Cryptocurrency Market Buzz: Why $1,000 in Ethereum and Bitcoin Might Be a Smart Move

Ethereum (CRYPTO: ETH) and Bitcoin (CRYPTO: BTC) have recently gained new traction, presenting a compelling case for a $1,000 investment, even for current holders.

A Promising New Opportunity for Investors

The Securities and Exchange Commission (SEC) approved on January 30 the initial phase of Bitwise Asset Management’s application for a Bitcoin and Ethereum exchange-traded fund (ETF), according to Bloomberg. This expedited approval raises the likelihood of the final consent arriving soon, leading to trading on the market.

Following this announcement, existing ETFs for either Bitcoin or Ethereum attracted around $655 million in fresh investments. This uptick indicates that institutional investors view the potential combined ETF as an opportunity that could lift both cryptocurrencies’ prices. While the exact price increase remains uncertain, this development adds to the attractiveness of investing in either coin.

Bitwise’s proposed ETF promises combined exposure to both cryptocurrencies, which diverges from what traditional financial instruments typically offer. Notably, the fund will be weighted based on the market caps of Bitcoin and Ethereum, meaning it will likely mirror Bitcoin’s performance more closely than Ethereum’s. This presents a chance for investors to take advantage of Ethereum’s current undervaluation while maintaining the relative stability associated with Bitcoin investments.

Maintain Realistic Expectations

While the new ETF could further link Bitcoin and Ethereum to traditional finance, attracting more investment, it is essential for investors to remain realistic. The ETF is unlikely to dramatically change the landscape for these assets. However, it does not diminish their long-term value as investment options.

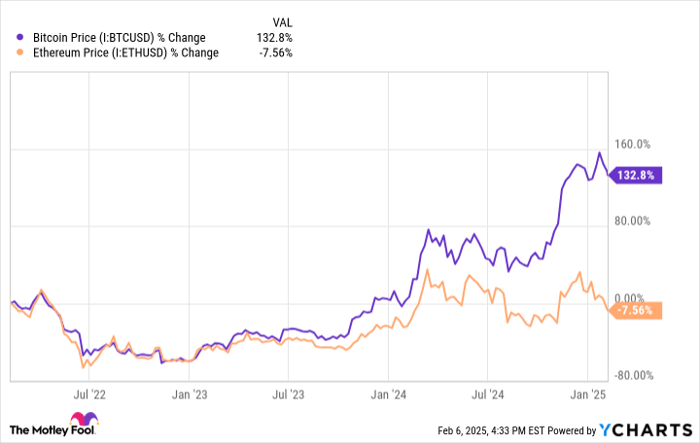

Bitcoin and Ethereum ETFs have been available for some time. The following chart illustrates their gains over the past three years:

Bitcoin Price data by YCharts

Can you pinpoint when ETFs for these cryptocurrencies started trading post-approval? If you guessed early January 2024 for Bitcoin and late July 2024 for Ethereum, you would likely be correct—but recognizing the correlation without prior knowledge is challenging. ETF approvals do not inherently drive prices, as seen in Ethereum’s price movements after July.

If the new Bitcoin-Ethereum ETF gains traction, expect additional combinations to appear, potentially pushing prices higher. However, investing in Bitcoin or Ethereum should be approached with caution. It’s not advisable to take on excessive debt in anticipation of skyrocketing prices once trading begins for the new ETF. A moderate investment of around $1,000 could be wise, especially if you’re prepared to hold for several years to reap the full benefits from ETF-related inflows.

Seize This Second Chance for Growth

Have you ever felt you missed out on top-performing stocks? Now’s your moment to act.

On occasion, our analysts put forward a “Double Down” stock recommendation for companies poised for significant growth. If you think you’ve lost your opportunity, act now before it’s too late. The numbers are compelling:

- Nvidia: An investment of $1,000 during our 2009 recommendation would be worth $336,677 today!*

- Apple: If you invested $1,000 in 2008, it would be worth $43,109!*

- Netflix: A $1,000 investment from our 2004 alert would yield $546,804!*

Currently, we are issuing “Double Down” alerts on three exceptional companies, and opportunities like this may not come around again soon.

Learn more »

*Stock Advisor returns as of February 3, 2025

Alex Carchidi has positions in Bitcoin and Ethereum. The Motley Fool has positions in and recommends Bitcoin and Ethereum. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.