In the ever-shifting landscape of the 2024 energy sector, marred by supply and demand imbalances, oil and natural gas prices are charting separate courses. While oil surged to a yearly peak of $81.33 a barrel, geopolitical tensions continue to apply upward pressure. In contrast, natural gas grapples with a two-month slump, precipitated by a surplus following a mild winter. Ripple effects are inevitable.

Amidst this dichotomy, the stars of midstream companies continue to shine brightly. These unsung heroes focus on the transportation, storage, and processing of oil and gas. In these tumultuous times, they present a haven for investors seeking stability and steady returns within the choppy waters of the energy market.

The Resilient World of Midstream Investments

Earnings projections for midstream companies carry a note of cautious optimism for the current year, foreseeing a modest growth trajectory. The bedrock of MLP business models lies in fees, tied to the volume of oil or gas they handle. This revenue structure allows MLPs to offer both annual and longer-term forecasts, painting a clearer picture for investors navigating the turbulent energy markets.

Dive deeper into the Midstream earnings forecasts in: “2024 EBITDA Guidance: Midstream/MLPs See Growth”

The fee-based framework utilized by MLPs comes with a host of advantages. Not only does it shield investors from the worst of price volatility associated with commodities, but it also ensures a steady cash flow even when oil and gas markets are witnessing wild swings.

This robust cash generation translates into attractive yields for investors. The Alerian MLP ETF (AMLP) boasts a trailing 12-month yield of 7.4% as of 03/15/24, with an indicated yield of 7.55%. The indicated yield gauges the most recent dividend, annualizes it, and then divides it by the current share price, casting a forward-looking gaze.

AMLP aims to mimic the Alerian MLP Infrastructure Index (AMZI) performance. This index, being capped, float-adjusted, and capitalization-weighted, encompasses MLP companies primarily reliant on midstream cash flows.

