Steady Growth Potential: Elevance Health, Inc. (ELV) stands as a beacon of growth, propelled by rising memberships in individual commercial risk-based enterprises and Blue Card businesses. Notably, a surge in performance within the Carelon Services segment is set to bolster the company’s position in the market.

With a substantial market capitalization of $118.6 billion, Elevance is a heavyweight in the American health benefits domain. Given its robust outlook, this Zacks Rank #2 (Buy) stock presents a compelling investment opportunity in the current landscape. Join us on this journey as we uncover the drivers of growth, estimates, and essential factors that investors should closely monitor.

Earnings Predictions and Growth Trajectory

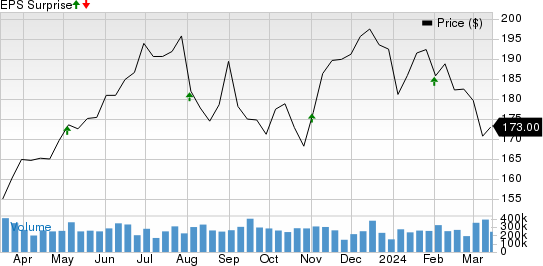

Forecasting ahead, the Zacks Consensus Estimate for ELV’s 2024 earnings is set at $37.14 per share, showcasing a promising 12.1% year-over-year growth projection. Over the past 30 days, the company witnessed an upward revision in estimates versus stagnant projections in the opposite direction. Noteworthy is Elevance’s consistent track record of surpassing earnings expectations over the last four quarters, achieving an average surprise rate of 3.1%.

Propelling Revenues: The Upward Trajectory

Anticipated at $172.4 billion for 2024, the consensus figure for Elevance’s revenues hints at a modest 1.3% year-over-year ascent. Headquartered in Indianapolis, IN, the company’s top line is poised for growth, fueled by an uptick in product revenues, administrative fees, and other income streams. The model further predicts over 5% year-over-year growth in 2024 product revenues and a robust 12.1% increase in administrative fees and supplementary revenues.

Reflecting on the past year, Elevance’s shares have surged by 11.9%, outperforming both the industry’s 7.6% uptick and the Medical sector’s 10.7% increase. Bolstered by its robust operations, the stock is primed to sustain its upward momentum in the market.

Driving Forces for Growth

Buoyed by augmented premiums from the Commercial Health Benefits arm and an expanding member base, Elevance is set to witness a surge in top-line growth. Forecasts indicate over 5% and 16% year-over-year growth in Blue Card and individual business memberships, respectively, in 2024. Furthermore, expansions in dental and vision lines memberships are poised to substantiate this positive trajectory.

The Carelon platform continues its upward trajectory, spearheaded by expanding CarelonRx pharmacy product revenues alongside a rise in the number of external pharmacy members serviced. With the Carelon Services sector exhibiting strong performance, a significant boost in profit growth is anticipated. Notably, the recent acquisition of Paragon Healthcare, integrated into the CarelonRx pharmacy services unit, is expected to fortify Elevance’s market stance.

With strategic acquisitions like Paragon Healthcare and BioPlus specialty pharmacy, Elevance is scaling its Carelon business, enabling cost reductions in care provision and expanding options for patients. Moreover, adeptly divesting non-core assets to elevate profitability, the company boasts a remarkable return on invested capital of 11%, surpassing the industry average of 8.2%. This underscores the company’s superior efficiency in generating returns from its invested capital compared to industry peers.

Challenges Ahead: Managing Rising Expenses

While prospects remain bright, investors should keep a watchful eye on rising expenses. Posting increases of 13% in 2021, 14% in 2022, and 9.8% in 2023, escalating expenses could potentially impact Elevance’s margins. Yet, we maintain faith that a methodical and strategic action plan will steer long-term growth prospects in the right direction.

Exploring Other Medical Investment Opportunities

Diversifying healthcare options, promising stocks in the Medical sector include Universal Health Services, Inc. (UHS), The Cigna Group (CI), and Health Catalyst, Inc. (HCAT), each currently carrying a Zacks Rank #2. Click to view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

With Universal Health Services predicting a 19.9% year-over-year growth in 2024 earnings and Cigna Group projecting a 13% increase, these companies showcase robust potential for investors. Health Catalyst’s remarkable 113.3% surge in 2024 full-year earnings highlights its agile growth stance in the industry.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.” Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.2% per year. So be sure to give these hand-picked 7 your immediate attention.