British American Tobacco (NYSE:BTI) is often portrayed as a golden opportunity for income-focused investors. The company boasts a defensive business model, a towering dividend yield bolstered by solid earnings, and an apparently appealing valuation. Despite these apparent strengths, I remain cautious about this stock as I see long-term challenges ahead that could potentially jeopardize its ability to deliver attractive returns and even threaten its dividend.

Evaluating the Bull Case For BTI Stock

Many argue that BTI is a no-brainer buy right now. With a plethora of recent Buy and Strong Buy ratings from Seeking Alpha analysts, Morningstar labeling the stock as a five-star stock, and awarding it a Wide Moat rating, the case for BTI appears strong. Additionally, all three Wall Street analysts covering the stock forecasts a 45.9% upside to its average price target.

BTI’s Wide Moat rating seems deserved, given governmental regulations in the tobacco sector that create barriers to entry. This is combined with BTI’s brand strength and its loyal customer base, providing a formidable competitive advantage. Moreover, the sheer size of BTI’s operations allows it to enjoy considerable economies of scale, further enhancing its ability to extract excess returns on invested capital.

Furthermore, BTI is actively taking steps to counteract the growing headwinds, especially in the U.S., by transitioning towards a “Smokeless World.” Its plan is to derive 50% of its revenue from non-combustibles by 2035. With a strategic pivot toward “Next-Generation Products” like vaping, heated tobacco, and modern oral products, BTI has shown initial success in its efforts.

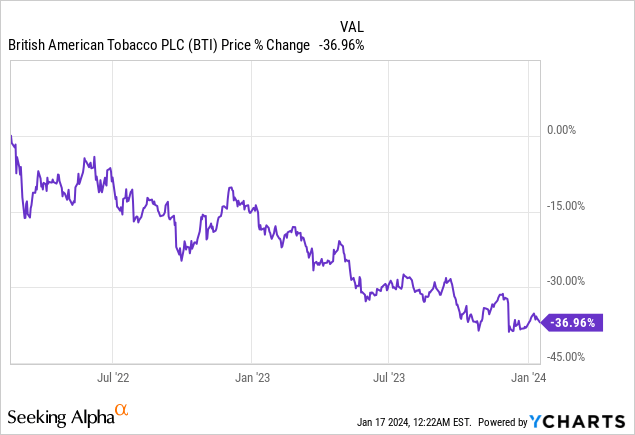

Additionally, BTI’s valuation metrics seem exceedingly attractive, with low EV/EBITDA, high dividend yield, and a low price-to-earnings ratio. Combined with Morningstar’s Wide Moat rating and the stock’s significant decline over the past 23 months, it presents a compelling investment opportunity for income-focused value investors.

Why BTI Stock Is Not A Buy

Despite its apparent strengths and attractive valuation, we do not find BTI worthy of a Buy rating primarily due to one significant reason: Its core business is in terminal decline, and we are uncertain about its ability to reverse course.

This is underscored by the recent announcement of a substantial impairment charge of $31.5 billion on its U.S. cigarette brands. As their Chief Executive Tadeu Marroco described the move: It’s “accounting catching up with reality,” highlighting the uncertainty of sustaining the value of these brands indefinitely.

Consequently, BTI not only needs to replace lost cigarette revenues with new revenues but must do so as profitably and securely to sustain its earnings and competitive advantage. Given the struggles of peers in replacing lost revenues and the profitability of new ventures, the odds are heavy against BTI in pulling this off successfully.

Even the bullish analysts covering the stock agree that BTI will struggle to sufficiently replace its declining core business revenue for the foreseeable future. Current consensus estimates project free cash flow to decline by 10.5% in 2024 and at a 6% CAGR through 2027. Another concern is BTI’s BBB+ credit rating from S&P, which is at risk of getting downgraded with a negative outlook. This could limit BTI’s ability to invest aggressively in growing its business.

This combination of a shrinking core business and a pressured credit rating will weigh heavily on BTI’s ability to continue growing its dividend. As a result, we do not find the total return proposition attractive enough to warrant a buy rating, thus, we rate BTI a Hold.

Closing Thoughts for Investors

While BTI’s yield and valuation appear attractive, the terminal decline of its core business and the regulatory challenges it faces, compel a cautious approach. Consequently, it is prudent for investors to remain on the sidelines.