Rivian Faces Challenges, Yet Holds Potential for Investors

If you’ve been keeping up with financial news, you may have noticed that Rivian (RIVN) is attracting attention for less-than-favorable reasons. The electric truck manufacturer made its debut on Nasdaq in 2021 with significant backing from Amazon (AMZN) and Ford (F). Back then, Rivian’s stock was priced at $170 per share on November 16, but today it’s significantly lower, trading at $10.03. Since its IPO, Rivian has battled numerous challenges, including supply chain disruptions that have led to parts shortages and reduced automobile production. For Fiscal Year 2024, Rivian management has already cut its production expectations by 8,000 to 10,000 vehicles.

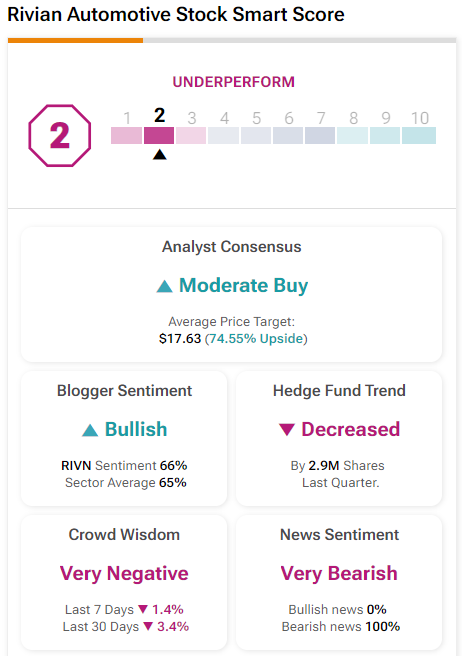

According to Tipranks’ Smart Score, RIVN stock currently receives an Underperform rating of 2, indicating a strong sell or bearish outlook. This rating stems from bearish trends among hedge funds and negative public sentiment. For the latest updates on Rivian, you can find more news here.

Despite this challenging overview, let’s take a look at three reasons why some investors might remain hopeful about RIVN stock:

- Strong Backing and Partnerships: While Ford sold its shares in 2022, Rivian still enjoys support from Amazon, which has increased its investment and committed to purchasing 100,000 vehicles by 2030. This backing not only supplies crucial funds but also enhances Rivian’s credibility among potential investors. Furthermore, in June, Rivian formed a new partnership with Volkswagen (VOW3), which plans to invest up to $5 billion in the venture over the next two years, ultimately signaling confidence in Rivian’s future.

- Promising Product Line: Rivian targets a unique market by designing electric vehicles for outdoor enthusiasts. Its R1T pickup and R1S SUV feature high ground clearance and strong off-road capabilities. Notably, 86% of surveyed customers indicated they would consider purchasing another vehicle from Rivian, reflecting growing brand loyalty. The company also aims to develop commercial vans to attract everyday customers.

- Cost Reduction Initiative: To streamline its finances, Rivian is working to reduce production costs significantly. By 2026, the company plans to launch its Gen 2 platform, which aims to cut material costs by 45%. Such improvements may accelerate its path to profitability. Moreover, Rivian appears to be applying lessons learned to better manage its supply chain, which was a source of previous delays.

What Is the RIVN Price Target?

Wall Street labels Rivian as a Moderate Buy, with nine buy ratings, ten holds, and no sells. The average price target is set at $17.63, representing a potential upside of 74.55%.

See more RIVN analyst ratings

Conclusion

Overall, Rivian is navigating a tough landscape, facing production issues and a significant debt burden. Nonetheless, there are grounds for cautious optimism. Positive product reviews, customer satisfaction, and strong partnerships with Amazon and Volkswagen suggest that Rivian could still have a promising future. For now, the company remains on the radar for potential investors.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.