Key Points

-

Apple’s Q1 fiscal 2026 results exceeded Wall Street estimates, but shares dipped slightly.

-

Sales in Greater China increased 38% year-over-year, with record iPhone upgrades.

-

Apple’s supply chain constraints may affect future growth, particularly for 3-nanometer chip availability.

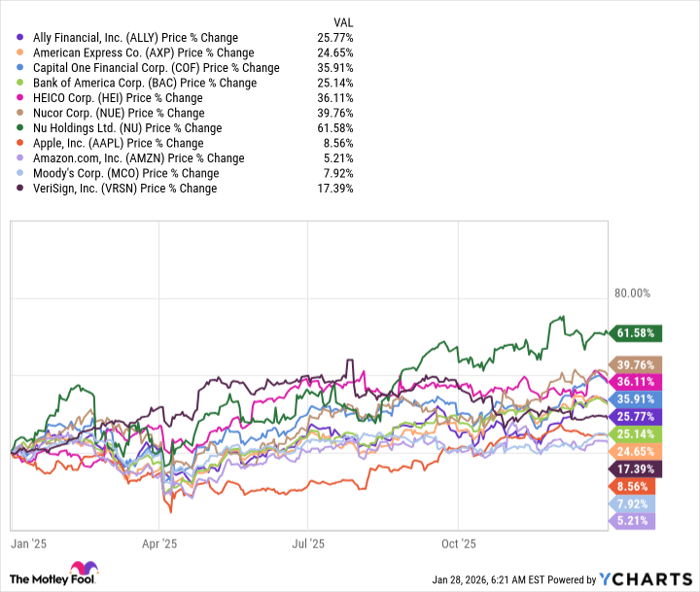

Apple (NASDAQ: AAPL) reported strong earnings on January 29, 2026, with a significant 38% increase in sales in Greater China, which accounts for about 18% of total revenue. CEO Tim Cook highlighted an all-time record for iPhone upgrades in the region, alongside notable successes in India, where iPhone sales also reached a December high.

Despite the robust sales performance, supply chain issues pose risks for Apple. Cook indicated challenges in acquiring 3-nanometer systems-on-a-chip and forecasted potential increases in memory prices, which could impact margins in the next quarter. These factors may complicate Apple’s growth trajectory moving forward.