General Motors Positioned for Growth Despite Economic Challenges

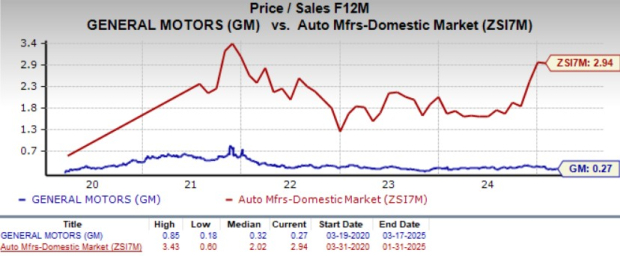

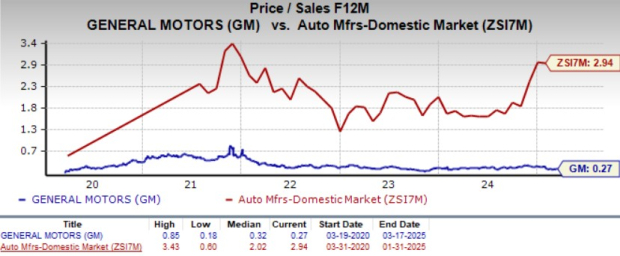

General Motors (GM) is currently trading at a low valuation, presenting a strong investment opportunity despite its impressive financial performance. With a forward sales multiple of just 0.27, which is below its five-year average and industry standards, GM boasts a Value Score of A.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

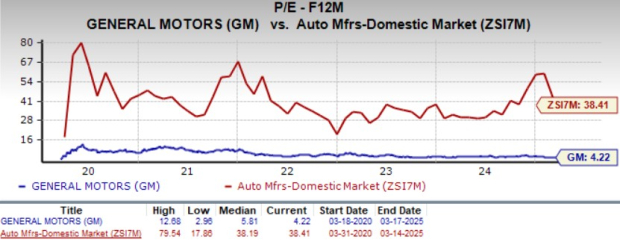

For the full year of 2024, GM reported a revenue increase of 9%, totaling approximately $187 billion. The company’s adjusted EBIT reached a new high of $14.9 billion, and annual earnings surged by 38% to a record $10.60 per share. The price-to-earnings (P/E) ratio further indicates that GM is undervalued, with a forward earnings multiple of 4.22, which is lower than industry benchmarks and its own historical average.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

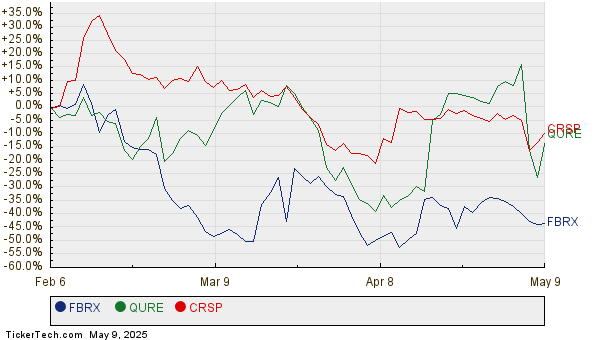

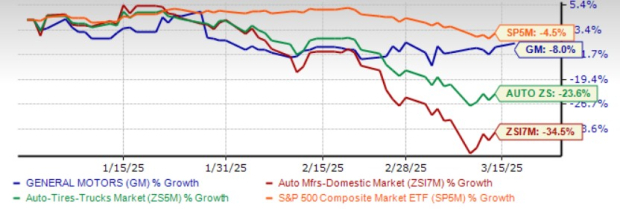

After a strong rise of over 45% last year, GM’s stock has seen a modest decline of 8% year-to-date, reflecting broader economic uncertainty and tariff issues. In comparison, the overall auto sector has faced greater declines, positioning GM favorably to address these concerns. With solid fundamentals and a favorable valuation, the stock is anticipated to yield future gains, making it an appealing choice for investors.

