Analyzing Wall Street’s View on Microsoft: A Cautionary Approach

Wall Street analysts’ recommendations play a significant role in guiding investors on buying, selling, or holding stocks. When these brokerage analysts update their ratings, it can lead to changes in a stock’s price. But how reliable are these recommendations?

Let’s focus on what analysts are saying about Microsoft (MSFT) to understand these dynamics better.

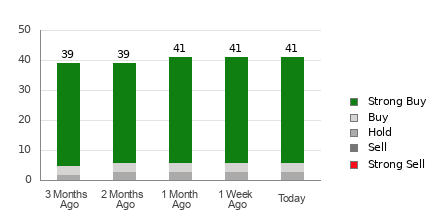

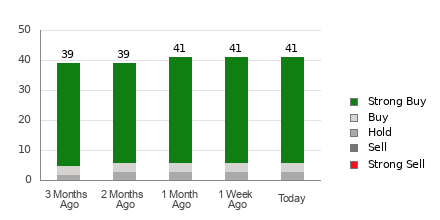

Microsoft has an average brokerage recommendation (ABR) of 1.22. This score is derived from 41 brokerage firms and ranges from 1 (Strong Buy) to 5 (Strong Sell). An ABR of 1.22 indicates a consensus leaning towards the Strong Buy category.

Breaking down the recommendations, 35 are categorized as Strong Buy and three as Buy, accounting for 85.4% and 7.3% of the total recommendations, respectively.

Current Trends in Brokerage Recommendations for MSFT

While the current ABR suggests a favorable outlook for Microsoft, relying solely on these ratings to make investment choices may not be wise. Research indicates that brokerage recommendations often fall short in identifying stocks that are likely to appreciate significantly in value.

This bias can be traced back to the vested interests of brokerage firms; analysts typically favor a positive outlook on stocks they cover. Our findings suggest that for every Strong Sell recommendation, there are five Strong Buys.

Thus, brokerage recommendations might not fully align with the interests of individual investors. It could be more beneficial to use this data as a complement to your own research rather than the main basis for investment decisions.

Utilizing the Zacks Rank, which rates stocks based on a comprehensive analysis, could enhance your investment strategy. This proprietary tool categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) and has a strong historical track record in predicting short-term price movements.

Understanding the Differences: Zacks Rank vs. ABR

While both Zacks Rank and ABR are based on a 1-to-5 scale, they represent different metrics. ABR values are derived solely from broker recommendations and are expressed as decimals (e.g., 1.28), whereas the Zacks Rank relies on earnings estimate revisions and is presented in whole numbers—from 1 to 5.

Historically, brokerage analysts have been overly optimistic in their assessments. Their ratings often suggest stronger prospects for stocks than warranted, misguiding investors more frequently than they assist.

In contrast, the Zacks Rank focuses on earnings estimate revisions, which have been shown to correlate significantly with short-term stock price movements.

Moreover, the Zacks Rank is constantly updated, reflecting the latest earnings estimate trends, while the ABR may not always be current.

Is Microsoft a Wise Investment Right Now?

According to the most recent data, the Zacks Consensus Estimate for Microsoft’s earnings for this year remains steady at $12.93.

This unchanged consensus may imply that analysts are generally cautious about Microsoft’s near-term performance, suggesting it will likely align with broader market trends.

Taking into account recent earnings estimate changes and other factors, Microsoft holds a Zacks Rank #3 (Hold). Investors can explore a full list of Zacks Rank #1 stocks by following the link provided.

Thus, it may be wise for investors to approach Microsoft’s Buy-equivalent ABR with a degree of caution.

Discover Zacks’ Top 10 Stocks for 2025

Are you interested in receiving early insights on our 10 top stock picks for 2025?

Past performance indicates these choices could be highly rewarding. Since 2012, when our Director of Research Sheraz Mian began overseeing the portfolio, the Zacks Top 10 Stocks surged by +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Sheraz is currently evaluating 4,400 companies to select the best 10 stocks to buy and hold in 2025. Don’t miss out on these picks when they are released on January 2.

Stay updated with the latest recommendations from Zacks Investment Research. Today, you can download a report on 5 Stocks Set to Double for free.

For more in-depth analysis of Microsoft Corporation (MSFT), check out our Free Stock Analysis Report.

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.