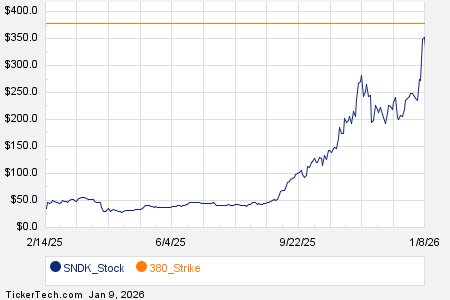

4) BA Stock Shows Signs of a Potential Reversal

Market analysts are observing a head and shoulders pattern in Boeing’s stock performance. This pattern typically indicates market reversals, with three peaks signaling potential price movements. The left shoulder peaked at $243.10, the head reached $167.54, and the right shoulder hit $196.95. After testing a low of $137.03, the stock has rebounded to $180.72.

For investors, these movements suggest an opportunity for potential gains. The daily RSI indicates upward momentum, and Fibonacci pullback support levels sit at $171.16, $159.32, $142.46, and $132.43, offering additional points for consideration.

Investment Strategy Considerations: Investors looking to capitalize on the stock’s movement may consider employing cash-secured puts at the identified support levels. This strategy offers a way to buy shares at a lower cost while simultaneously providing income through covered calls if the shares are assigned.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.