MercadoLibre: A Potential Growth Stock for Investors

If you’re content with average market returns, investing in an S&P 500 index fund might suffice. However, for those aiming to outperform the market, individual stock selection is essential, which can be challenging.

Investors searching for stocks that could beat the market may want to consider MercadoLibre (NASDAQ: MELI).

Understanding MercadoLibre

Unfamiliar with MercadoLibre? You’re not alone—its business operates primarily in South America.

Yet, it is a significant player in the region’s e-commerce landscape. MercadoLibre dominates markets in Brazil, Mexico, and Argentina, and is often called the “Amazon (NASDAQ: AMZN) of Latin America.”

Beyond e-commerce, the company also functions as a major payment processor, similar to PayPal, and provides logistics services. Increasingly, it’s becoming an advertising platform.

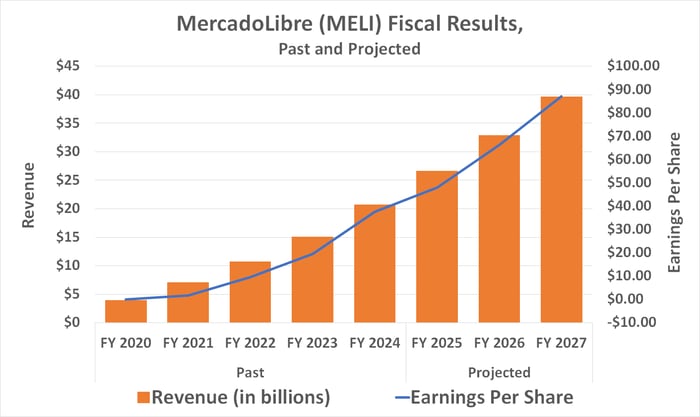

Last fiscal year, MercadoLibre generated $20.8 billion in total business, converting over $2.6 billion into net operating income, marking increases of 37% and 19%, respectively. Analysts project continued strong performance this year and next, despite broader economic stagnation in the region.

Data source: StockAnalysis.com. Chart by author.

Latin America: A Market on the Rise

Latin America is at a similar crossroads as North America was during the late 1990s and early 2000s.

Back then, the internet was growing, and high-speed connections were becoming the norm. The first smartphones were on the horizon, positioning mobile devices for rapid adoption.

This technological revolution paved the way for online shopping and digital payments that fueled Amazon’s rise.

Image source: Getty Images.

There are differences between North America then and South America now. Notably, South America operates as a “mobile first” market, where smartphones serve as the primary internet connection for many consumers. According to digital marketing company Siprocal, over 270 million residents in Latin America (around 58% of the population) are mobile-first users.

As connectivity improves, online shopping is expected to follow suit.

Americas Market Intelligence (PCMI) estimates the region’s e-commerce sector will grow by 21% this year, with similar rates projected until at least 2027. For context, GSMA expects smartphone penetration in Latin America to rise from 80% of mobile users in 2023 to 92% by 2030. In fact, technology market research firm Canalys reported that a record 137 million smartphones were shipped to Latin America last year.

As technology spreads, users are likely to engage more with their devices, creating additional opportunities for growth.

The Time to Invest is Now

U.S. investors appear to recognize this potential, as evidenced by MercadoLibre’s impressive 300% increase from last year’s low, reaching new highs.

However, prospective investors shouldn’t be deterred.

MercadoLibre’s trajectory mirrors that of early Amazon. Just as Amazon defied expectations, continuing to expand despite doubters, MercadoLibre is already profitable and well-positioned for future growth. Historical patterns show that technological progress can outlast economic challenges.

With ongoing concerns about economic stability due to potential tariff impacts, particularly from the U.S., it’s vital not to underestimate the resilience of capitalist markets. Consumers often prioritize convenience and pricing, as seen with Amazon during the 2008 financial crisis. South American consumers are similarly inclined toward online shopping.

# Navigating MercadoLibre’s Potential Amid Economic Uncertainty

Investors are keeping a close eye on the economic landscape, as there are concerns regarding potential hardships ahead. Notably, South America and the United States do not maintain a significant trading partnership. Brazil primarily trades with China, while Argentina’s main partner is Brazil. Many countries on the continent rely on mutual trade, which helps them mitigate the tariff-related pressures currently affecting the U.S. and its key trade connections.

In summary, MercadoLibre presents a strong investment opportunity that many are currently overlooking. While it may be wise to wait for a price correction, it’s essential not to delay too long in case the anticipated dip doesn’t materialize.

Identifying Potential Lucrative Investments

Have you ever felt like you missed out on buying top-performing stocks? If so, this news could be of interest to you.

On rare occasions, our analysts issue a “Double Down” Stock recommendation for companies they believe are about to experience significant growth. If you worry that your investment window has closed, consider that now may be the ideal time to invest before it’s too late. The historical performance of past recommendations illustrates this point clearly:

- Nvidia: If you had invested $1,000 when we issued the recommendation in 2009, it would now be worth $350,971!*

- Apple: If you had put in $1,000 when we doubled down in 2008, it would now total $40,309!*

- Netflix: An investment of $1,000 when we made the recommendation in 2004 would now be worth $620,719!*

Currently, we are issuing “Double Down” alerts for three promising companies, which are available when you join Stock Advisor, and opportunities like this don’t come around often.

View the 3 recommended stocks »

*Stock Advisor returns as of May 12, 2025

John Mackey, former CEO of Whole Foods Market, now a subsidiary of Amazon, serves on The Motley Fool’s board of directors. James Brumley holds no position in any stocks mentioned. The Motley Fool has investments in and recommends Amazon, MercadoLibre, and PayPal. The Motley Fool also recommends specific options related to PayPal. For full disclosure, please refer to our policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.