MLPs: Paving a Different Path in the Energy Arena

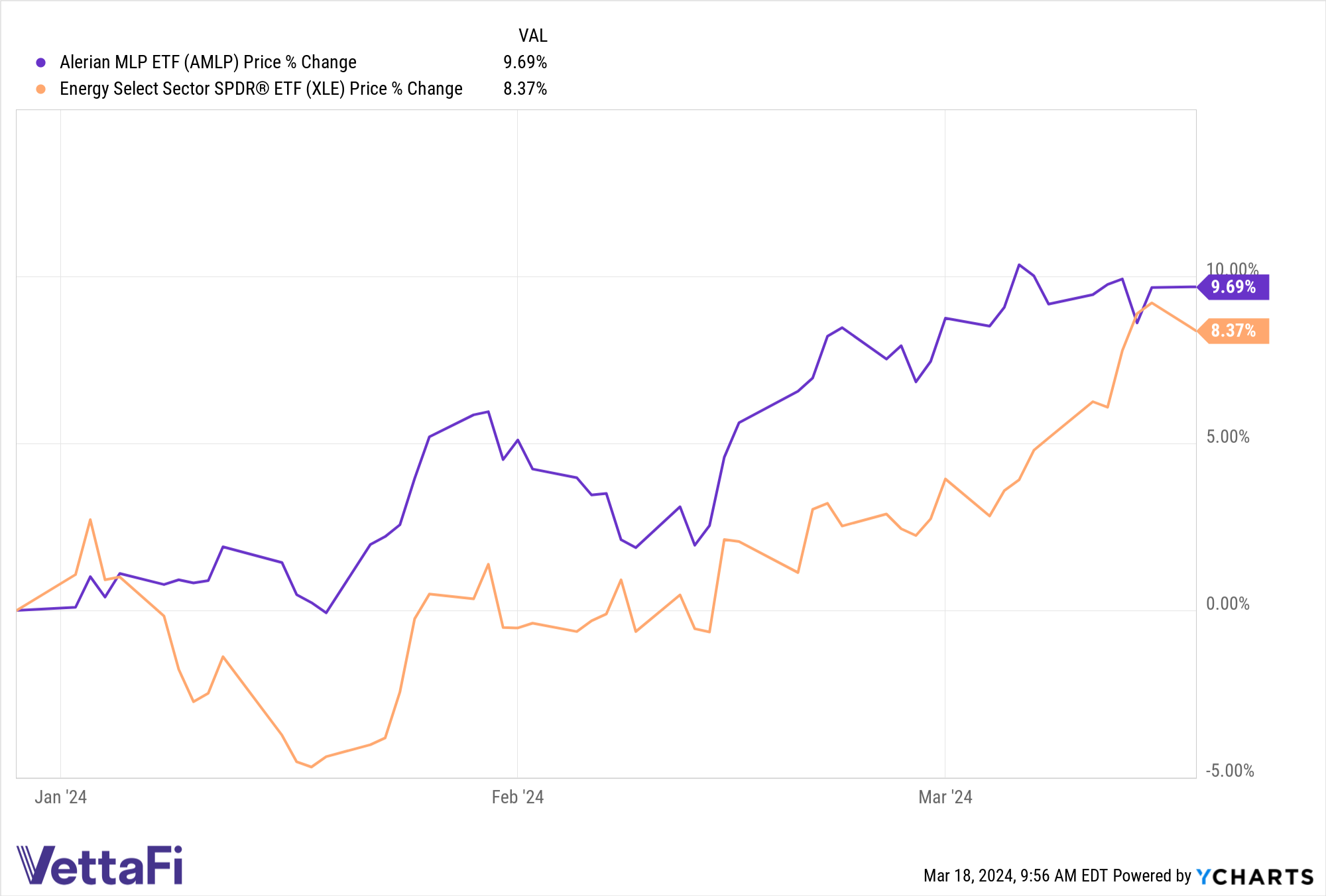

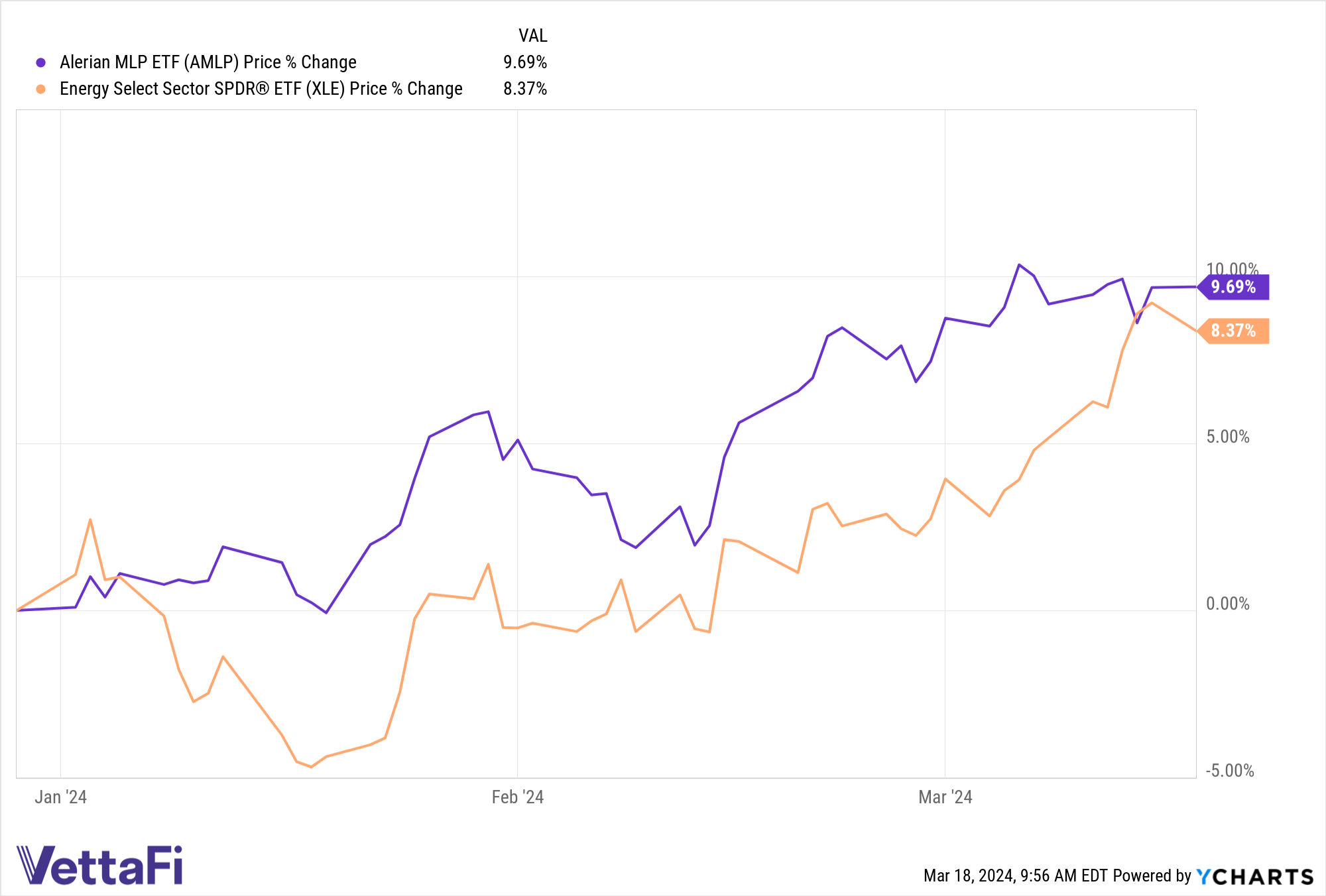

In a narrative set against a backdrop of energy sector turmoil, AMLP has risen above the fray compared to the broader energy market, exemplified by the Energy Select Sector SPDR Fund (XLE). While XLE experienced notable outflows this year to the tune of $1.6 billion as of 03/15/24, AMLP continues to draw consistent inflows. Witness its $83 million uptick this month, with sturdy inflows totaling $192 million so far this year.

The recent success of AMZI can be credited in large part to robust guidance, earnings, and distributions by Western Midstream Partners LP (WES). Currently boasting a 20.37% climb YTD as of 03/15/24 and commanding a 12.18% weightage in the index, WES foresees a 52% surge in base distribution for Q1, now sitting at $0.875 per unit.

Midstream companies serve as a compass in the stormy sea of the energy space, offering investors a unique path different from the commodities themselves. With promising yields, a positive outlook for 2024, and a business model adept at softening the blows of oil and gas price fluctuations, it may be time for investors to set their sights on targeted exposure.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi oversees the indices for AMLP and MLPB, earning an index licensing fee. However, it’s essential to note that AMLP and MLPB are not issued, sponsored, endorsed, or sold by VettaFi. VettaFi bears no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP and MLPB.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

Read more on ETFTrends.com.

The perspectives shared here are solely those of the author and may not mirror the views of Nasdaq, Inc.