YTD Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Reasons for Optimism Regarding General Motors

Rising Market Share: General Motors continues to be the leading automaker in the United States. Its strong offerings in trucks and SUVs, particularly from brands like Chevrolet, Buick, GMC, and Cadillac, are driving growth, resulting in an increase in market share to 16.5% in 2024.

Advancements in Electric Vehicles: In the latter half of 2024, GM became the second-largest seller of electric vehicles (EVs) in the U.S., only behind Tesla. With 114,000 EV sales and a 50% annual increase, GM’s EV portfolio achieved variable profit status in the fourth quarter, spurred by new launches and cost efficiencies. The company aims to produce 300,000 electric vehicles this year, projecting $2 billion in reduced losses in its EV division.

Efforts in China: GM is making headway in its restructuring efforts in China, focusing on optimizing operations and product launches. The company reported positive equity income from its China business in Q4 2024, seeing deliveries increase by more than 40%, the best quarterly performance since mid-2022. GM aims to regain profitability in this market this year.

Cost Reduction Strategies: Meeting its target of $2 billion in net fixed cost reductions by 2024, GM is refining its autonomation strategy and exiting certain developments. This is expected to yield $1 billion in annual savings. With increased demand for its vehicles and controlled costs, GM projects adjusted EPS of $11-$12 for 2025, an increase from $10.60 in 2024.

Strong Liquidity and Shareholder Returns: In 2024, GM generated $14 billion in adjusted auto free cash flow and returned $7.6 billion to shareholders through dividends and stock buybacks. The company is actively reducing its share count, ending the year with 995 million shares. With $35.5 billion in liquidity, including $21.7 billion in cash, GM is in a solid financial position. It recently announced a 25% increase in its dividend to 15 cents per share, effective in April 2025, aligning it with competitor Ford. Additionally, GM has launched a $6 billion buyback program, with $2 billion planned for immediate repurchase.

Prepared for Tariff Changes: As the top U.S. automaker with imports from Mexico, GM has shipped 750,000 vehicles from Mexico and Canada in 2024. With the impending 25% tariff on imports delayed until April 2025, GM has reduced its international inventory by 30% to mitigate costs. The company is also working on streamlining its supply chain operations, while competitors like Ford have expressed concerns about potential disruptions. GM’s prepared strategies put it in a favorable position to manage these risks effectively.

General Motors is a Strong Investment Option

Given these positive trends, investors may find General Motors a compelling choice right now. The company holds a Zacks Rank of #2 (Buy).

Analysts estimate that GM’s EPS will increase by 9% in 2025 and by 4% in 2026. Over the past month, EPS estimates for both the current and next fiscal year have increased by 7 cents and 11 cents, respectively.

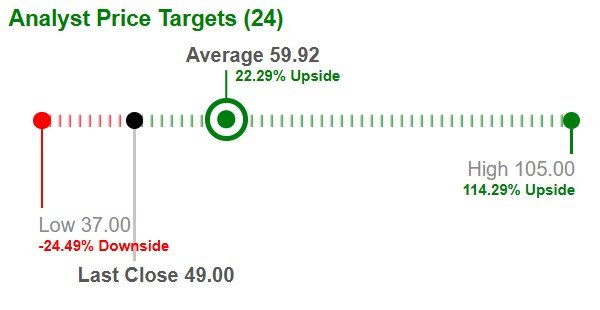

The average target price for GM from Wall Street is $59.92, indicating an upside potential of over 22% from current prices.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

For more stock insights, you can explore the complete list of Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Expected to Double

Each of these selections, identified by Zacks experts, is poised for substantial growth of 100% or more in 2024. Previous recommendations have yielded impressive gains, showcasing the potential of these picks.

Many of these stocks are currently under the radar, offering a strategic entry point for investors. Today, discover 5 Potential Home Runs >>

Keep up with the latest recommendations from Zacks Investment Research. Download your free report on the 7 Best Stocks for the Next 30 Days.

Ford Motor Company (F) : Access your free Stock Analysis report.

General Motors Company (GM) : Access your free Stock Analysis report.

Tesla, Inc. (TSLA) : Access your free Stock Analysis report.

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.