Why Meta Platforms (META) Is Emerging as a Top Growth Stock

Investors are in a constant search for growth stocks that can deliver above-average financial returns. However, identifying a truly outstanding growth stock can be quite challenging.

These stocks tend to be volatile and carry a higher risk. Investors may find themselves stuck in a stock that appears to have lost its growth momentum.

The Zacks Growth Style Score, a part of Zacks’ comprehensive system, helps investors pinpoint promising growth stocks by evaluating real growth potential beyond traditional metrics. One standout recommendation from this approach is Meta Platforms (META), which not only boasts a favorable Growth Score but also holds a high Zacks Rank.

Historical data suggests that stocks with robust growth characteristics consistently outperform the market. Those stocks with a Growth Score of A or B, combined with a Zacks Rank of #1 (Strong Buy) or #2 (Buy), generally see even greater returns.

Here are three compelling reasons why Meta Platforms is regarded as a strong growth choice right now:

Strong Earnings Growth

Earnings growth is a critical factor for investors, as rising profits indicate a company is doing well. Growth investors typically favor companies with double-digit earnings growth, as this often signals healthy prospects and potential stock price increases.

Meta Platforms’ historical EPS growth rate stands at 18%. However, the focus should be on projected growth, which is expected to reach an impressive 44% this year, significantly surpassing the industry average of 28.3%.

High Asset Utilization Ratio

Asset utilization ratio, or the sales-to-total-assets (S/TA) ratio, is a key indicator in growth investing that shows how effectively a company uses its assets to generate revenue.

Currently, Meta Platforms has an S/TA ratio of 0.67, meaning the company generates $0.67 in sales for each dollar of assets. In contrast, the industry average is only 0.58, indicating that Meta Platforms is more efficient in its operations.

Sales growth is also important, and Meta Platforms projects a sales increase of 20% this year, outpacing the industry average of 7.9%.

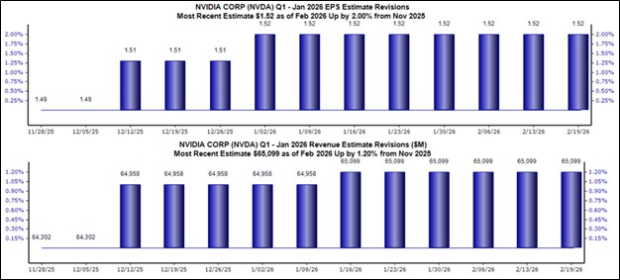

Positive Earnings Estimate Revisions

Another factor to consider is the trend in earnings estimate revisions. Research indicates a strong link between these revisions and stock price movements.

For Meta Platforms, current-year earnings estimates have seen upward revisions, with the Zacks Consensus Estimate climbing 0.3% in the past month.

Conclusion

Meta Platforms has achieved a Growth Score of B through various metrics, including those discussed, and holds a Zacks Rank of #2 due to positive earnings estimate revisions.

This combination places Meta Platforms in a strong position for potential outperformance, making it an appealing choice for growth investors.

Special Offer: Just $1 for Insights on Zacks’ Buys and Sells

No, this is not a joke.

Years ago, we surprised our members by offering them 30 days of access to all our investments for just $1, with no obligation to spend more.

While many took advantage, some hesitated, thinking there must be a catch. We simply want you to explore our portfolio services, such as Surprise Trader, Stocks Under $10, Technology Innovators, and others that successfully closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>

For the latest recommendations from Zacks Investment Research, download 5 Stocks Set to Double today. Click here to get your free report.

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.