Apple’s Stock Remains Expensive Amid Market Decline

Apple (NASDAQ: AAPL), the world’s largest company, has experienced a notable decline alongside the broader market this month. Currently, it’s about 23% off its all-time high, leading many investors to reevaluate whether it’s the right moment to invest in the Stock.

Despite Apple’s notable drop, I do not believe that the current prices represent a solid buying opportunity. The company remains relatively expensive compared to other major tech stocks, and I would need to see a further decline before considering an investment.

Where to invest $1,000 right now? Our analyst team recently pinpointed the 10 best stocks to buy at this time. Learn More »

Apple’s Core Revenue Stream Faces Stagnation

Apple has established itself as one of the most recognizable brands globally, particularly in the smartphone market, where its products are ubiquitous among American consumers. Nonetheless, this market is now saturated and growth has plateaued. Moreover, Apple has not introduced any groundbreaking features in its iPhones for some time, leading to fewer upgrades among consumers.

The iPhone constitutes a dominant 56% of Apple’s total revenue as reported last quarter, making this stagnation a concerning trend for the firm. It is also a long-standing issue, not confined to 2024 alone.

The most crucial quarter for iPhone sales occurs in the first quarter of Apple’s fiscal year, which ended on December 28, 2024 (for fiscal year 2025). However, sales in this period have remained stagnant over the past five years.

| Fiscal Year | Q1 iPhone Sales |

|---|---|

| 2021 | $65.6 billion |

| 2022 | $71.6 billion |

| 2023 | $65.8 billion |

| 2024 | $69.7 billion |

| 2025 | $69.1 billion |

Data source: Apple.

When inflation is taken into account, this stagnation becomes even more troubling. Additionally, tariffs pose another potential threat to Apple’s profitability. The majority of iPhones are assembled in China; although Apple recently received temporary relief from tariffs, a 20% tariff remains in place. Commerce Secretary Howard Lutnick has indicated that new tariffs related to semiconductors will likely impact Apple as well.

Faced with these tariffs, Apple has three options:

- Absorb the costs of tariffs,

- Pass those costs onto consumers, or

- Shift costs to suppliers.

The most favorable outcome for Apple’s finances would be option three; however, it’s doubtful they can transfer much of the costs to suppliers. Consequently, Apple may experience difficulties unless it can shift more operations back to the U.S.

These scenarios do not bode well for Apple, yet the Stock continues to trade at a premium valuation.

Apple’s Stock Remains Overvalued Despite Recent Declines

Even after a 23% decline, Apple’s Stock still commands a substantial premium.

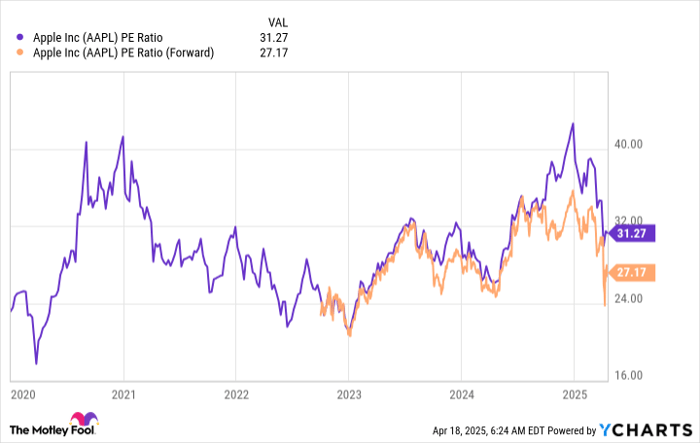

AAPL PE Ratio data by YCharts

Apple continues to trade at valuations higher than those it maintained from most of 2021 until early 2024. Its forward price-to-earnings (P/E) ratio is similarly unattractive, with Wall Street projecting only 4.2% revenue growth in fiscal year 2025 and 7.2% for fiscal year 2026.

In contrast, several companies within the “Magnificent Seven” group exhibit stronger growth potential and a lower valuation than Apple. Consequently, investors might find better opportunities in those stocks instead of Apple, whose valuation seems to hinge primarily on its brand reputation—a factor that may diminish if consumers face higher prices due to tariffs.

Is Investing $1,000 in Apple a Sound Decision Right Now?

Prior to purchasing Stock in Apple, consider the following:

The Motley Fool Stock Advisor analysts have identified the 10 best stocks to consider buying today—and Apple is not included. The stocks on this list have the potential to deliver significant returns in the near future.

Reflect on the example of Netflix, which was selected on December 17, 2004… if you had invested $1,000 at the time of our recommendation, you’d now have $532,771!*

Or consider Nvidia, which was picked on April 15, 2005… if you invested $1,000 then, you’d have $593,970!*

Overall, it’s important to note that Stock Advisor has an average total return of 781%—a substantial outperformance compared to 149% for the S&P 500.

see the 10 stocks »

*Stock Advisor returns as of April 21, 2025

Keithen Drury holds no positions in the stocks mentioned. The Motley Fool has positions in and recommends Apple. Please refer to the Motley Fool’s disclosure policy for more details.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.