Microsoft’s Stock Performance Metrics and Earnings Forecasts

Microsoft (MSFT) has recently attracted significant interest on Zacks.com. Key factors influencing the stock’s performance are essential to examine.

In the past month, Microsoft’s shares increased by +7.8%, outpacing the Zacks S&P 500 composite’s +6.4%. Meanwhile, the Zacks Computer-Software industry gained 12.9%. The crucial question remains: What direction will the stock take next?

Changes in a company’s business outlook often prompt fluctuations in its stock price. However, fundamental facts ultimately guide long-term investment strategies.

Revisions to Earnings Estimates

Zacks emphasizes the importance of assessing revisions in a company’s earnings forecast. These projections significantly impact the stock’s fair value.

Analysts adjust their earnings estimates based on prevailing market trends. An increase in these estimates generally leads to a higher stock fair value, attracting investor interest and driving up prices. Research shows a strong link between earnings estimate revisions and short-term stock price movements.

Microsoft is anticipated to report earnings of $3.35 per share for the current quarter, reflecting a year-over-year increase of +13.6%. The Zacks Consensus Estimate has risen by +2% in the last 30 days.

This fiscal year’s consensus earnings estimate stands at $13.33—an annual rise of +13%—which has also increased by +2.3% over the past month.

For the next fiscal year, the expected earnings of $14.89 represent an increase of +11.7% compared to last year. The estimate has grown by +2% recently.

Zacks’ proprietary rating tool, the Zacks Rank, provides a clear view of stock price trajectories based on earnings revisions. Due to a notable consensus estimate change and additional related factors, Microsoft holds a Zacks Rank of #3 (Hold).

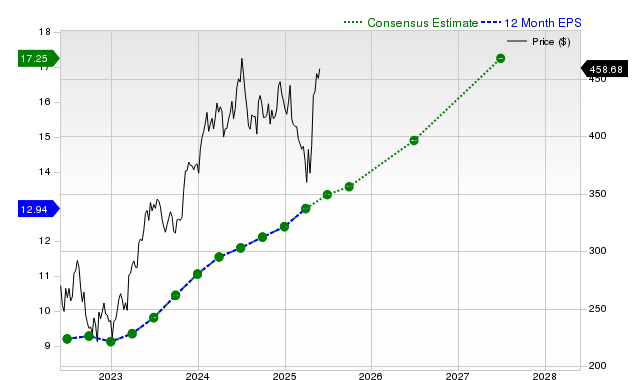

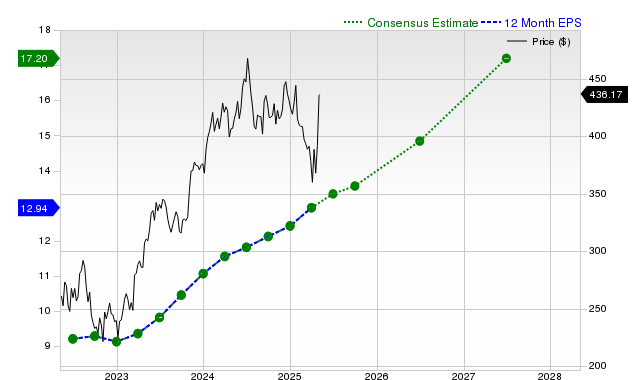

The chart below shows the company’s forward 12-month consensus EPS estimate:

12 Month EPS

Projected Revenue Growth

A company’s ability to grow its revenues is crucial for sustaining earnings growth. Without revenue increases, long-term earnings expansion is challenging.

For Microsoft, the current quarter’s consensus sales estimate is $73.71 billion, indicating a year-over-year increase of +13.9%. The projected sales for the current and next fiscal years are estimated at $278.8 billion and $313.23 billion, representing increases of +13.7% and +12.4%, respectively.

Last Reported Results and Surprise History

In its last reported quarter, Microsoft recorded revenues of $70.07 billion, up +13.3% year-over-year. The EPS of $3.46 compared to $2.94 last year.

Reported revenues exceeded the Zacks Consensus Estimate of $68.38 billion, resulting in a surprise of +2.46%. The EPS surprise was +8.13%.

The company has consistently surpassed consensus EPS and revenue estimates across the previous four quarters.

Valuation

Accurate investment decisions depend on stock valuation. It is vital to assess whether a stock’s current price correctly reflects its intrinsic value and growth potential.

Evaluating the company’s valuation multiples—P/E, P/S, and P/CF—relative to its historical values aids in determining if the stock is fairly, over-, or undervalued. Comparisons with industry peers also provide useful insights.

Under the Zacks Style Scores system, Microsoft received a D grade for value, indicating it trades at a premium compared to its peers.

Bottom Line

The information presented here may inform decisions regarding Microsoft’s stock amid market commentary. Its Zacks Rank of #3 suggests potential performance in line with the broader market in the near term.