Netflix Stock Soars: Why Now is the Time to Invest

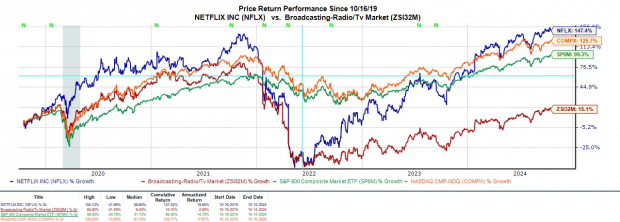

With shares trading over $700, Netflix NFLX has rallied more than 40% year-to-date and boasts gains of nearly 150% over the last five years.

Despite the high price, Netflix carries a Zacks Rank #2 (Buy) as it approaches its third-quarter results, set for Thursday, October 17. With this in mind, let’s explore why investing in Netflix could be a wise decision now.

Image Source: Zacks Investment Research

Strong Subscriber Growth Points to Potential

Investor confidence in NFLX is largely due to its strong subscriber growth. In Q3, Netflix is expected to add 4.75 million new users, following an impressive 8.76 million subscriptions in the same quarter last year. Moreover, it surpassed expectations in Q2, with 8.04 million new subscriptions, exceeding estimates by over 2.2 million.

By consistently enhancing its array of original content, Netflix remains the leader in streaming services. As of Q2, the platform had over 277 million users, outpacing Disney’s DIS combined services (Disney+, Hulu, ESPN), which total 164 million subscribers. Additionally, Paramount Global PARA and Warner Bros. Discovery WBD reported 68 million and 103 million subscribers, respectively.

Image Source: Zacks Investment Research

Quarterly Financial Growth on the Horizon

Thanks to robust subscriber additions, Netflix is projected to experience double-digit revenue and profit growth in fiscal years 2024 and 2025. For Q3, analysts predict sales will climb by 14% to $9.77 billion from $8.54 billion a year earlier.

Earnings per share (EPS) are also expected to thrive, soaring 36% to $5.09 compared to $3.73 in the same quarter last year. Impressively, Netflix has beaten the Zacks EPS consensus in three of its last four quarterly reports, with an average earnings surprise of 6.15%.

Image Source: Zacks Investment Research

Valuation Analysis: A Closer Look at Netflix’s P/E Ratio

While Netflix’s stock price may seem high, its valuation appears more reasonable compared to previous years. Currently, NFLX trades at 37.3X forward earnings, significantly lower than its five-year peak of 100.6X and slightly under the median of 37.9X during that period.

Image Source: Zacks Investment Research

Conclusion: The Road Ahead for Netflix Investors

If Netflix meets or exceeds earnings forecasts and continues its stellar subscriber growth, its current rally could persist. Given the company’s strong market position, any post-earnings drop may provide an even more attractive buying opportunity, particularly in light of its long-term growth potential and improved valuation.

Infrastructure Stock Boom on the Horizon

A significant initiative to repair the aging U.S. infrastructure is expected to begin soon, with bipartisan support. This endeavor will involve trillions in spending, creating vast potential for investors.

Are you prepared to invest early in the right stocks that stand to gain the most?

Zacks has published a Special Report to guide you, available for free today. Discover five companies positioned to benefit from the construction and repair of roads, bridges, and buildings, as well as from cargo hauling and energy transformation.

Download FREE: How To Profit From Trillions In Infrastructure Spending >>

Stay informed with the latest recommendations from Zacks Investment Research. Download the free report titled 5 Stocks Set to Double.

Netflix, Inc. (NFLX): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

Warner Bros. Discovery, Inc. (WBD): Free Stock Analysis Report

Paramount Global (PARA): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.