Lear Corporation Faces Challenges: A Look at Recent Performance and Future Outlook

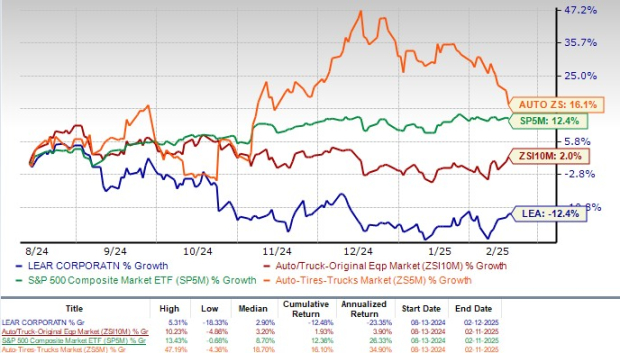

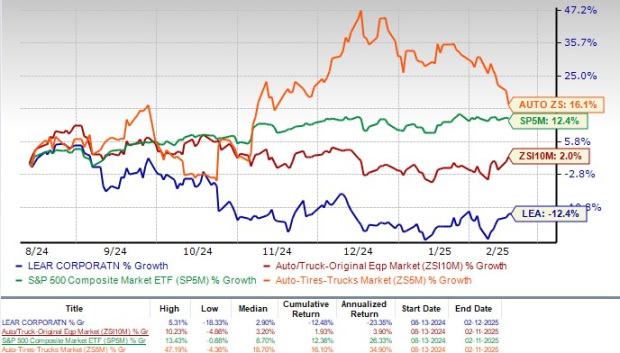

Lear Corp. (LEA) has seen its stock value decrease by 12.4% over the last six months. In comparison, the Zacks Auto, Tires, and Trucks sector has increased by 16.1%, while the Zacks Automotive – Original Equipment industry has shown a modest gain of 2%.

Analyzing Lear’s Decline

Image Source: Zacks Investment Research

Production Cuts and Delays Impact Lear’s Growth

Lear’s recent struggles are rooted in significant cuts to electric vehicle (EV) production. Several Original Equipment Manufacturers (OEMs) have reduced their output due to a downturn in the industry and uncertainties regarding demand. Additionally, delays in EV program launches and cancellations have thwarted Lear’s growth prospects. A slowdown in new program sourcing for 2024 has resulted in a reduced backlog for 2025, which limits the company’s revenue growth potential this year.

In China, declining volumes for key models such as the Buick Regal, BMW X3, and Volvo XC40 have also affected Lear’s performance, placing additional pressure on its operations.

In response, Lear has initiated restructuring efforts. The company has closed or sold off 13 facilities and reduced its total facility count by 4%. Plans are underway to close or sell five more sites, mainly in Europe, due to excess capacity. While these actions aim to streamline operations, they may introduce short-term costs and disruption to profitability.

2025 Projections Show Weak Outlook

Looking ahead, Lear anticipates its net sales for 2025 to range between $21.88 billion and $22.88 billion. The midpoint indicates a decline of 4% compared to 2024. Adjusting for foreign exchange, commodities, acquisitions, and divestitures, Lear expects revenue to decrease by 2%.

Core operating earnings are projected to be between $915 million and $1.175 billion, reflecting a year-over-year decrease of 5% at the midpoint. Furthermore, operating cash flow is estimated at $1.06 billion to $1.26 billion, slightly down from $1.12 billion in December 2024. Free cash flow is expected to fall between $430 million and $630 million compared to $561.4 million at the end of 2024, and capital spending is forecasted to be around $625 million, up from $558.7 million in 2024.

Lear also expects approximately $230 million of net new business in 2025, a significant decrease from the $800 million anticipated at the beginning of 2024. This sharp drop is primarily due to lower production estimates for several vehicles, including the RAM Charger and GM EVs, alongside delays in the RAM REV’s launch.

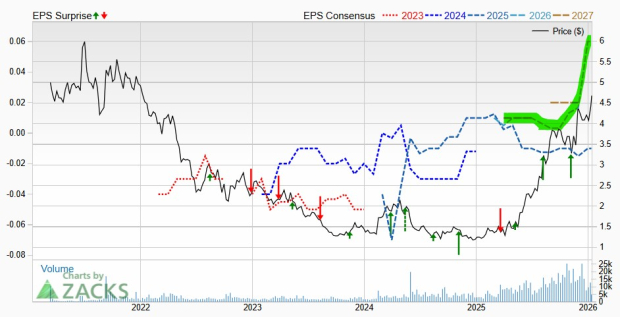

Earnings Estimates Suggest Continued Decline

The Zacks Consensus Estimate for LEA’s first-quarter 2025 earnings per share (EPS) stands at $2.90, indicating a year-over-year decline of 8.8%. Similarly, the estimated EPS for the second quarter of 2025 is $3.26, which reflects a 9.4% decrease compared to the previous year.

Furthermore, the consensus estimates for LEA’s EPS in 2025 and 2026 have decreased by 2.63% and 1.12%, respectively, over the past week, now standing at $12.94 and $14.97.

Conclusion

Given the multiple challenges facing Lear Corporation and the unfavorable outlook for 2025, the stock may not be an appealing investment for the near term. Currently, LEA holds a Zacks Rank #4 (Sell), suggesting that investors should be cautious.

Alternative Investment Options

Investors seeking alternatives in the automotive space might consider stocks like Dana (DAN), Allison Transmission Holdings (ALSN), and Custom Truck One Source (CTOS). DAN currently boasts a Zacks Rank #1 (Strong Buy), while ALSN and CTOS both carry a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for DAN’s 2025 earnings suggests impressive growth of 79.17% year-over-year, whereas ALSN forecasts a 12.17% increase and CTOS anticipates a remarkable 75% growth.

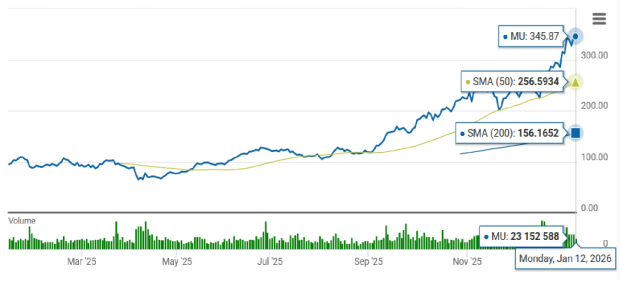

Zacks Highlights a Top Semiconductor Stock

In related news, Zacks has identified a top semiconductor stock that is significantly smaller than NVIDIA, which has surged by over 800% since its recommendation. This new stock is positioned to capitalize on the soaring demand for technologies such as Artificial Intelligence and the Internet of Things.

With projections indicating that global semiconductor manufacturing could increase from $452 billion in 2021 to $803 billion by 2028, the growth potential looks promising.

Discover This Stock Now for Free >>

Lear Corporation (LEA): Free Stock Analysis Report

Dana Incorporated (DAN): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Custom Truck One Source, Inc. (CTOS): Free Stock Analysis Report

Read this article on Zacks.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.