Key Facts on Oracle’s Market Position

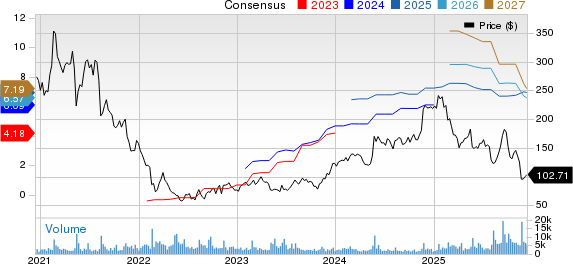

Oracle Corporation (NYSE: ORCL) is poised for significant growth in its cloud computing segment, with management forecasting Oracle Cloud Infrastructure (OCI) revenue to reach $18 billion in fiscal 2026, surging to $144 billion by fiscal 2030. This growth comes as cloud services now account for half of Oracle’s total revenue, positioning it to potentially become a leading cloud operator focused on artificial intelligence (AI) by 2031.

Despite its promising trajectory, Oracle faces challenges, including a substantial long-term debt of $100 billion against $19.2 billion in cash. In the first half of fiscal 2026, Oracle’s capital expenditures reached $20.54 billion, resulting in a negative free cash flow of $10.33 billion, raising concerns about its rapid spending compared to its cash generation capabilities.

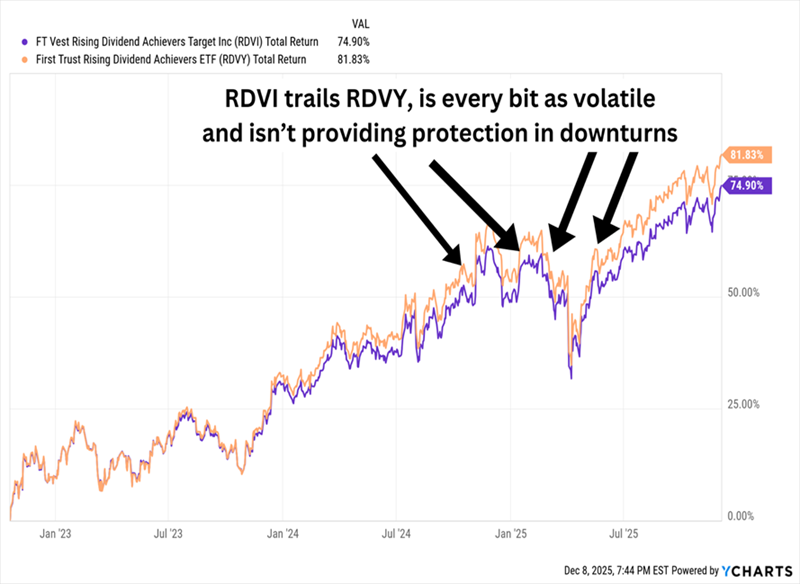

In contrast, Microsoft (NASDAQ: MSFT), which ranks higher among key tech stocks for 2026, offers a more balanced investment approach, generating strong operating margins and maintaining a healthy cash position while Oracle navigates its financial red flags.