Amazon Faces Challenges, But Long-Term Investor Confidence Remains Strong

The stock market has experienced significant volatility following President Trump’s announcement of a new tariff plan on April 2. The tariffs are set to impact over 180 countries, leading major indexes to decline sharply, with big-name tech stocks similarly affected.

Among the hardest-hit companies is Amazon (NASDAQ: AMZN), which has dropped over 10% since the tariff announcement and more than 20% since the beginning of the year. This downturn largely stems from a new 34% tax imposed on Chinese imports. While Amazon itself primarily runs an e-commerce platform, many items sold on its site come from third-party sellers rather than the company directly.

Start Your Mornings Smarter! Wake up with Breakfast News in your inbox every market day. Sign Up For Free »

Investor concerns abound regarding a potential domino effect: rising costs for sellers could lead to increased prices for customers, potentially stifling consumer spending. Despite these worries, I am considering purchasing more stock as its price continues to decline. Here are three reasons for my optimism.

1. Amazon Web Services Remains Resilient Against Tariffs

While e-commerce initially established Amazon’s reputation, the bulk of its profitability now springs from Amazon Web Services (AWS), its cloud computing platform. AWS has become so successful that it could function independently as a standalone tech company.

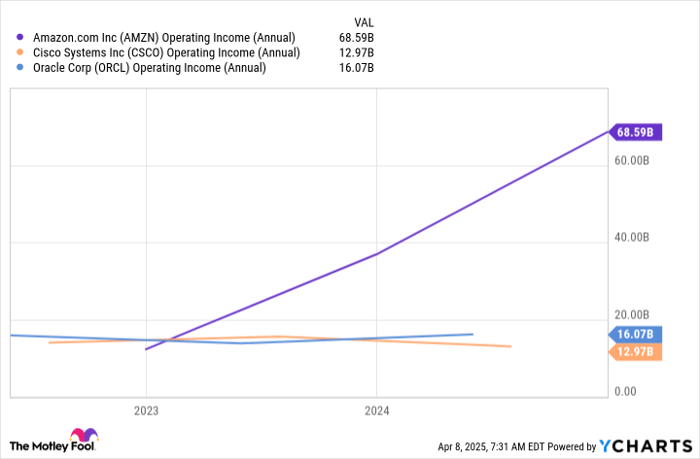

In 2024, AWS’s operating income reached $39.8 billion, constituting 58% of Amazon’s total operating income, surpassing the last full-year operating income of Oracle and Cisco Systems combined.

AMZN Operating Income (Annual) data by YCharts

AWS may encounter some costs due to the new tariffs, especially on imported parts required for data center operations. Components like servers, chips, networking equipment, and storage devices are essential for building new data centers and updating old ones. Consequently, Amazon could face increased expenses in the future.

However, these potential cost hikes are unlikely to significantly impact AWS’s overall profitability. I don’t foresee a cascading effect that would drive AWS customers to disengage in search of alternatives, as those providers would grapple with similar tariff challenges. AWS remains the largest cloud service provider by a considerable margin and is expected to maintain this position.

2. Increased Demand for Amazon’s Logistics Services Likely

As businesses prepare for the impact of the new tariffs, many may choose to stockpile products in the U.S. Leading up to this, I anticipate that numerous companies will rely on Amazon’s logistics network for efficient inventory storage and distribution.

Services like Fulfillment by Amazon (FBA) and Supply Chain by Amazon (SBA) could see heightened demand during this period. FBA might attract businesses seeking to use Amazon’s fulfillment centers for storage and distribution capabilities, while SBA could appeal to those looking for comprehensive supply chain support that alleviates operational burdens.

Amazon’s logistics network has proven to be a valuable asset, enabling its growth within the expanding e-commerce landscape, even beyond direct platform sales. This trend could foster new revenue streams for the company.

3. Historical Trends Show Promise for Buying Amazon’s Stock

This marked decline is not Amazon’s first experience with significant stock price drops. Previous declines—albeit stemming from different circumstances—include a 94% drop from December 1999 to September 2001, a 60% decline from December 2007 to November 2008, and nearly a 50% drop in 2022.

Despite these challenges, Amazon’s stock has consistently demonstrated resilience, marking its position as one of the greatest success stories in the stock market. Over the past 20 years, its value has surged nearly 10,000%, and the last decade has seen an average annual return exceeding 25%.

AMZN data by YCharts

While it is unlikely that Amazon’s stock will continue to grow at its historical rates, the company has repeatedly proven able to withstand various challenges. I anticipate that, once the situation stabilizes, those who purchase stock now may find themselves pleased in the future.

Is Now the Right Time to Invest $1,000 in Amazon?

Before making a decision to buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team has identified their top 10 stock recommendations for investors, and Amazon is not included in this list. The selected stocks have strong potential for substantial future returns.

For comparison, when Nvidia was recommended on April 15, 2005, an investment of $1,000 would have grown to $700,739!*

Stock Advisor offers investors a straightforward guide to success, including portfolio building advice, analyst updates, and new stock picks each month. This service has significantly outperformed the S&P 500 since 2002.* Don’t miss out on their latest list of top stocks, available upon joining Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 5, 2025

John Mackey, the former CEO of Whole Foods Market, which is an Amazon subsidiary, serves on The Motley Fool’s board. Stefon Walters has no positions in the stocks discussed. The Motley Fool owns shares of and recommends Amazon, Cisco Systems, and Oracle. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.