Nvidia’s Growth Potential and Current Market Position: A Bold Investment

Nvidia (NASDAQ: NVDA) has emerged as a leading player in the artificial intelligence (AI) arena since 2023. The company’s impressive performance has continued with its recent financial results. Yet, despite these achievements, Wall Street’s enthusiasm appears to be waning.

Much like a favored sports franchise that loses its fanfare over time, Nvidia currently struggles to hold the market’s attention. Although the company reported remarkable fourth-quarter results for its fiscal year 2025, which concluded on January 26, the stock experienced a sell-off.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to consider. Learn More »

Is now the right time to invest in Nvidia? Here are three reasons to consider a bullish stance on the stock.

1. Innovative Blackwell Growth

Nvidia’s graphics processing units (GPUs) have played a vital role in igniting the AI revolution due to their capability to perform parallel computations. This feature makes them ideally suited for demanding computational tasks, such as training AI models. Although the initial AI training occurred mainly on Nvidia’s Hopper architecture, the introduction of the latest design, Blackwell, marks a significant shift.

Blackwell GPUs deliver substantial performance improvements over the Hopper, boasting four times faster AI training. Additionally, AI inference costs utilize Blackwell GPUs are now 20 times lower than those based on the Hopper architecture. This innovation is set to propel AI advancements further, and Nvidia will enjoy the benefits throughout the year.

Even though Blackwell chips accounted for $11 billion of Nvidia’s $35.6 billion in data center revenue, production of this breakthrough product is still ramping up. This ramp-up has contributed to one negative aspect Wall Street highlighted in Q4: decreasing gross margins. Nvidia’s management acknowledged that margins declined from the high 70% range to 73% in Q4. Analysts anticipate this trend to continue through Q1, but recovery is expected by year’s end as production efficiencies improve for Blackwell GPUs.

Understanding that these margins will eventually rebound is crucial, and Nvidia is committed to prioritizing customer needs by maximizing the output of its Blackwell chips. This production strategy should drive revenue growth, making it a reason for investors to remain optimistic, even with short-term margin challenges.

2. Strong Sustained Growth Rates

Nvidia has demonstrated remarkable growth, unmatched by any other company of its size. In Q4, the company’s revenue surged 78% year-over-year and increased 12% compared to Q3. For Q1, management anticipates $43 billion in revenue, reflecting 65% year-over-year growth and 9% from the previous quarter. Nvidia’s history shows a pattern of under-promising and over-delivering, which suggests that actual results might exceed forecasts.

This level of growth for such a sizable organization is impressive, and Wall Street predicts it to continue into this year and next. Analysts project a 57% revenue growth for the current fiscal year, tapering to 22% growth in the following year, far outperforming many of Nvidia’s major technology peers.

The growth potential in AI and other industries supported by Nvidia remains robust. This sustainability is yet another reason why investing in Nvidia stock could be prudent.

3. Nvidia’s Stock Appears Undervalued Now

While Nvidia shares have often been viewed as pricey during their recent ascent, they now show signs of becoming relatively inexpensive.

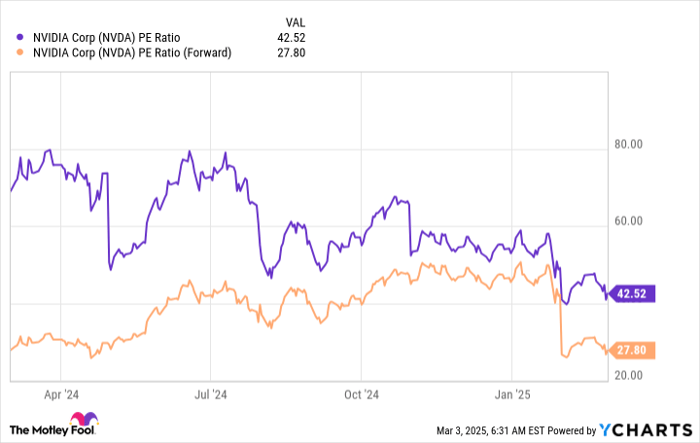

NVDA PE Ratio data by YCharts.

Currently, Nvidia trades at approximately 43 times trailing earnings and 28 times forward earnings, while yielding substantial growth figures. When compared to other prominent tech firms, especially within the Magnificent Seven, Nvidia’s value becomes clearer.

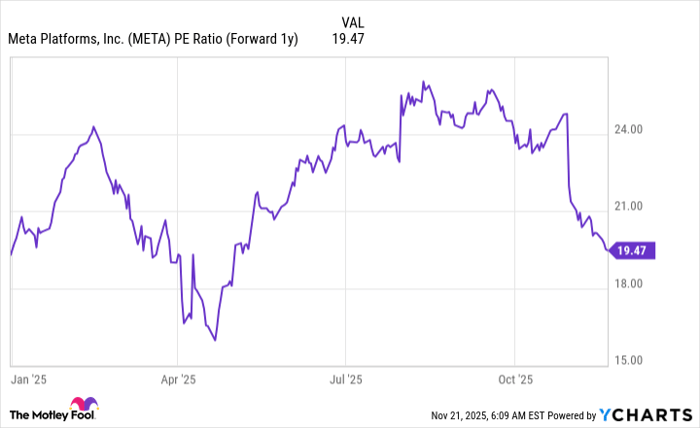

NVDA PE Ratio data by YCharts.

Although Nvidia has the highest trailing P/E ratio, it is not by a large margin. In fact, when evaluating forward earnings, Nvidia is comparatively less expensive than other major tech companies.

This raises a pertinent question: why opt for any other tech company when Nvidia stands poised to benefit significantly from leading-edge innovation? Investors should view Nvidia as an attractive buy at its current levels, especially following the post-earnings dip.

Consider This Opportunity

Have you ever felt you missed the chance to purchase successful stocks? If so, this is the moment for you.

Occasionally, our expert team of analysts issues a “Double Down” Stock recommendation for companies they predict will gain momentum. If you’re concerned about having missed your opportunity, now is the best time to invest before it’s too late. The data speaks for itself:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $286,710!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,617!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $488,792!*

We are currently issuing “Double Down” alerts for three impressive companies, and opportunities like this may not return soon.

Continue »

*Stock Advisor returns as of March 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Keithen Drury holds positions in Amazon and Nvidia. The Motley Fool recommends and holds positions in Amazon, Apple, Microsoft, and Nvidia. The Motley Fool advises on the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool adheres to a disclosure policy.

The views and opinions contained herein represent those of the author and do not necessarily express those of Nasdaq, Inc.